The $4.3 billion fine imposed by Binance, the world’s largest cryptocurrency exchange, in the USA and the events surrounding this fine were widely talked about in the industry. While all these discussions continue, the native token of the bankrupt crypto exchange FTX FTT Tokenattracted attention by gaining more than 55% in value in the last 48 hours.

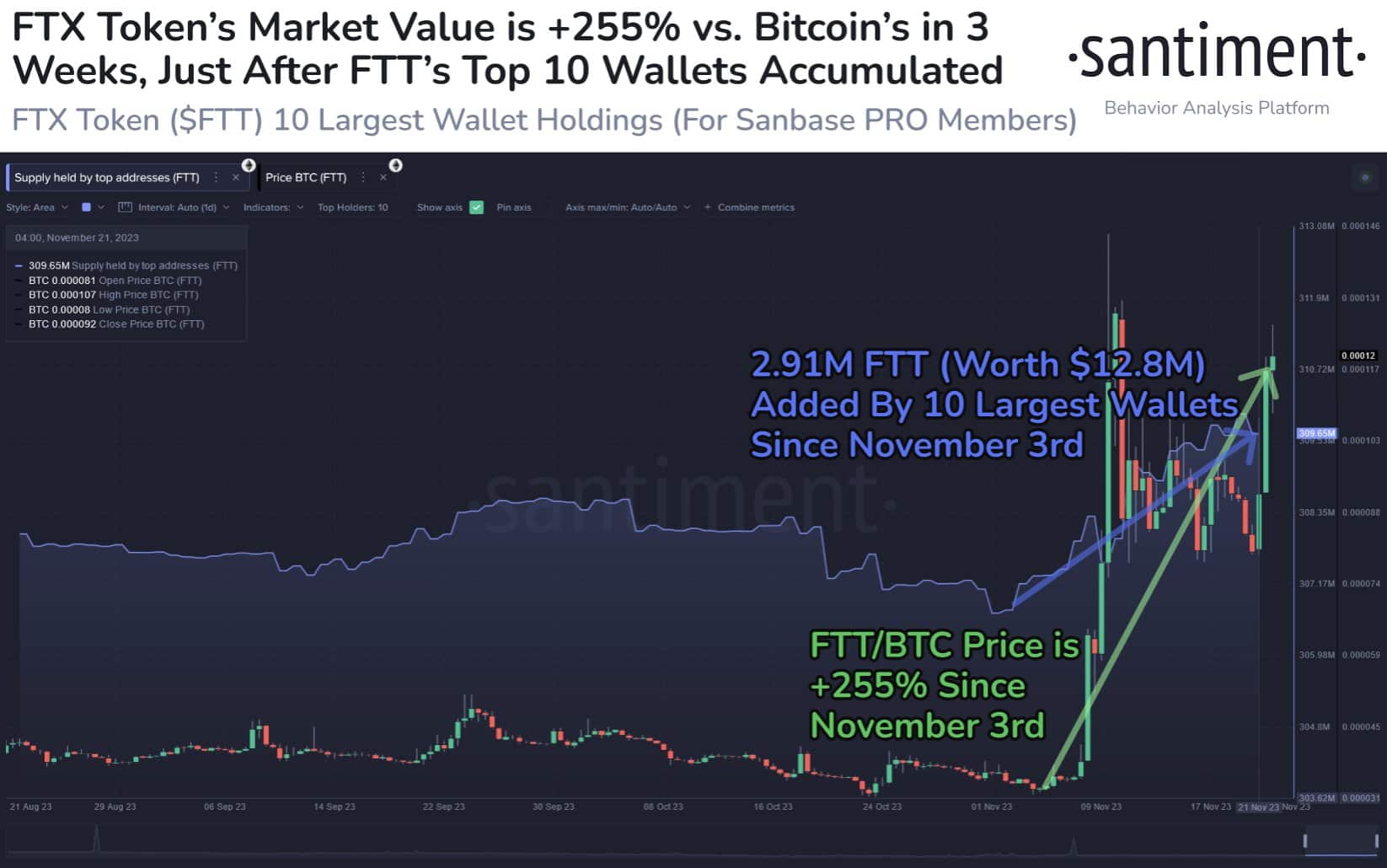

FTT recorded a phenomenal growth of 337% month-on-month. Most of the gains came in the last 10 days, when the heavy accumulation of the top 10 whale wallets continued. Market cap of FTT during this period BitcoinIt increased by 255% compared to .

According to Santiment’s analysis, FTT Token recorded a second increase following the latest developments in Binance. The token’s value fueled this surge, with the top 10 wallets amassing $12.8 million worth of coins in just 19 days.

Excitement Around FTT Token Increases

FTX’s recent approach to liquidate its assets and transfer significant funds between different exchanges. cryptocurrency triggered increased activity in the market. In an important move, FTX and its subsidiary Alameda Research made a significant asset transfer worth a total of $474 million.

This strategic move is being undertaken as part of a broader initiative aimed at addressing the financial responsibilities of the exchange and potentially paving the way for a new phase dubbed “FTX 2.0”. Another striking detail is that this action took place in the middle of Binance’s $4.3 billion agreement with the United States Department of Justice.

The recent increase in FTT Token price is notable given its relatively limited utility. This rise indicates significant institutional interest despite the token’s historical connection to FTX’s bankruptcy troubles. FTT also managed to attract attention by reaching the highest level since the beginning of the year with 4.3 dollars.

In contrast, Binance’s native token BNB suffered a decline, falling 13% to $235. Additionally, outflows from the stock market attracted attention, exceeding $1 billion.