At the end of a very busy and declining day for the crypto money markets, an altcoin is trying to create an opportunity to start the uptrend by turning the crisis into an opportunity.

VeChain (VET) The price continues to develop conditions for a ‘triple bullish’ breakout, which represents a significant uptrend. VeChain, which wants to ‘lead’ in the altcoin market, seems to want to catch an uptrend setup by trying to use all the crises in the market to its advantage.

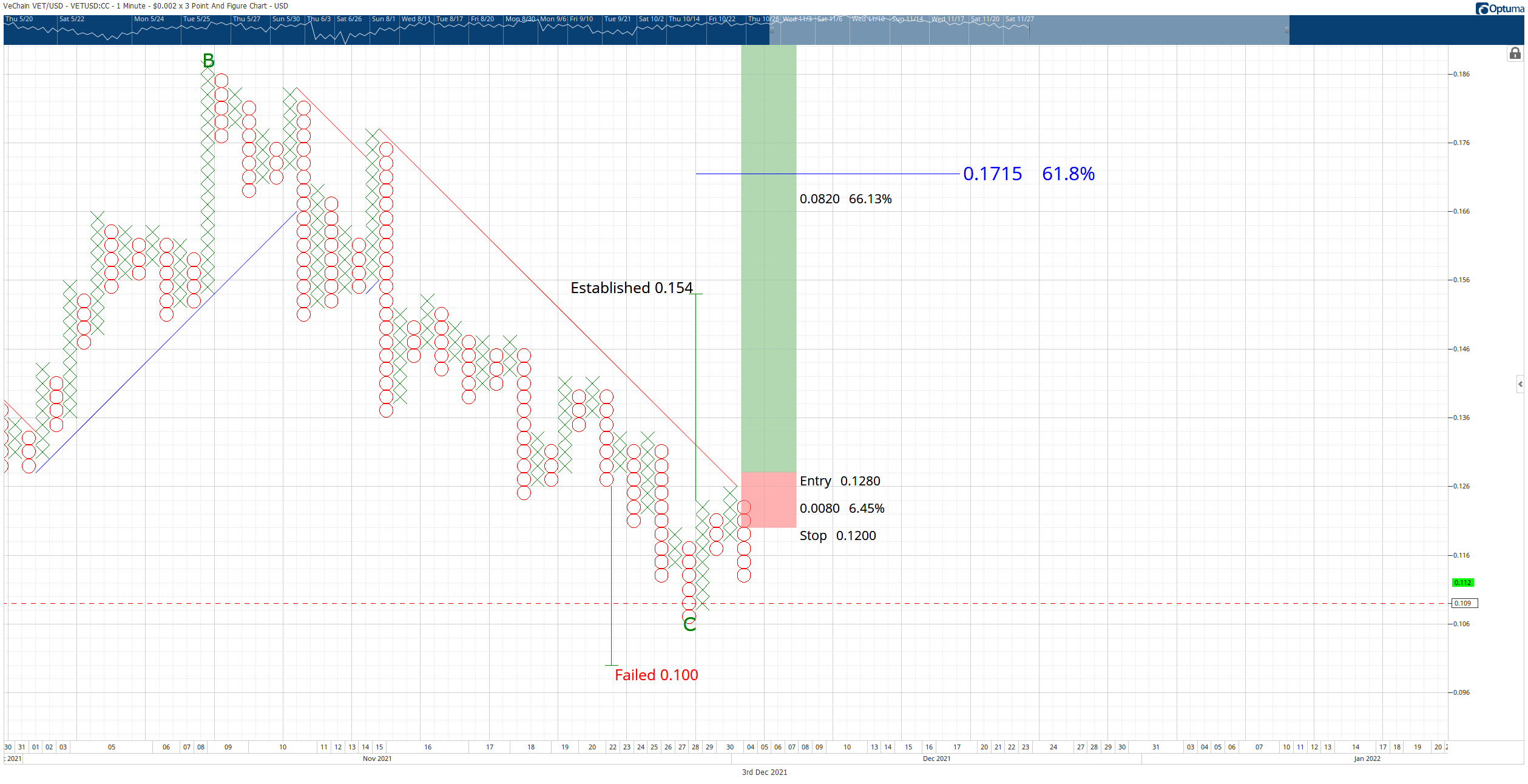

The price spiral may result in a break towards $0.21 at the end of the setup, but the possibility of ‘sudden’ downside moves technically remains. VeChain price is positioned for a massive bear trap, which will see an increase of over 80%. The $0.002/3-box Dot & Figure chart illustrates why a break above $0.126 could start a spike higher.

Could it have turned the crisis into an opportunity?

VeChain price looks set to explode, continuing to shatter all hopes of current and future “short” sellers.

VeChain price has a rare combination of three strong bullish signals on the “Dot and Shape chart”. And if VeChain reaches the entrance of the hypothetical long setup, all three signals are considered real or verified. The three signals are as follows:

- An entry of $0.128 would confirm an ascending triple top break.

- An entry of $0.128 confirms a “bear trap point and shape pattern.”

- An entry of $0.128 breaks the dominant bear market angle and turns VeChain into a bull market.

It’s not uncommon to have such a substantial collection of upside reversal signals at the same price level. Because of these three signals, they worsen the predicted profit target from the “Vertical Profit Target Method”. As a result, the profit target at $0.21 is only slightly below the 100% Fibonacci expansion of $0.212.

The theoretical long entry is a buy stop of $0.128, a stop loss of $0.120 and a profit target of $0.21. The idea of a long trade will be invalidated if VeChain price drops below the $0.106 value area.

If there is any weakness over the weekend (which is always possible in weekend trading sessions), the downside risk should be capped by the 38.2% Fibonacci retracement at $0.072.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.