Ethereum (ETH) price plunged 7% this morning as global markets reacted to the US Fed’s latest Funds Rate announcement. With Ethereum long-term holders losing strength, is ETH poised for a prolonged bearish spell?

The Fed paused interest rates this month as expected, while the regulator also signaled the possibility of further increases in the future. This is especially true in risky assets such as BTC, ETH, and in general. crypto- lowered the excitement of investors in the markets.

Ethereum Long-Term Investors Lose Power

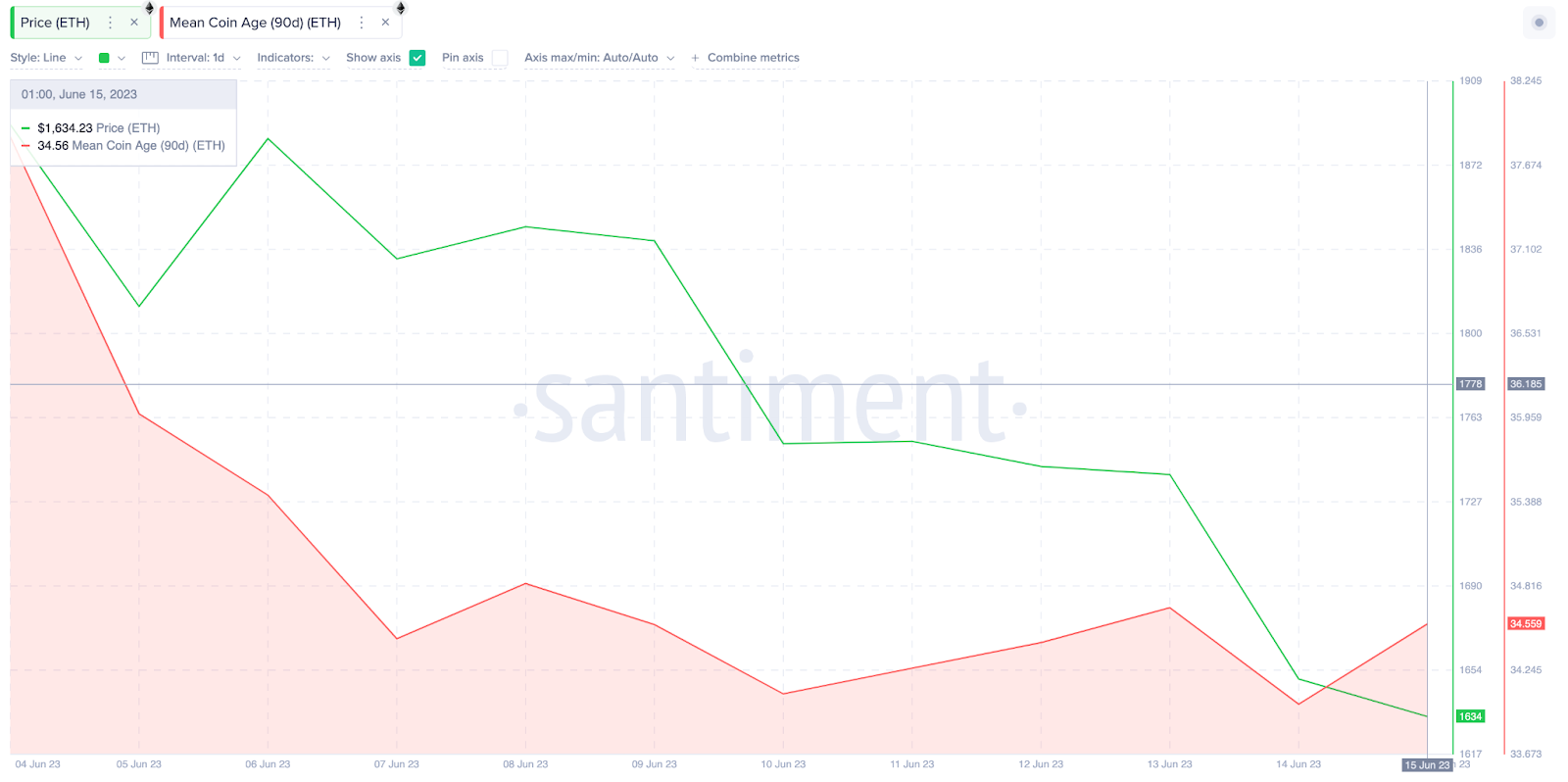

Amid the market turmoil, Ethereum witnessed significant exits from some of its loyal long-term investors. According to Santiment’s Average Coin Age data, there has been a network-wide sell-off, especially among long-term investors.

Average Coin Age assesses the market sentiment of long-term investors by measuring the average number of days that coins in circulation spend at their current addresses.

The chart below shows that the Average Coin Age of ETH decreased from 37.87 to 34.56, down 9% between June 4 and June 15.

The fact that the Average Coin Age has dropped significantly over a short period of time indicates that many long-held coins have been disposed of. This could negatively impact ETH prices, as strategic investors may interpret this as the start of a network-wide sell-off.

If the selling action continues and ETH fails to attract enough demand, the downtrend could continue in the coming weeks.

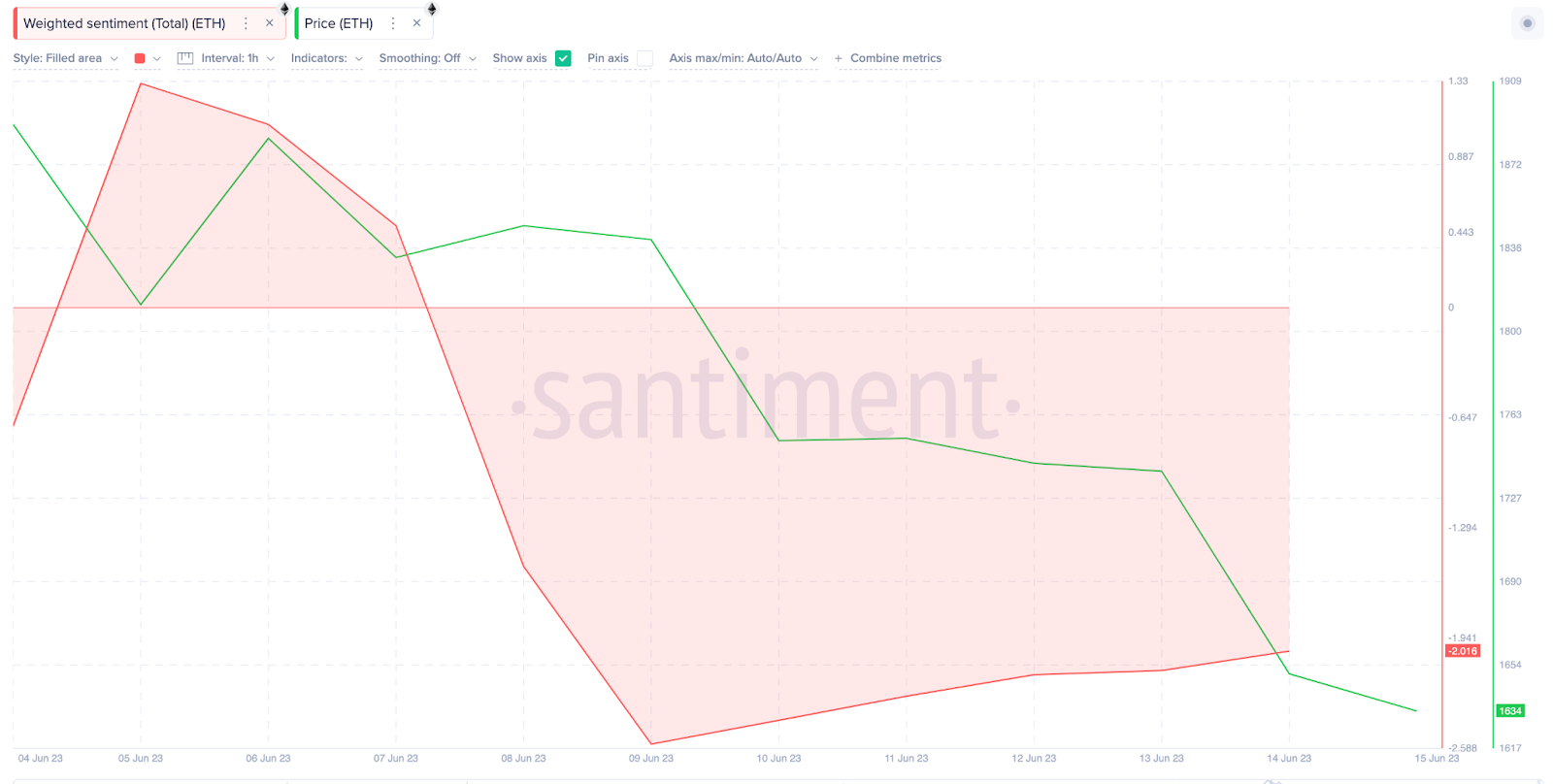

General Market Sentiment Slips into Critically Negative Zone

Over the past week, the overall market sentiment surrounding ETH has slipped into critically negative territory. Santiment’s Weighted Sentiment chart evaluates trending media views by comparing positive comments about an asset with negative ones.

As seen below, ETH Weighted Sentiment has remained below the critical 2.0 zone since June 9th.

In summary, for every optimistic view on Ethereum, there are more than two negative views. This shows that the bears now tightly control the media discourse.

If this trend continues, a significant portion of potential ETH traders could enter a bearish trend in the coming days.

In summary, continued network-wide selling and extreme negative market sentiment could potentially lower ETH prices.

ETH Price Prediction: Possible Drop to $1,500

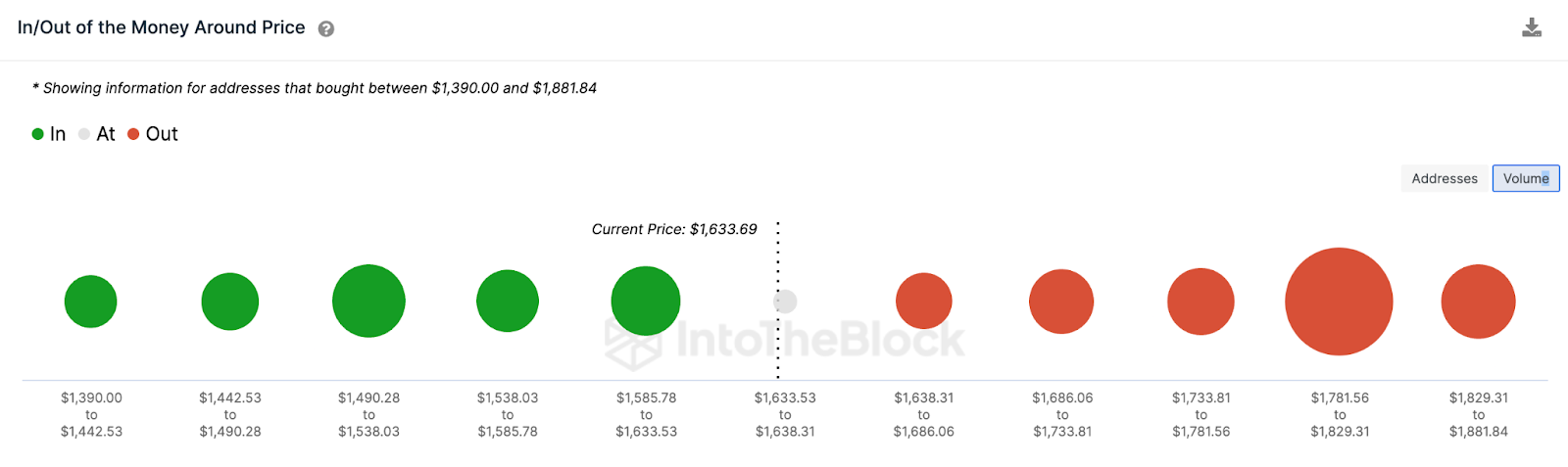

Based on the factors mentioned above, ETH is likely to drop below $1,500 in the coming weeks. However, the bears must first battle the initial support of $1,600.

In this region, In/Out of Money Around Price data shows a cluster of 2.3 million investors purchasing 2.6 million ETH at an average price of $1,607.

If the bears can break through this support zone, ETH is likely to drop towards $1,500.

However, if ETH can rise above $1,700 again, the bulls could invalidate the negative stance. However, the sell wall mounted at an average price of $1,704 could stand in the way. As seen above, a cluster of 1.34 million investors holding 2.33 million ETH could sell around this price.

If the bulls break this resistance altcoin It could climb towards $1,900.

You can find the current market movements here.