A widely followed crypto analyst says the trend will reverse for a Binance-backed altcoin. Keeping in mind that estimates are not exact, let’s take a look at what Jason Pizzino had to say in his latest YouTube post.

Jason Pizzino expects ‘multi-year’ drop for Binance-backed altcoin

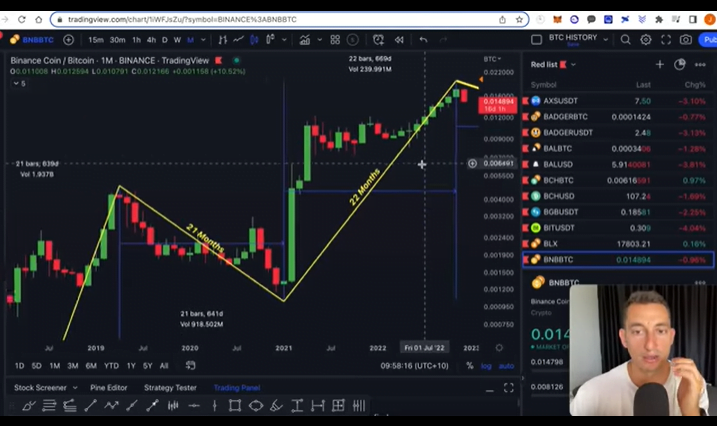

According to the popular analyst, the token of the world’s largest crypto exchange BNB Coin (BNB) is reversing its trend on the Bitcoin (BTC) chart. Pizzino reports that Binance Coin (BNB/BTC) has peaked after nearly two years of bull run. The upcoming reversal marks a multi-year downtrend for BNB/BTC, according to Pizzino. In part of the video, the analyst says:

We started our first big month bearish for a potential top in BNB/BTC here. This could take up to two years from that point.

BNB/BTC is currently trading at 0.013784 BTC ($230). According to the analyst, BNB has been showing clear bullish and bearish trends against BTC since 2017. Pizzino interprets the historical data as follows:

From July 2017, it showed bullish and bearish trends from the 21st month to the peak in April 2019. We know that Bitcoin has peaked around June 2019 from this point forward. While Bitcoin was also rising after that macro low, after this low cycle, this was recovering. BNB then fell against BTC for 21 months, falling until January 2021. It has since reached its highest level in November 2022. So no one can argue that this is not a clear 21 to 22 month bull and bear trend.

Jason Pizzino predicts the decline will last until this date

The crypto analyst predicts that if the BNB/BTC pair continues to repeat this cycle, the downtrend will continue until the third quarter of 2024. Detail noted the following as the bottom date:

If the cycle repeats, we have 22 months or 21 months to get us to August 2024. If we want to go out during these 22 months, then it will be around September 2024. Therefore, around August or September of 2024, the BNB/BTC chart may find a bottom.

BNB Coin was the most damaging altcoin project of the week

BNB price is down 6.5% in the past day and 15% from last week. Currently, Binance is facing questions about FTX’s ability to meet potential repurchase demands for $2.1 billion in bankruptcy proceedings. Binance and CEO CZ were one of the first and major investors in FTX. It looked like it could save the rival stock market before opposing the buyout. However, the rumors that have emerged around Binance in recent days have been hitting the stock market over BNB Coin. cryptocoin.com We have transferred the US case and large withdrawals.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.