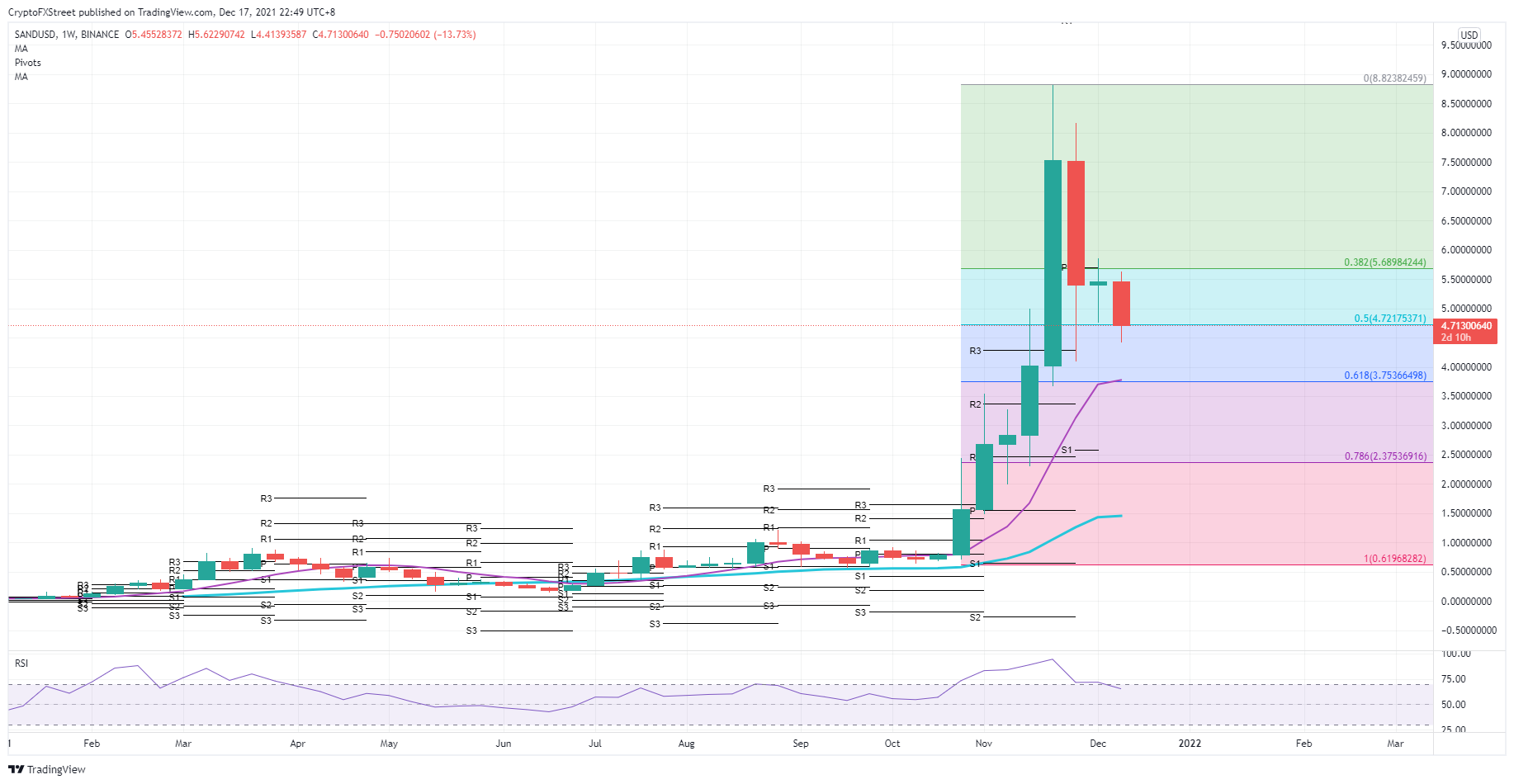

Sandbox The price fell sharply after the bulls failed to retrace the 38.2% Fibonacci level. SAND even risked getting more “tanked” as price action broke the 50% Fibonacci level to the downside. With the “tailwinds” emerging late last week, sentiment is turning in favor of the bulls and retrace the 38.2% Fibonacci level with new highs for buying.

Metaverse altcoin SAND heavily rebounded its gains after hitting all-time highs at the end of November. A “bull trap” almost even formed as the bulls tried to retrace these lost levels.

With the shift in global sentiment and the resurgence of tailwinds in cryptocurrencies, the bulls got out of the situation at the last minute and are now trying to retrace key strategic levels upwards with the 38.2% Fibonacci level before attempting to hit all-time highs.

SAND bulls reclaim strategic levels for new heights

Sandbox experienced a significant downward movement at the end of November with the effect of investors who wanted to take profits. As the bulls tried to retrace their all-time highs, they squeezed out of their positions and almost formed a bull trap, entering at the 38.2% Fibonacci level around $5.69 and stopping at the 50% Fibonacci level around $4.72. But the turn in sentiment from the US central bank this week seems to have been enough to bail out their strategy.

SANDsees the bulls bounce off the 50% Fibonacci level and push back towards the 38.2% Fibonacci level to protect the new all-time high insights.

It would be somewhat delusional to expect this to happen overnight as current headwinds also affect some of the mainstream cryptocurrencies as investors will want to spread their investments across several cryptocurrencies. As we head into Christmas and the end of the year, it would be much more realistic to expect an upside squeeze with all-time highs reached.

The risk for trading in the last two weeks of the year represents weak liquidity. It could come as a shock to some institutional investors who withdraw their money during the holiday season, triggering a global sell-off in cryptocurrencies as retail investors will want to exit as well.

In this case, you can expect the SAND price action to be replaced by the 50% Fibonacci level from the $4.72 low and see another drop towards the 61.8% Fibonacci level from $3.75. This level should be of interest to traders as it has a 55-day Simple Moving Average which makes the level additionally attractive to traders.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.