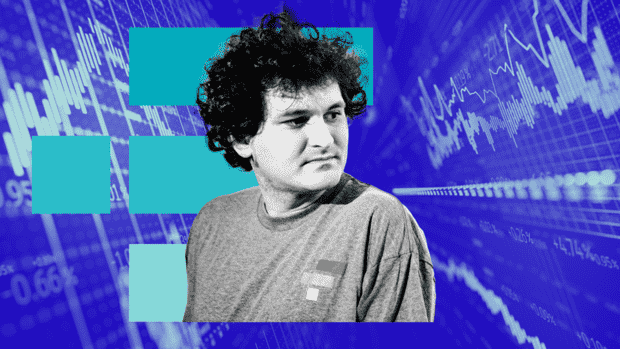

After the bankruptcy of his crypto exchange, several authorities have him in their sights.

(Photo: Getty Images (2))

Frankfort, Jerusalem It is arguably one of the biggest crypto scandals in history: the bankruptcy of what was once the third largest crypto exchange in the world, FTX. The US Securities and Exchange Commission, the Justice Department and a host of other agencies have targeted FTX and its founder Sam Bankman-Fried. Bankman-Fried – the former star of the scene – is suspected of having been a big con man. He is accused, among other things, of having stuffed billions in losses at his hedge fund Alameda Research with client funds from FTX.

It is the third major crypto crisis of the year: in mid-May, the Terra crypto project crashed, wiping out around $50 billion in investor assets. And in July, the crypto platform Celsius Network filed for bankruptcy. But what lessons can investors, crypto platforms and regulators now learn from the renewed crisis?

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue