Crypto analyst Ekta Mourya says she is challenging TRON to the crypto winter. The analyst also predicts that his partnership could accelerate MATIC’s recovery. Crypto analyst Filip L, on the other hand, is expecting a 40% rise for the OP price. Analyst Aaryamann Shrivastava notes that Floki Inu is going through tough times. Crypto analyst David is looking at 100 on the horizon for Litecoin. Finally, according to Santiment, this altcoin is probably about to rally.

This altcoin challenges the crypto winter!

Cryptokoin.com’As you can follow from the TRON network, earlier this week, the TRON network reached important milestones. Now main-net has several new upgrades lined up. As of Tuesday, the total number of transactions on TRON exceeded 5.7 billion. This, in turn, signaled increased growth and adoption of the network. On Wednesday, daily transactions exceeded 10.9 million, a record high for TRON. According to Tronscan data, the total number of USDT transfers exceeded 2.1 million.

While the TRON network has reached new milestones in terms of on-chain activity, the price has yet to reach this level. Altcoin price climbed from $0.0667 on May 1 to $0.0765 on Wednesday. This indicates an increase of 14.69%.

However, last week the TRON price fell 7% from $0.0797 on May 23 to $0.0741. The altcoin is currently trading at $0.0740. Hence, it needs a bullish catalyst to start the recovery.

Can this partnership accelerate MATIC’s recovery?

The Polygon network has the backing of one of the world’s largest telecommunications giants. Deutsche Telekom has expanded its operations towards Blockchain technology. Thus, it was included in the network as a validator, supporting the MATIC ecosystem. The partnership with the telecom giant is likely to fuel bullish sentiment among MATIC holders and catalyze the token’s recovery. According to press time, MATIC has provided its owners with gains of up to 3% in the last two weeks.

The altcoin is likely to attempt a recovery in its bullish trajectory towards its weekly high of $0.9491.

This altcoin has strong technical cards to rise

Optimism price has been falling like a rock since Monday. But OP is not a single case. Rather, it is under scrutiny of a global pressure to avoid risk in global markets where stocks and cryptocurrencies are sold hand in hand. As crypto enters its third day of selling pressure, some indicators such as the Relative Strength Index (RSI) are heavily oversold. Therefore, a pullback is possible.

The OP is approaching the long-term green ascending trendline, which has been tested many times in the past. Add to that the big psychological figure of $1.30, and there are two excellent reasons for a rebound. In a recovery, it could quickly go to $1.90 with the key $1.46 high as the only element in the path of a 40% upswing.

However, a break of this green ascending trendline and the $1.30 level would risk a complete blowout in the OP. At $1.10 there is still S3 support for May. But once it surpasses it, it becomes a clear path to $0.65. This is a new low for 2023. That means a close to 60% drop for this week.

Floki Inu is having a hard time

FLOKI price has dropped more than 10% on the charts in the last three days. Currently, the altcoin is trading at $0.00003143. Since the beginning of May, FLOKI has seen significant fluctuations. But it failed to sustain any green candlestick. The meme coin is still struggling to break through the key barrier of $0.00003790. In this way, investors are somehow enjoying the profits again.

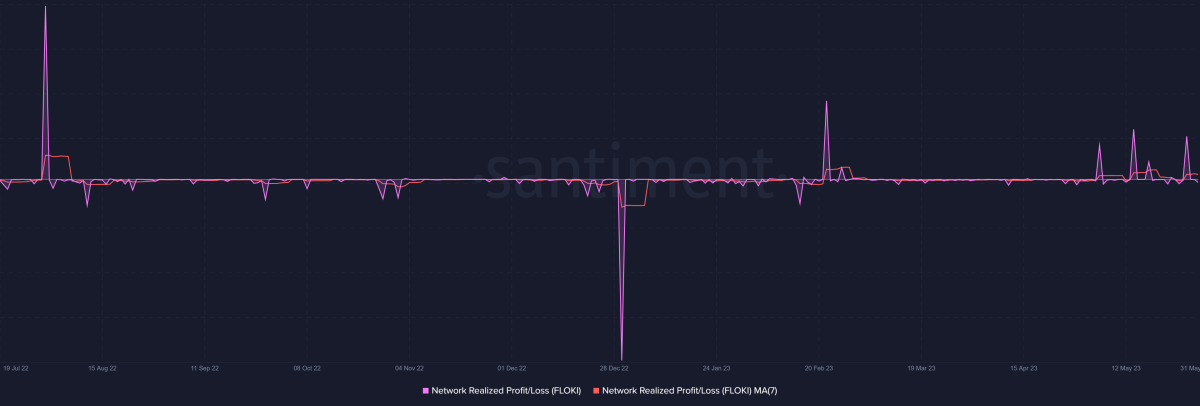

The on-chain realized profit/loss indicator shows that traders have made gains in the past few days. This situation was last experienced towards the end of February, after which the activities of the investors slowed down significantly. However, these gains also point to sales. Because profits or losses are realized only when they are resold for their current value. It’s good for investors to see profits rather than losses. However, these are still the impact of the sale. So it’s possible that if it goes up it will be detrimental to the price.

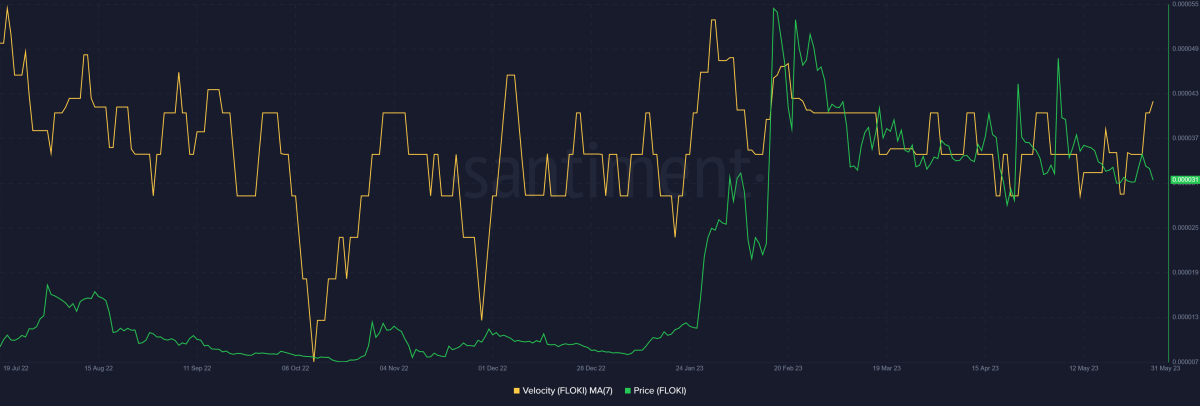

The supply of FLOKI started to change hands at a good pace as it was. The speed, which measures the speed at which a token moves through addresses, is currently at a three-month high. This indicates that network activity is strong at the moment as more tokens are moving, indicating that investors are transacting on-chain.

Hence, realized profits and higher on-chain activity from investors indicate that FLOKI has the potential to rise further and break the $0.00003790 resistance level. The transformation of this level into a support base will also provide the necessary support for FLOKI to rise further. However, rejection from the same level could leave the altcoin vulnerable to drop below $0.00003000.

Is $100 on the horizon for this altcoin?

Litecoin (LTC) price has been rising along an ascending support line since November 7, 2022. The price has bounced off this line multiple times, most recently on May 8 (green arrow). Next, the price formed a morning star pattern (red ellipse). This is usually a bullish pattern that indicates the continuation of the previous uptrend.

Indeed, the price formed a bullish ‘pin bar candlestick’ the following week. Thus, it pointed to strong buying pressure at lower levels. Therefore, altcoin price is likely to rally towards the nearest resistance level at $100 and potentially $130. The weekly RSI indicator supports this possibility as it bounced off the 50 level, which coincided with the price bouncing off the support line.

The most likely outlook is for LTC price to break above the current short-term pattern and rally to at least $100. However, the bullish perspective is invalidated if the price dips below the support line of the ascending triangle at $87.

XRP about to rally!

Crypto analytics platform Santiment says the bullish XRP signal that preceded a major rally in March has once again flashed. The market intelligence firm notes that daily XRP address activity has historically increased to a level that preceded a breakout. According to Santiment, XRP saw the largest address activity increase in its history on March 18. Also, the token went up in price by 45% in the following 10 days. In this context, Santiment makes the following statement:

XRP Network has experienced the second and third largest address activity growth of all time over the past two days. A slight divergence of +4% emerged between XRP and the altcoin package. If history repeats itself after the March 18th increase in activity, this rate could increase even more.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.