As a cross-chain interoperability protocol Polkadot (DOT) continues to grow, many projects built on its framework are experiencing huge price increases as a result of this development.

Moonbeam (GLMR)

First in the list of altcoins with price action Moonbeam (GLMR) exists. Monbeam is a smart contract platform that runs on the Polkadot parachain and is compatible with the Ethereum Virtual Machine (EVM).

The project also goes beyond the core features of Ethereum by offering staking, on-chain governance, and cross-chain integrations.

In January, Moonbeam raised over $900 million in DOT tokens during a crowdfunding campaign.

As a result of this ecosystem growth, Moonbeam has experienced an increase in its price by more than 100 percent in the last few days; It saw it rise from $2.97 to $5.94. After experiencing a major correction, GLMR is trading at $5.01, up 2% on the day.

Moonriver (MOVR)

Another altcoin with big gains is; sister project of Moonbeam, a smart contract platform with full Ethereum compatibility, Moonriver (MOVR). The goal of the project is to use the Ethereum Virtual Machine (EVM) to allow developers to efficiently migrate their projects to Moonriver while simplifying the use of popular developer tools to create or redistribute projects based on the Solidity programming language.

Moonriver initially rallied over 36 percent, from $64.17 to $87.36. However, the altcoin, which has since corrected itself, has slumped over 6% to $76.91 in the last 24 hours.

Primer (ASTR)

An open-source, multi-chain smart contract platform Primer (ASTR) is among the rising Polkadot projects. Astar Network connects layer-1 blockchains through the Polkadot ecosystem with capabilities ranging from decentralized finance (DeFi), non-fungible tokens (NFT) to decentralized autonomous organizations (DAO).

As the service token of the platform, ASTR provides staking rewards, transaction fees and on-chain governance.

The liner was priced at $0.12 last week before climbing 125% to as high as $0.27 on Friday. ASTR has corrected since Friday and is now trading at $0.20, down 6.5 percent on the day.

Acala (ACA)

The fourth success story based on DOT is the decentralized finance (DeFi) network powering the aUSD (AUSD) stablecoin ecosystem. from Acala (ACA) came.

The network charges “micro” gas fees and its service token, ACA, is used for governance as well as node providers.

Acala has rallied over the past week, jumping 57 percent from $1.24 to $1.95 on Saturday. Experiencing some volatile price action, the ACA is up over 4% in the last 24 hours and retains most of its gains at its current $1.81 valuation.

Polkadot is a favorite of crypto mutual funds

Messari, a crypto analytics firm, noted that Polkadot’s cryptocurrency DOT is currently the most widely held token among crypto mutual funds, among other key developments.

“Whether Polkadot’s native token, DOT is a service and governance token used to participate in governance, transaction fees, security via staking, and connecting to parachain slots. As of March 2022, DOT is the most widely held asset among crypto funds.

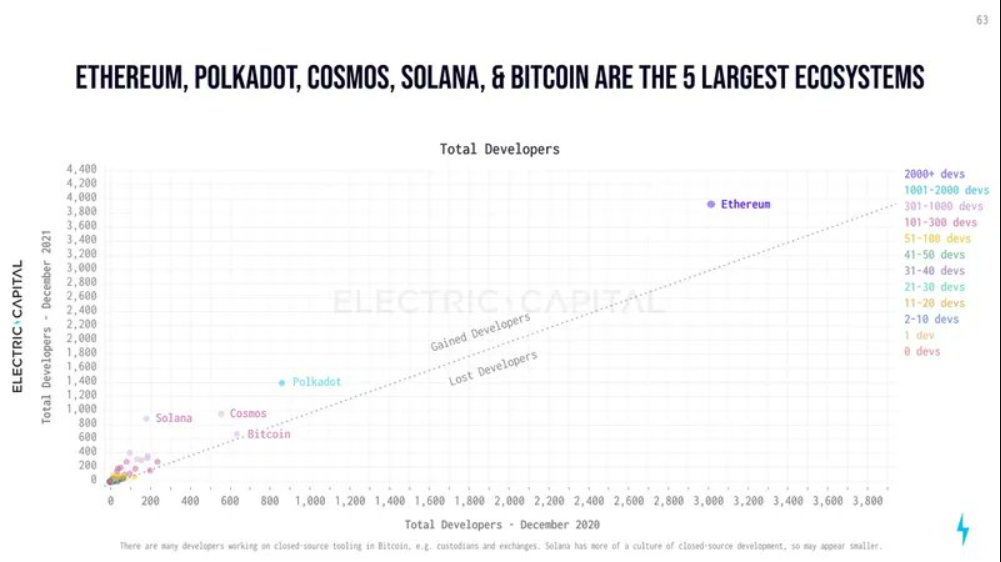

After the distinctive architecture of Polkadot combined with the adaptability of Substrate, the platform has attracted the second largest developer community. Now that Parachains are operational and huge [girişim sermayesi] Now that the funding has been secured, the developers’ rewards are available to the masses.”

Polkadot recently completed its 13th parachain auction. Users participate in these highly selective auctions by bidding on crypto assets for predetermined times to determine which network will receive a parachain slot, a private blockchain that confirms transaction accuracy.

At the time of writing, Polkadot is down 5 percent. 21.88 traded in dollars.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.