One of the steps that forced banks to return to TL deposits within the framework of the Central Bank’s liraization strategy was partially backed down. As it will be remembered, one of the regulations that subject the deposit and holding of dollars to additional securities liabilities was the regulations regarding the securities establishment liabilities. The Central Bank’s regulations obligated banks to issue low-interest securities to banks that remained below a certain TL deposit rate. With a regulation published in the Official Gazette tonight, this regulation was softened.

Although the CBRT kept its 70 percent liraization target, it lowered the additional burden limit for banks that fell below this rate from 60 percent to 57 percent, and reduced the security establishment burden of banks that failed to meet the target.

At the same time, with a knock-on effect, this forced banks to implement some practices to alienate their customers from foreign currency, or to convert foreign currency deposits into TL by paying astronomical interest rates on the TL side. With the new regulation, it is thought that there may be a partial relief on the side of foreign exchange liquidity and a stir in foreign currency deposits.

After this development, eyes will be turned to the dollar front. This development, which affects the foreign exchange liquidity, is also interpreted as a development that may psychologically put pressure on the dollar rate as the first regulation regarding the return from the liraization strategy, which has been widely criticized in terms of markets.

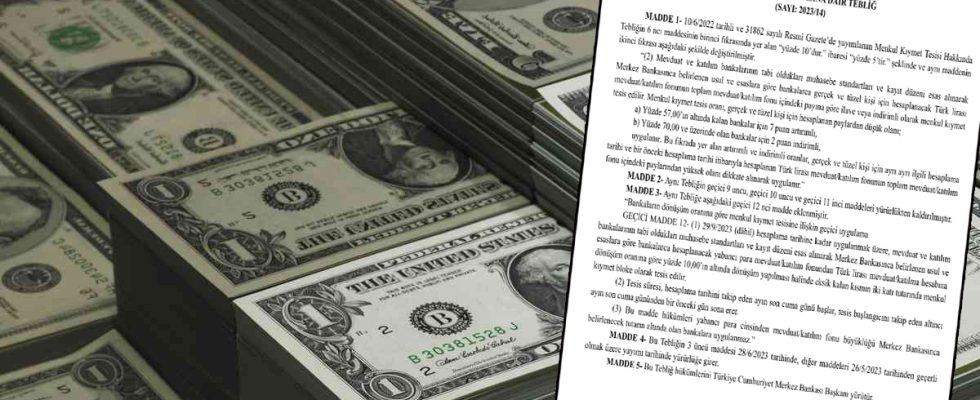

Here is the Central Bank’s regulation published in the Official Gazette:

ARTICLE 1- It is “10 percent.” The phrase “5 percent.” and the second paragraph of the same article has been changed as follows.

“(2) Securities in additional or discounted securities according to the share of the Turkish lira deposit/participation fund to be calculated for real and legal persons by banks in accordance with the procedures and principles determined by the Central Bank, based on the accounting standards and registration scheme to which deposit and participation banks are subject, in the total deposit/participation fund. value is established. The rate of establishment of securities is the lower of the shares calculated for real and legal persons;

a) 7 points increase for banks below 57.00 percent,

b) 2 points discount for banks with 70.00 percent or more,

is applied. Incremental and reduced rates in this paragraph are applied separately for real and legal persons, taking into account the higher of the relevant calculation date and the share of the Turkish lira deposit/participation fund calculated as of the previous calculation date in the total deposit/participation fund.”

ARTICLE 2- Provisional 9th, provisional 10th and temporary 11th articles of the same Communiqué have been repealed.

ARTICLE 3- The following provisional article 12 has been added to the same Communiqué.

“Temporary application regarding the establishment of securities according to the conversion rate of banks

PROVISIONAL ARTICLE 12- (1) The foreign currency deposit/participation fund to be calculated by the banks in accordance with the procedures and principles determined by the Central Bank, based on the accounting standards and registration scheme to which deposit and participation banks are subject, to be applied until the calculation date of 29/9/2023 (inclusive). In case of conversion below 10.00 percent according to the TL deposit/participation account conversion rate, a security equal to twice the remaining amount is blocked.

(2) The facility period starts on the last Friday of the month following the calculation date and ends the day before the last Friday of the sixth month following the start of the facility.

(3) The provisions of this article do not apply to banks whose foreign currency deposit/participation fund size is below the amount to be determined by the Central Bank.

ARTICLE 4- Article 3 of this Communiqué shall enter into force on 28/6/2023, and other articles shall enter into force on the date of its publication, with effect from 26/5/2023.

ARTICLE 5- The provisions of this Communiqué are executed by the President of the Central Bank of the Republic of Turkey.

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.