Santa Clara, Munich At the photo shoot in Munich at the end of June, Roland Busch and Jensen Huang first joked about their height. The photographer found it difficult to get the tall Siemens CEO and the much smaller Nvidia founder in a picture that was beneficial for both of them.

Busch and Huang visibly tried to present the cooperation they had just sealed as a partnership on an equal footing. Not that easy, because at least on the stock exchange the balance of power is clear: the chip specialist is worth around five times as much as the Dax group. And this despite the fact that the high-flyer from California does not even generate half of Siemens’ sales.

Just like at the Siemens headquarters on Munich’s Wittelsbacherplatz, Huang is going in and out of more and more corporate headquarters in Germany. The billionaire from Silicon Valley has become one of the most important suppliers to German industry. Whether Bosch, Mercedes or Siemens: The chips of the 59-year-old electrical engineer are intended to pave the way for traditional companies into the future.

Why is Nvidia such a coveted partner among German corporations? What distinguishes the company that the Taiwanese immigrant Huang has made the most valuable chip company in the world within three decades? A look into the nerve center of the company provides information.

Top jobs of the day

Find the best jobs now and

be notified by email.

Nvidia is at home in a spaceship

In the south of Silicon Valley, in Santa Clara, a new building complex dominates the streetscape. With the 70,000 square meter office colossus “Voyager” and the adjoining “Endeavor” building, Huang has built a futuristic headquarters. The names stand for the founder’s world of thought: this is what spaceships are called in the space series “Star Trek”.

The Voyager and Endeavor office complexes are named after spaceships from the Star Trek series.

(Photo: Nvidia)

A gigantic roof construction, reminiscent of tents, spans the open office space. “Every job here has a good view,” says Danny Shapiro, head of Nvidia’s automotive division, during a tour of the site.

The complex is the solid performance record of the man who shaped Nvidia like no other: Jensen Huang, a married father, co-founded the company in California in 1993 and has been running it since day one. “Huang recognized early on that the big technology trends require an incredible amount of computing power,” says Peter Fintl, chip expert at the consulting firm Capgemini.

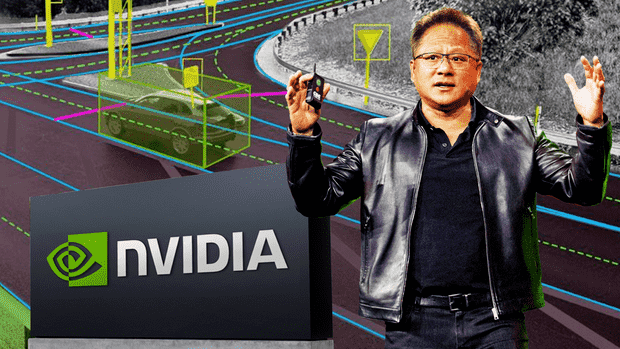

Huang and his people developed the most powerful graphics chips. The processors called GPU are crucial for computer games. However, they have also long been indispensable in data centers and for artificial intelligence (AI) applications, such as those required for autonomous driving or for virtual worlds. A small but interesting business is also that of processors for cryptocurrency mining.

The tremendous demand for its semiconductors has given Nvidia an impressive rise. In fiscal 2015 (ending January 30), sales were just under $5 billion, seven years later it’s $26.9 billion. The business is also highly profitable: in the 2022 fiscal year, Nvidia will make a profit of $9.8 billion.

Partners for car manufacturers

German companies have been global leaders in many areas for decades. Cars and machines “made in Germany” are still among the best in the world. But they can only make the leap into the digital world with the help of the Americans. “Nvidia not only has staying power,” emphasizes consultant Fintl. “The group also has the necessary funds to invest heavily in future fields. Determination and financial strength distinguish the company from many European technology players.” The company helps Siemens make factories more efficient. She works with Mercedes and Bosch on self-driving cars. Nvidia is working on a supercomputer with Continental. BMW is also one of the customers.

The chips from the US manufacturer are popular with German companies.

(Photo: Reuters)

Nvidia has retained its entrepreneurial spirit to this day. This can be seen directly opposite the head office. Huang rented a garage there. Dozens of Mercedes vehicles swarm the streets of Silicon Valley every day. “These are no ordinary Mercedes sedans,” says Shapiro, head of the auto division. The vehicles were supplemented with sensors in a number of places. “We are testing the best systems so that cars will soon be able to drive themselves.”

It’s typical for Nvidia not to simply sell chips. Huang is always concerned with taking technical development to a new level. “If a problem is easy to solve, then it doesn’t interest me,” he once said during a performance in Munich.

Huang knows that the German corporations need him, but he doesn’t let them know, at least to the outside world. On the contrary: the company leader flatters his customers. “Mercedes is an incredible partner. I can’t think of a better one,” he said recently. “Mercedes will become the most valuable luxury brand on the planet,” added Huang. And Mercedes boss Ola Källenius is a visionary. German car bosses rarely hear such niceties from Silicon Valley.

>> Read here: The race to catch up with chips threatens to fail – the future of German industry is at stake

However, the partnership has a catch: Nvidia has a largely free choice among the car manufacturers with whom the company wants to cooperate. The only notable competitor is Qualcomm. So Huang has the upper hand when it comes to the conditions. Mercedes therefore even agreed to a share of the revenue – a novelty in the car industry as well as in the chip industry. Up to now, they have delivered their semiconductors at a fixed price, as if they were ordinary screws. In the future, Nvidia will receive a significant share of the proceeds from all autonomous driving applications that Mercedes sells to its customers.

For Nvidia, there is enormous potential in the vehicles. The automotive division “stands for the group’s next multi-billion dollar deal,” says the analyst CJ Muse convinced by the investment bank Evercore ISI.

Metaverse for industry

It’s not the only future field Huang is pushing into. Nvidia manager Richard Kerris presents the next beacon of hope in a darkened demonstration room at the company’s headquarters: Huang’s vision for a perfectly controlled factory. The screen does not show a real production line, but the virtual twin of a factory. “We can create a digital image of anything,” Kerris claims. For example, improvements in the production process can be simulated before they are implemented.

He takes care of the necessary platform at Nvidia. While the Facebook group Meta speaks of the “metaverse”, Nvidia speaks of the “omniverse”. “Our platform is the basis for digital worlds – including the metaverse,” says Kerris confidently. To put it plainly: Without the chips from Nvidia, there will be nothing with the virtual worlds on Facebook either. The system already has more than 150,000 users and 300 corporate customers.

Recently, one of them is Siemens. As with Mercedes, Huang uses his mischievous charm to ensnare the new customer. He jetted to Munich in June to announce the cooperation. As he sits next to Siemens CEO Busch, dressed as always in his leather jacket and all black, Huang prophesied: “Siemens will be one of the largest technology companies in the world.” Semantic similarities with his compliment to Mercedes are of course coincidental.

Busch and Huang had been negotiating for months. The engineers understand each other, reports from the environment. Huang studied electrical engineering, Busch physics. Both have a reputation for digging deeply into technical subjects. And both have come to the conclusion that the age of partnership and cooperation has arrived. The future belongs to open interfaces, not closed systems.

At Siemens, Nvidia’s computing and graphics power should enable a photorealistic digital twin of systems, machines and buildings in real time. This partnership could be the catalyst for breaking into the industrial metaverse, says Huang. The digital twin will one day be the most used application in industry.

However, his plans don’t stop there. The company is only just beginning to enter other sectors. This includes healthcare.

Nvidia pushes into healthcare sector

Nvidia manager Kimberly Powell places a large, black box in front of her. “It allows us to take existing healthcare devices to new heights,” says Powell, who leads the healthcare business. The box is a high-performance computer that can, for example, better process sensor data from an ultrasound device or help with the analysis of MRI images.

>> Read also: The dark side of subsidies: chip industry fears planned economy

Nvidia relies on AI to enable new applications in medicine. The “Clara” platform is intended to help identify diseases earlier and develop medicines more quickly. Among other things, the methods for decoding genomes are being optimized for this purpose.

Great visions of this kind, coupled with reliable double-digit growth, have captivated investors for a long time. At its peak last fall, the company was worth over $800 billion in the stock market. However, the slump in the rating of technology groups has also caught Nvidia recently. In November, a share still cost around 330 dollars, the papers were last listed at a good 150 dollars.

“Nvidia is a top pick,” said Jefferies analyst Mark Lipacis. He forecasts a price of 370 dollars in the medium term. It is true that the important business with the games industry is under pressure. Nvidia can counteract this with its future areas and business with data centers. In any case, the group still has its best times ahead, says Capgemini expert Fintl: “The capabilities of Nvidia’s chips are just as in demand in the digital world as they are in physical machines – whether they have four wheels or robotic arms.”

More: Comment: Dependent on America: The German industry also lacks the guts when it comes to chips