Spot Bitcoin On the ETF’s first day of trading on Wall Street, the BTC price did not react much. BTC is trading at $46,080, down 0.87%, and has a market value of $902 billion. Additionally, options data also shows a muted response in trading activity.

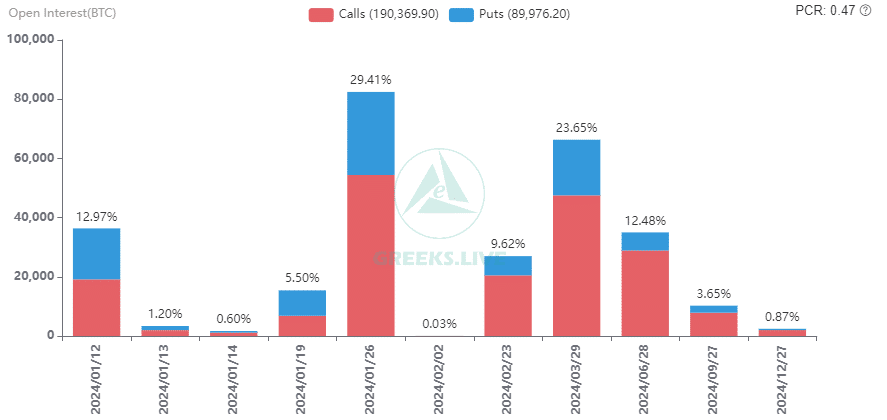

Greeks.Live reported that as of January 12, 36,000 Bitcoin options were about to expire, revealing a Put Call Ratio of 0.9, a maximum pain point of $45,000, and a face value of $1.68 billion.

In the run-up to ETF approval, short-term implied volatilities (IVs) peaked, followed by a significant decline in large-term IVs as market volatility fell below expectations. While the adoption of the Bitcoin Spot ETF is likely to inject additional capital into the crypto market in the long term, short-term uncertainty remains. Various factors at play could contribute to continued sharp swings like those witnessed throughout this week.

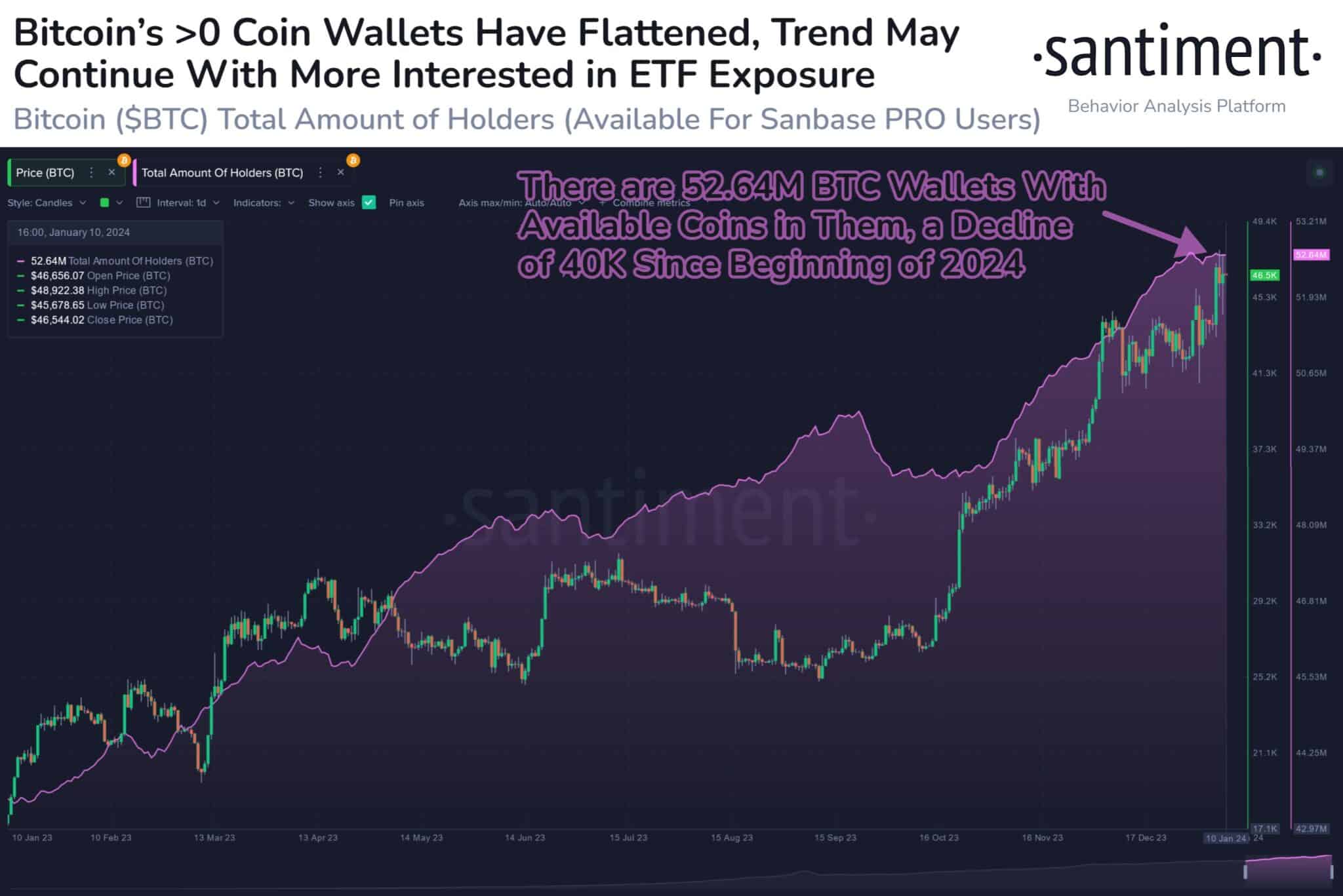

Alongside Bitcoin options data, Santiment noted the approval of on-chain data BTC ETFs, indicating a slight downward trend in active wallets on the blockchain.

Investors remain unimpressed with the current Bitcoin (BTC) price as the excitement surrounding the Spot BTC Exchange Traded Fund (ETF) has not translated into significant gains.