Future expectations regarding inflation and interest rates have an impact on gold prices. Therefore, market players predict that the yellow metal will rally when the Fed cuts interest rates in 2024. But investors may be disappointed, according to CME Group Executive Director and Chief Economist Erik Norland.

What really drives gold?

cryptokoin.comAs you follow from , the shiny metal continues to trade above $2,000. In recent years, investors who wanted to protect themselves from high inflation flocked to gold. Because gold is generally accepted as an inflation protection tool. But is this really the case? Economist Erik Norland makes the following assessment:

Gold’s rise from 2001 to 2011 coincided with stable core inflation of around 2%. In contrast, gold prices have remained virtually unchanged between 2021 and 2023, when the US economy experienced the sharpest increase in inflation since the late 1970s and early 1980s. So, if it’s not inflation, what’s really driving gold? And what should investors expect in 2024 and 2025?

Norland talks about factors that will continue to affect gold prices in 2024. One of these, he says, is central bank purchases that “seem to move prices over the long term.” Norland makes the following statement:

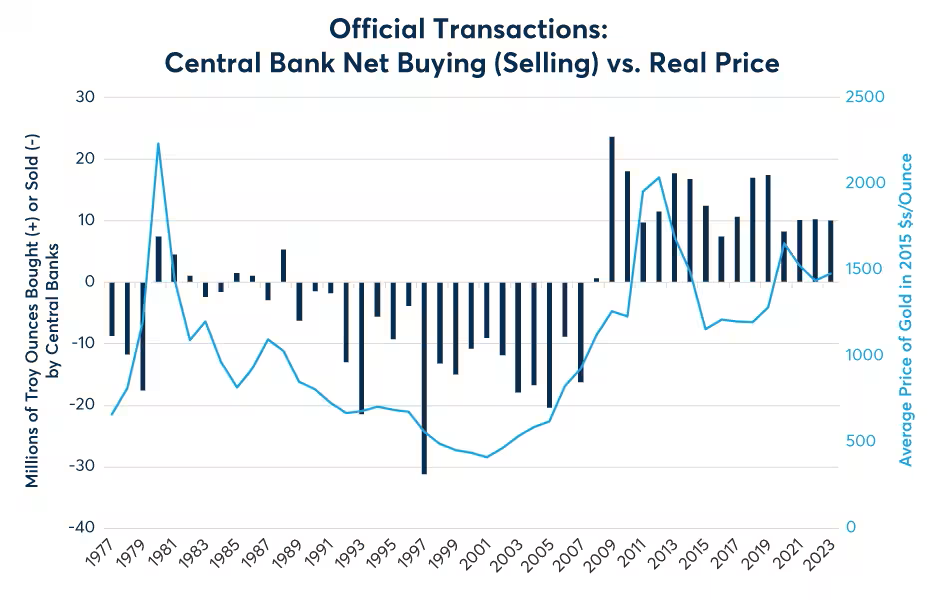

The world’s central banks clearly view gold as a currency. They have also been buying more and more since the global financial crisis (GFC). The fact that central banks have been setting near-zero or even negative interest rates for many years, combined with quantitative easing (QE) and various sanctions regimes, has caused many central banks to prefer gold instead of currencies issued by the central bank. Neither the recent upward trend in interest rates nor the reversal of QE appear to have alleviated these concerns.

Gold prices have a strong negative correlation with interest rates

Erik Norland draws attention to the fact that central banks have been purchasing gold since 2008. He says it has reversed a long period in which they were consistently net sellers from 1982 to 2007. “This means that pre-GFC central bank policy valued fiat currencies such as the US dollar, euro, yen, pound and Swiss franc more than gold as reserve assets,” Norland said. This relationship has reversed since KFC. “This trend continued in 2023, despite central bank interest rate hikes pushing fiat yields to their highest levels since 2007.” says Norland, noting that investors also see gold as a currency.

Because precious metals do not earn interest, “gold generally counters expectations of higher interest rates,” Norland said. As the Fed raises rates from zero to as high as 5.375%, this, along with the strength of the US dollar, is likely what has capped gold prices in 2021 and 2022. Since 2015, gold prices have almost always had a strong negative correlation with the daily change in Fed funds futures two years ahead.” says.

Gold doesn’t just react to future inflation, it predicts it!

Erik Norland says that although gold will not see an inflation-driven rally between 2021 and 2023, it still performs as a good inflation hedge. He also notes that he anticipates future inflation rather than just reacting to it. In this context, the economist makes the following statement:

Between October 2018 and June 2020, Fed funds futures went from pricing Fed funds at 3% for two years ahead to nearly zero. During this period, gold prices rose from $1,200 to $2,080, an increase of 73%. However, when inflation came in 2021 and strengthened in 2022, this was not good news for gold. Because short-term interest rates (STIRS) caused investors to reassess their expectations for long-term Fed rates from 0% to 4.5%. So, although inflation may have pushed gold prices up, the expectation (and then the reality) of higher interest rates pushed gold prices back.

This is why gold benefits from interest rate cuts!

Norland also covers gold’s rise to an all-time high in December. The economist says it’s another example of the precious metal anticipating rather than reacting to the possibility of interest rates falling in 2024 and 2025. Norland notes that the fact that gold prices have done such a good job of predicting and pricing future changes in inflation and interest rates poses a risk for gold investors going forward. Because he warns that response-based gains probably won’t be there. In this regard, Norland says the following:

For rate cuts to benefit gold, it may need to exceed the 200 basis points at which Fed funds futures are currently priced.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!