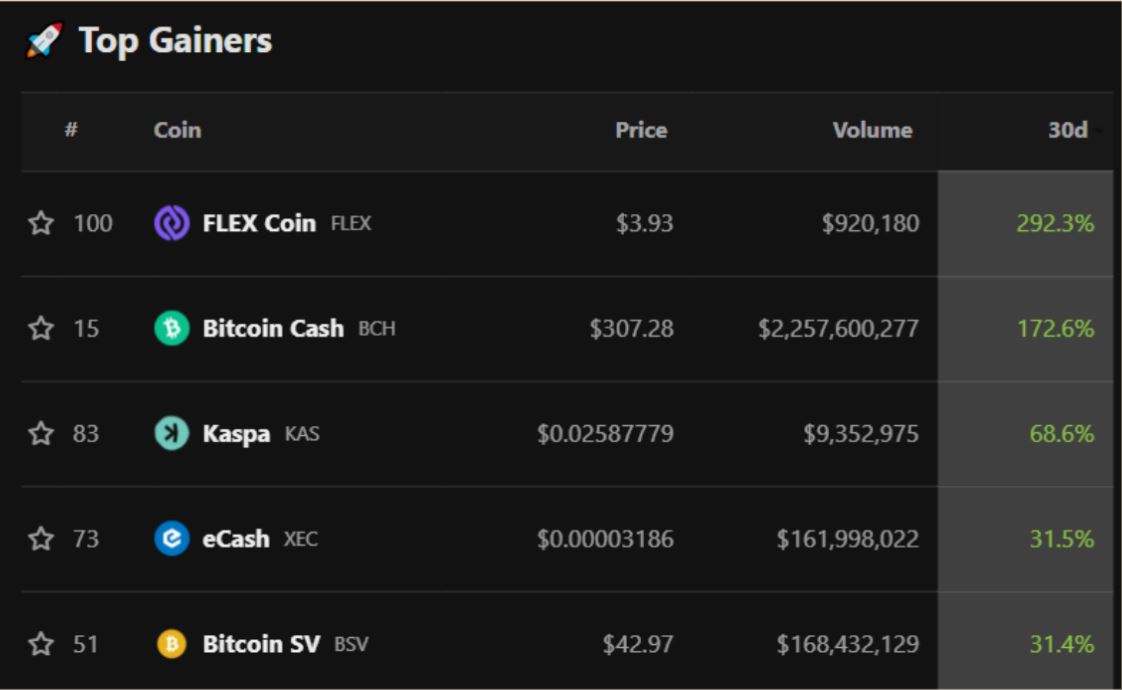

The altcoin market has watched the rally of coins with Bitcoin forks over the past 30 days. So were the gains organic and will the rally continue?

BCH, BSV and XEC rose last month, any more?

The lawsuits by the US regulator SEC against Binance and Coinbase triggered negative price movements in the cryptocurrency market at the beginning of June. However, BlackRock’s ETF filing on June 16 turned the tide just as quickly. cryptocoin.com As we reported, Santiment confirms that the rally is largely linked to ETF news.

During this period, Bitcoin fork BCH, BSV and XEC were in a rally trend. KAS and FLEX led the way in terms of altcoin gains in June. The launch of EDX Markets, backed by Wall Street giants Fidelity Investments, Citadel Securities and Charles Schwab, will launch on June 20 with Bitcoin fork coins such as Bitcoin Cash and Bitcoin SV and other Proof-of-Work (PoW) such as Kaspa (KAS). It has stimulated a particular industry that includes cryptocurrencies.

The exchange launched with Bitcoin, Ether, Litecoin and BCH. The inclusion of BCH caused an uptrend in other Bitcoin fork coins. Three Bitcoin forks were among the top winners for June, followed by FLEX Coin (FLEX), backed by Kaspa and co-founders of the bankrupt Three Arrows Capital fund backed by Open Exchange (OPNX). FLEX benefited from its integration with OPNX.

In contrast, Bitcoin, which traded above the $30,000 level for the first time since April 2023, recorded a monthly gain of 11.94%.

FLEX Coin (FLEX) received short-term support from link with 3AC co-founders

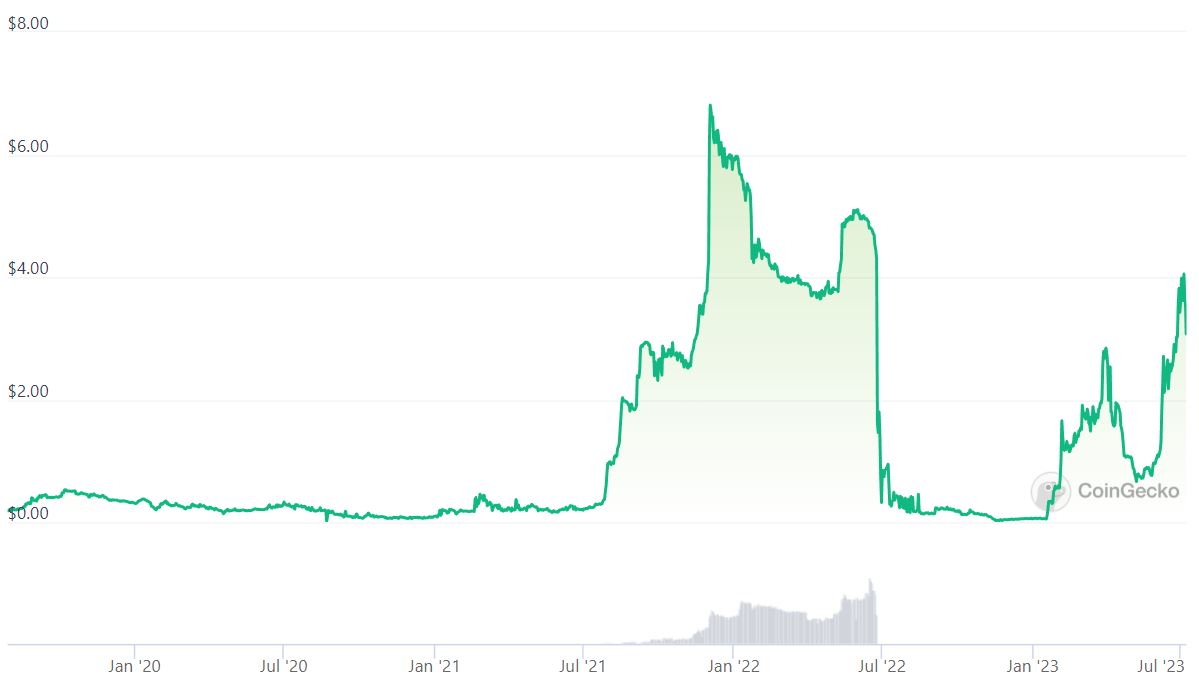

FLEX announced in May 2023 that it was switching to OPNX, a bankruptcy claims exchange. The altcoin price hit a 13-month high of $4.37 on June 27. OPNX is backed by the co-founders of the now-bankrupt venture fund Three Arrows Capital. Reportedly, the co-founders face $1.3 billion in liability for actions that increased the fund’s losses.

Nevertheless, the duo continued to support OPNX under the new venture fund using the same brand as their previous funds. FLEX was approved by the Seychelles courts on March 6 for the restructuring of its exchange. Its integration with Open Exchange benefits FLEX on OPNX to settle claims and earn staking rewards.

Notably, as the FLEX price soared to 2022 highs, trading volumes remained low at around 0.01% of the $1 billion daily volume it generated at its peak. This also poses a danger sign. It represents a significant volatility situation in illiquid assets. Due to limited liquidity, investors can more easily raise the price of these cryptocurrencies compared to larger, more liquid assets.

Technically, the 2022 break near $5.08 and the ATH level at $7.56 will act as upside resistance levels. The token faces 80% downside risk up to $0.75, which represents the accumulation level in May 2023.

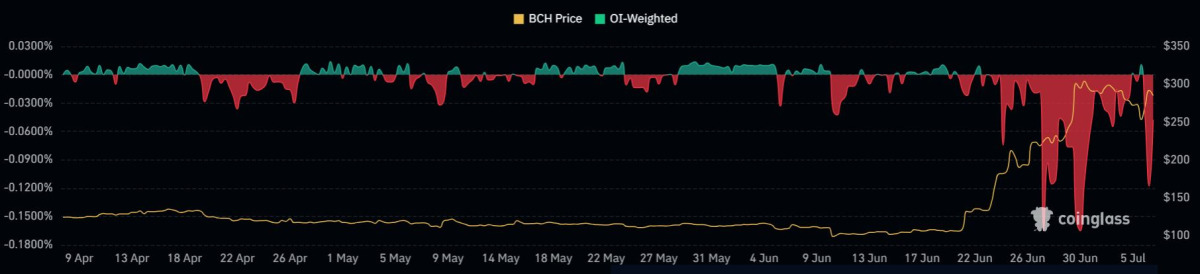

Bitcoin Cash (BCH) continues its uptrend in EDX markets

The price of BCH more than doubled in June after it was listed on the EDX markets. BCH was one of four cryptocurrencies to debut on the platform, along with BTC, ETH, and LTC. EDX listing acts as a positive catalyst. Meanwhile, the boom on South Korean stock exchange Upbit is another impetus.

According to analysis from The TIE, BCH witnessed a total liquidation of $21 million in June. Total fees paid on the Bitcoin Cash network have been under $200 since the beginning of the year. This shows that the use of Blockchain is limited.

By comparison, Litecoin with a similar benefit generates nearly 10x more revenue for miners than BCH. Weak fundamentals and high liquidation levels raise a red flag on the sustainability of recent gains.

BSV rides altcoin BCH wave despite weak fundamentals

BCH and BSV have a strong correlation of 0.78. This may be why BSV posted 31.4% gains in June. BSV has been in a stable downtrend since 2022, as the crypto bull market and interest in Blockchain waned after trading volumes dried up.

The Bitcoin fork hit the ATH level of $21.43 on June 10 before BCH caught the bullish wave and made an upward move. Its poor performance drove miners away from its ecosystem. Thus, it made the 51% attack on Bitcoin SV relatively cheaper.

Kaspa (KAS) benefits from improved performance and lower liquidity

Kaspa is a PoW-based Blockchain network similar to Bitcoin and Litecoin. It also offers a high throughput of one block per second compared to a block every 10 minutes for Bitcoin. Kaspa Labs has also recently hinted at the launch of a new public testnet that will increase the scalability of the network by 10,000 times.

However, KAS is primarily traded on unregulated exchanges with low trading volumes and low trust scores, according to CoinGecko. This makes the cryptocurrency highly volatile and susceptible to manipulation.

If the bullish momentum continues, KAS will attempt to retest the 2023 high of $0.40. On the downside, it risks a correction to yearly lows of around $0.15. While the altcoin is facing tough competition from major PoW networks like Bitcoin and Litecoin, one-year price action has been positive with higher and higher bottoms.

eCash (XEC) joins altcoins BSV and BCH in a Bitcoin fork rally

Finally, eCash (XEC), similar to BCH and BSV, rode the positive wave. Similar to Bitcoin SV, eCash lacks core value. Therefore, it fluctuates due to illiquid market conditions. The token is listed on several major exchanges such as Binance and Bithumb. However, it is not yet listed on any US-based exchange. This raises a red flag too.

The rise of low-liquidity tokens suggests price manipulations. The long-term value proposition of Bitcoin forks remains questioned, with low utility and security. You can take a look at what happened in the South Korean market last week from this article.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.