As one of the largest economies in the world, China’s stance on crypto has always had a profound impact on the crypto market. Still, China’s historical relationship with cryptos is quite complex. With recent developments pointing to a possible change in policy, the future of these altcoins in China hangs in the balance.

China’s crypto ban history

China has a long history of imposing restrictions on crypto. The first attempt came in 2013 when the People’s Bank of China (PBC) published rules prohibiting financial institutions from transacting in virtual currencies such as Bitcoin. However, this has not made it illegal for Chinese citizens to buy, store or send crypto. It just made it harder to access cryptos from exchanges. This initial ban was intended to slow down Bitcoin trading. Because Bitcoin had become so widespread that many businesses, including the country’s largest search engine Baidu, began to accept Bitcoin as payment.

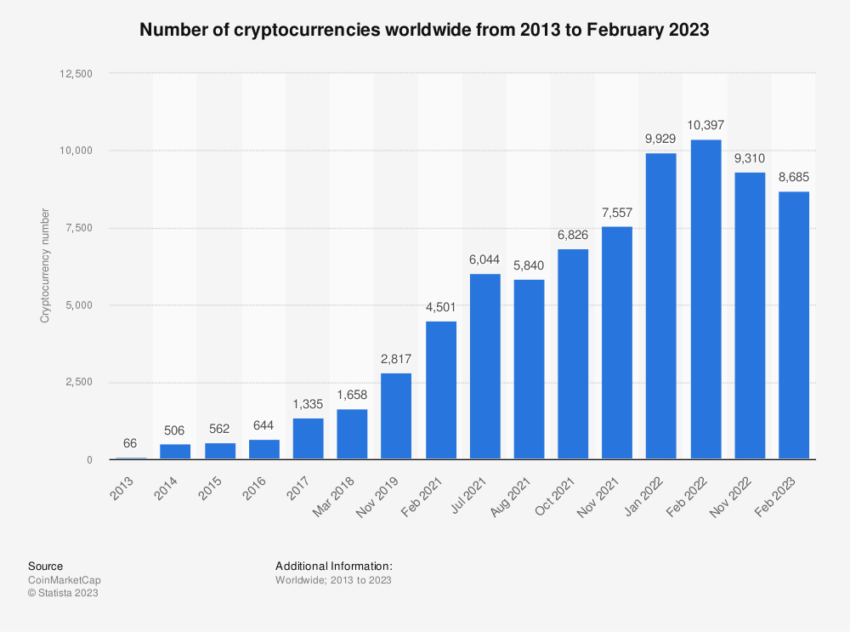

In 2017, during the crypto bull market, Chinese authorities increased sanctions on crypto trading, with a particular focus on Initial Coin Offerings (ICOs). There has been a significant increase in trading of ICOs, digital tokens representing ownership stake in a new crypto project. However, many of these ICOs have turned into scams due to lack of regulation. To curb the ICO craze, China has banned all platforms offering ICOs. If an exchange sold an ICO, it had to return the money to investors.

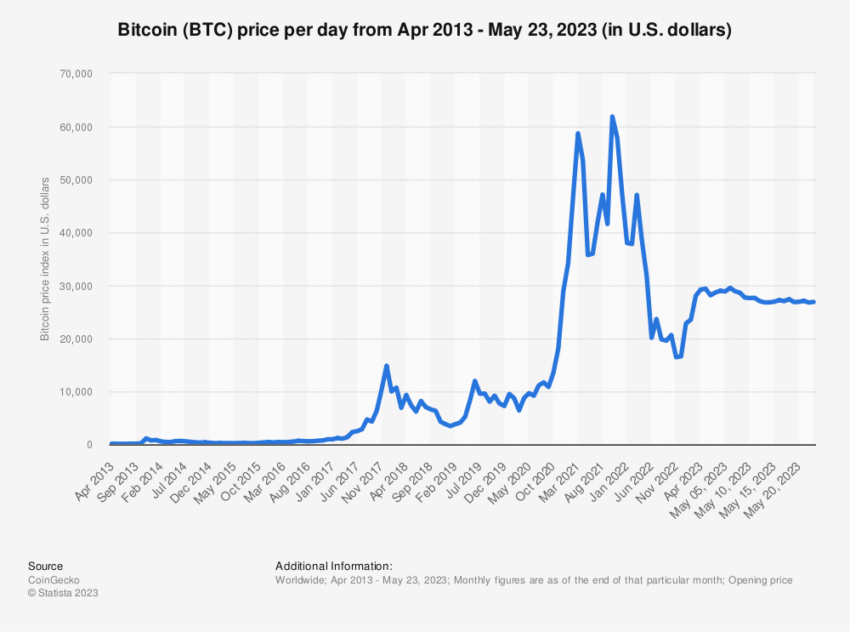

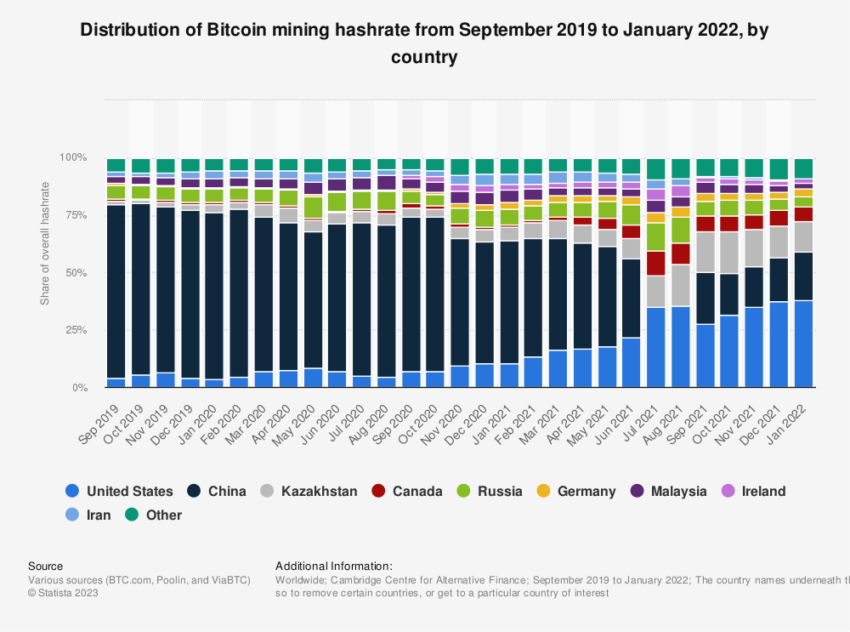

In 2021, China took the most serious measures in its history against cryptocurrencies. With Bitcoin hovering around $55,000, the State Council of China announced an official ban on crypto mining. Shortly after, the hash rate on the Bitcoin network dropped by 50%. Also, the price of Bitcoin dropped to around $30,000 in the months that followed.

Along with the Bitcoin mining ban, China’s regulatory agencies have banned all crypto trading and transactions. It is also illegal for residents to send cryptocurrencies and for businesses and banks to accept coins like Bitcoin and Ethereum. Despite the ban, there is no specific policy against holding digital assets. This is why Chinese residents who already have crypto in a wallet are not breaking existing laws.

Why did China ban cryptos?

Various factors were influential in China’s decision to ban cryptocurrencies. These include:

- Consumer protection concerns as cryptos are associated with fraud and money laundering.

- Uncertain legal status of digital currencies.

- The potential for capital flight.

- devaluation of the yuan.

- Environmental concerns due to Bitcoin’s high energy requirement.

- Desire to control Central Bank Digital Currencies (CBDCs) and metaverse projects.

cryptocoin.comAs you follow, China is actively working on an official CBDC known as the “digital yuan”. Also, cities like Shanghai have committed billions of dollars to develop national metaverse projects.

The ban had significant effects on the global crypto industry. China’s ban on Bitcoin mining has resulted in a significant drop in hashrate on the Bitcoin Blockchain. Most of China’s Bitcoin miners have fled to countries that are friendlier to the crypto industry. However, Bitcoin’s overall hashrate continued to rise in the months following the ban. As of January 2022, it was significantly higher than before China’s Bitcoin ban.

Mining activity in China was also observed to appear on Bitcoin’s network in September 2021. This indicates that many Chinese mining pools still operate underground.

Is China lifting its ban on Bitcoin and altcoins?

Despite strict restrictions, China’s crypto ban has not completely halted activity in the industry. Underground crypto markets have sprouted as crypto enthusiasts in the country continue to find ways to circumvent restrictions. Recently, however, there have been signs of a possible shift in China’s attitude towards crypto. In the latest development, there are indications that China may ease its tough stance on cryptos. This news is quite significant considering that one of the most significant shocks to the crypto market in the last few years came with the release of China’s most significant push for digital assets in 2021.

This push was part of a broader effort to regulate the fintech industry. It was also in line with China’s desire to launch its own digital currency, the digital yuan. The global crypto community is watching closely for signs of a potential shift in China’s stance towards crypto. However, the details of this change are not yet clear and it is not yet clear how these developments will result. It should be noted that even as China eases its restrictions, it will continue to exercise tight control over the industry to ensure consumer protection, avoid potential financial risks, and maintain control over its own digital currency initiatives.

What if China lifts its ban on Bitcoin and altcoins?

If China lifts its ban on Bitcoin and altcoins, this will likely significantly impact the global crypto market. As the world’s most populous country and one of its largest economies, China’s adoption of crypto could stimulate global demand, boost prices and potentially lead to wider acceptance of digital currencies. It’s also possible that it could pave the way for the return of crypto mining activities to what was once the world’s largest Bitcoin mining hub.

Binance CEO Changpeng Zhao says lifting China’s crypto ban is a “major event”. CCTV’s recent release of a news section on crypto has made waves in the Chinese-speaking communities. Zhao commented:

Historically, such news has led to bull runs. I am not saying that the past predicts the future.

Still, the lack of a ban for altcoins can also pose challenges. For example, it is possible that it will lead to increased volatility in the crypto market. In addition, it is likely to pose regulatory challenges as authorities grapple with consumer protection, money laundering and financial stability issues. The potential lifting of China’s ban on crypto is a development with significant implications for the global crypto market. However, until more concrete information is obtained, the real impact of this development will be seen.

Popular Chinese coins

Below is a list of popular Chinese coins.

- neo (NEO)

- Cocos-BCX (COCOS)

- Vechain (VET)

- Conflux (CFX)

- Alchemy Pay (ACH)

- Filecoin (FIL)

- IRIS (IRIS)

- Flamingo Finance (FLM)

- Highstreet (HIGH)

- Measurable Data Token (MDT)

- SelfKey (KEY)

- Linear Finance

- dForce (DF)

- Barley (ARPA)

- Phoenix (PHB)

- Ontology (ONT)

- IOST (IOST)

- Tron (TRX)

- Eos (EOS)

- LeverFi (LEVER)

- Sui Network (SUI)

- The Sandbox (SAND)

- OKx (OCD)

- BitDAO & Mantle (BIT)

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.