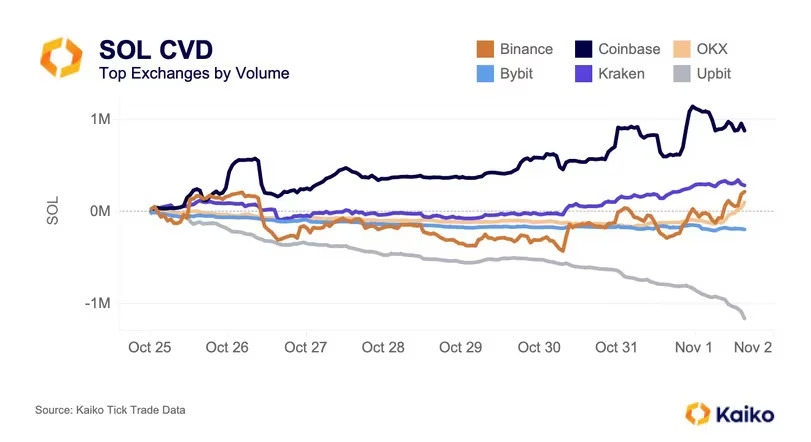

According to data provided by Paris-based Kaiko, solana The reason why its price increased by over 50% in two weeks may be Coinbase, which is listed on Nasdaq.

Since October 25, SOL’s cumulative volume delta (CVD) has increased by nearly $1 million on Coinbase, indicating a net capital inflow. CVD on Binance and Kraken turned positive earlier this week, while South Korean exchange Upbit has been negative and trending south for two weeks.

The CVD metric tracks the net difference between buying and selling volumes, which is a measure of the net bull or bear pressure in the market. Positive CVD values indicate that the buying volume is greater than the selling volume, while negative CVD values indicate that the selling volume is greater than the buying volume. This metric can reflect market sentiment and the emotional reactions of investors because investor behavior affects buying and selling volumes, which can lead to changes in the CVD metric. CVD can be used to provide information about the overall trend of the market and potential trend changes.

According to Kaiko analyst Riyad Carey, coinbaseThe median order size on may have had more significance than on other exchanges, perhaps a sign of institutions bidding on Solana (SOL). Coinbase’s lead in the SOL market comes after the release of a report predicting a bullish scenario that could push the price of the cryptocurrency as high as $3,200 by 2030. This prediction is based on the potential that Solana could become the first blockchain to support applications with over 100 million users.

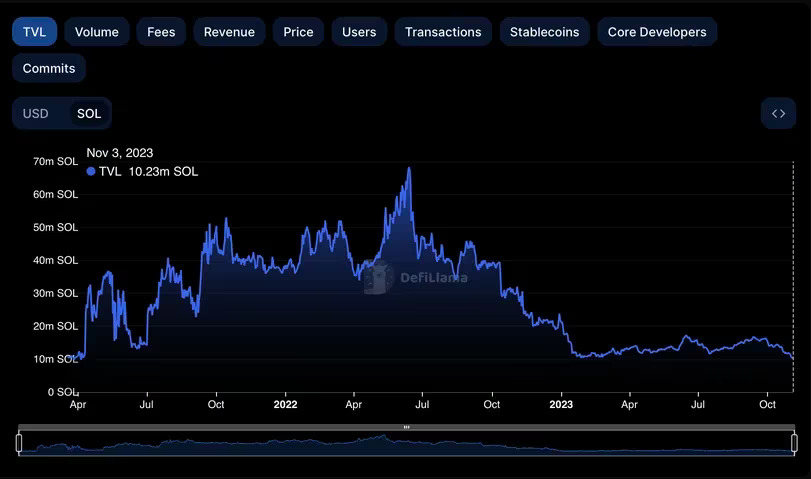

However, despite SOL’s recent price increases, activity on the chain does not seem to have revived yet. According to DeFiLlama, the total value of assets locked in Solana-based DeFi protocols decreased from 12.03 million SOL to 10.23 million SOL in the last two weeks, the lowest level since April 2021. This caused TVL, a commonly used metric to measure the usage of smart contracts, to drop.

The order size on Coinbase and the report on Solana’s future are seen as important factors to evaluate SOL’s potential and attract investors’ attention. However, the revival of on-chain activities and adoption of protocols will be critical to demonstrating the true value of SOL.

Volume on Solana-based decentralized exchanges and active addresses on the network are increasing, but not enough to justify price increases, chain analyst Patrick Scott wrote in a post on stated.