Berlin, Dusseldorf, Beijing Fear of the consequences of absolute dependence on China is growing in the German solar industry. “There is an inescapable dependence on China that cannot be denied. And that is significantly greater than the dependency on Russia when it comes to gas,” said a high-ranking manager from the solar industry to the Handelsblatt.

How dangerous this dependency is has been evident since the end of December at the latest. The Chinese Ministry of Economic Affairs published a catalog with proposals for new export regulations – also for the solar industry. Among other things, it provides for restrictions on the export of machines for the production of important components for photovoltaics (PV).

In a letter to the Federal Ministry of Economics, 24 companies from the industry have now drawn up a plan to breathe new life into the European solar industry. Among the signatories are energy companies such as Eon and solar giants such as Wacker Chemie, SMA Solar, Baywa Re and Meyer Burger. But also younger companies like Enpal, Pelion and Norsun. The letter is exclusively available to the Handelsblatt.

“The dependency resulting from this concentration harbors risks for the energy transition in Germany and Europe,” the senders warn. This was seen, among other things, in the massive disruptions in the global supply chain during the corona pandemic.

They are now demanding active government intervention. If politicians want to achieve their ambitious goals for the energy transition, Germany needs more solar energy and thus more production of solar technology. Germany provides one percent of global production capacity.

That’s how dependent it is on China

More than 80 percent of global solar energy production capacity is located in China. Whether polysilicon, the material used to manufacture solar cells, preliminary products for the modules such as ingots and wafers, finished solar cells or complete solar modules – according to a current analysis by the market research company McKinsey, China’s share in the individual segments is now between 68 and 95 percent .

“While European and above all German solar companies initially led the industry, Chinese PV groups now dominate the entire value chain in many respects,” write the consultants. In just 15 years, China’s solar industry has built up production capacities of 300 gigawatts. For comparison: In Europe, just under eight gigawatts were produced in 2021.

Solar energy is to become a key component of the German energy mix. From 2026, 22 gigawatts of solar energy are to be added each year, which is three times the current expansion. “Resilience in the energy supply costs money, and we are experiencing this painfully with gas. To ensure that this does not happen again with solar modules, Europe must now quickly invest in its own production capacities,” demands Gunter Erfurt, head of East German module manufacturer Meyer Burger.

When asked, the Federal Ministry of Economics said that various measures are currently being examined to further advance the expansion. You are working on a solar package. “This also includes state security instruments,” said a spokeswoman. Further details cannot be given at the moment.

idea of state guarantees

In contrast, an analysis by the German Energy Agency (Dena) on behalf of the Federal Ministry of Economics contains concrete proposals for the reconstruction of a European solar industry. The Handelsblatt reported exclusively on this. There it says: The federal government should “at least ensure the sufficient availability of capital for the successful revival of a European photovoltaic industry”. There is also talk of an industrial electricity price to support the industry.

Similar demands can also be found in the letter from the 24 solar companies. “Plannable financial support with regard to investments, for example via the state development bank KfW,” is needed.

The measures mentioned in the Dena paper are therefore in the right direction, but they should now also be available to the industry quickly, says Meyer Burger boss Erfurt. “In return, Germany and Europe will also receive several dozen solar factories,” announces the manager. As soon as the framework conditions are right, Meyer Burger is also ready to build a double-digit number of these factories itself.

Economics Minister Robert Habeck (Greens) announced at an industry meeting at the end of last week that solar companies should be guaranteed orders from the state for the coming years. In order to enable investments, “you need a guarantee that these orders will come,” he said in Berlin.

The China risk of the German solar industry seems to have been recognized in politics in the meantime. “It must not be that we exchange our dependence on Russian natural gas for an even greater dependence on Chinese photovoltaic modules,” Timon Gremmels, energy policy coordinator of the SPD parliamentary group, told the Handelsblatt.

China’s solar success also comes from Germany

Many in the industry find it almost ironic that the German solar industry has slipped into such a fatal dependency. After all, China has also become so strong because the German market collapsed massively after a significant reduction in subsidies.

Instead, German and European companies exported their technologies. So does Meyer Burger, which for years has manufactured precisely the machines for manufacturing solar components that are now possibly subject to export restrictions in China.

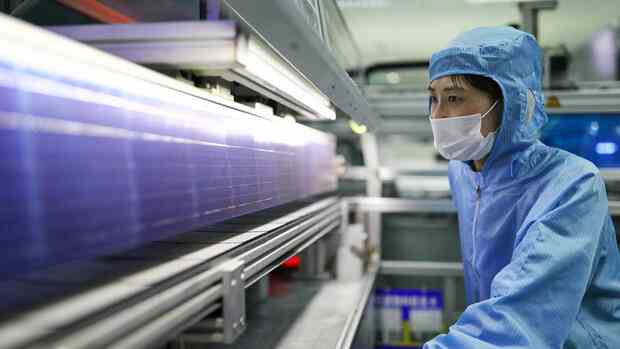

The company is one of the solar manufacturers that still produce in Europe.

(Photo: IMAGO/Sylvio Dittrich)

“But we still have the knowledge and can bring it back here,” says the head of the German module manufacturer Solarwatt, Detlef Neuhaus. In addition to political support, this requires European industrial alliances, for example. Similar to setting up battery cell production for electric cars in Europe.

>>Read also: So solar energy from space could cover the energy demand

Others suggest a model like that of the Montanunion. Founded in 1951, the European association was intended to give all member states access to coal and steel without having to pay customs duties.

Ex-Volkswagen boss Herbert Diess would like to get such an industrial consortium together. According to media reports, the former manager expects investments of 15 to 20 billion euros for several plants along the solar value chain. According to Handelsblatt information, however, the plans are anything but concrete and are still in their infancy.

Where Germany’s solar industry is still alive

Meanwhile, the German-European solar industry is not completely dead. Many of the remaining companies have been announcing regular increases in production for the past two years. At the beginning of February, Meyer Burger signed a long-term supply contract with the Norwegian wafer manufacturer Norsun. Meyer Burger intends to expand its solar cell production to three gigawatts by next year.

The Italian energy group Enel also wants to increase its production to three gigawatts. The Kassel-based inverter manufacturer SMA Solar even wants to double its factory at home by 2024. Enel, Meyer Burger, Solarwatt and a few others still produce their own modules in Europe.

With the planned expansions, European companies could reach production capacities of 15 to 20 gigawatts by 2025. Plans by the EU Commission even envisage a target of 30 gigawatts.

>> Read also: The dark side of the solar boom – grid operators are reaching their breaking point

However, this is not enough to noticeably reduce the China risk. “We’re running out of time in our efforts to rebuild everything here,” fears the boss of a large solar project developer. A few German companies are therefore also in talks with Chinese PV producers about settling in Europe.

That is permissible and makes sense: “It’s better if the production takes place on site”. According to Handelsblatt information, individual Chinese companies are now actively exploring the model of their own factories in Europe.

What the reconstruction of the solar industry costs

Either way, it takes billions to rebuild the European solar industry. The estimates are from 400 million to one billion euros per gigawatt of production capacity, if the entire value chain is to be mapped in Europe. For the EU’s plans, this means at least 25 billion euros in investments. But that is only a “fraction of what Europe has spent on securing gas supplies in the last twelve months,” emphasizes Meyer Burger boss Erfurt.

On the other hand, there is also potential revenue in the billions: the global PV market, measured against the expansion targets planned worldwide, would generate sales of up to 450 billion euros in 2035.

>> Also read the comment: The dangerous miscalculation of the oil and gas companies

However, the 24 signatories from the solar industry would be willing to pay a surcharge for European products. “Instead of just talking about how dependent we are, we finally have to take action,” says Solarwatt boss Neuhaus.

There is still a little time left: A spokesman for the Chinese Ministry of Economic Affairs told the Handelsblatt that it could be a “longer process” before the new export regulations are passed in China and come into force. There has been a great deal of feedback on the proposal for the solar industry. The catalog was last updated in August 2020. At that time, the process of changing the rules had taken more than two years.

More: After the skepticism comes the boom – this is how the USA wants to conquer the hydrogen market