The increasing upheavals caused by the Ukraine war and an impending halt to the supply of natural gas are fueling fears of a recession in Germany. The top representatives of the Association of German Chambers of Industry and Commerce (DIHK) have written a fire letter to their members in view of the precarious situation.

President Peter Adrian and CEO Martin Wansleben write: “Since February 24 this year, we’ve been in tatters.” The letter is available to the Handelsblatt. The current crisis has no foreseeable end, it continues: “Our own prosperity and that of our future generations is at stake.”

The German economy almost stagnated in the second quarter. According to the Federal Statistical Office, the gross domestic product shrank by 0.04 percent.

All leading indicators suggest that the situation is getting worse. “It’s only now getting really tough,” warns Lars Feld, President of the Walter Eucken Institute. The current situation could be worse than the financial crisis in 2008 or the effects of the corona pandemic in 2020.

Top jobs of the day

Find the best jobs now and

be notified by email.

“We assume that Germany will fall into a technical recession in the winter half-year,” says Oliver Rakau from Oxford Economics. This means the decline in economic output in two consecutive quarters.

And Ifo boss Clemens Fuest does not rule out that Germany could again become the “sick man” of Europe: “The mixture of gas shortages, demographic change, backlogs in digitization and friction in foreign trade affects Germany more than other countries in Europe.

Germany only in the bottom third

Germany, for many years the economic powerhouse of Europe, is now in the bottom third of Europe in terms of current growth data. Among the four largest economies in the euro area, Germany even takes last place.

Between April and June, France increased its economic output by 0.5 percent, Italy by 1.0 percent and leader Spain by 1.1 percent. Overall economic output in the currency area increased by 0.7 percent.

>> Read here: “The US economy is weakening very quickly” – US sends signals of recession

However, there is at least one small ray of hope: the Federal Statistical Office has corrected German growth for the first quarter upwards. If the authority had previously assumed an increase of 0.2 percent, it has now been revised to 0.8 percent. “In summer, the revisions are always particularly strong because the Federal Office then incorporates many statistics that came in late,” explains Oliver Holtemöller, Vice President of the Halle Institute for Economic Research (IWH).

A few weeks ago, and especially before the Russian attack in Ukraine, significantly higher growth rates were expected in Germany. In December, the IWH had predicted an increase of 2.1 percent for the second quarter, which is now stagnating. And the situation is likely to continue to deteriorate.

“In particular, the business expectations of companies have collapsed since the beginning of the war and point to a recession,” says Nils Janssen, economic researcher at the Kiel Institute for the World Economy (IfW). In fact, the mood in the top floors of German business is worse than it has been for around two years. The Ifo business climate index was at a two-year low in July.

There are five reasons for the poor prospects for the next few months:

1. The energy crisis is spreading

Germany is becoming more and more independent of Russian gas imports. Russia has already throttled deliveries several times and is currently delivering only 20 percent of the agreed quantity. According to calculations by the leading economic research institutes, that would be enough for Germany to get through the winter.

But the dispute is already damaging the economy. Above all, the ever-new threatening gestures from Russia are causing further price jumps. In June alone, import prices were 29.9 percent higher than a year earlier.

A sixth of German companies want to limit their production for this reason or have already done so, according to a DIHK survey. Alternatively, many companies are switching to other energy sources. This also increases the price of oil and electricity.

And furthermore, it cannot be ruled out that Russia will permanently stop its deliveries. Then Germany would inevitably slide into a recession.

A complete failure of Russian gas imports would reduce German gross domestic product by 1.5 percent in the current year, by 2.7 percent in the following year and by 0.4 percent in 2024, the International Monetary Fund (IMF) estimates. Rationing could only be avoided with strong support from other EU countries.

But this solidarity is not guaranteed. The chairman of the advisory board at the Federal Ministry of Economics, Klaus Schmidt, calls this circumstance “the greatest risk of a gas crisis”.

2. Inflation slows consumption

The high energy prices are increasingly being passed on to other goods. Although the inflation rate fell slightly in July to 7.5 percent, it is still at a high level. This is increasingly burdening private consumers.

These should have become a support for growth. According to estimates by the institutes and the federal government, private households are sitting on around 200 billion euros in additional savings that they accumulated during the corona pandemic because they were unable to spend the money in restaurants or on culture. With the end of the corona measures, they should have spent them en masse, that was the prospect before the war broke out.

However, in anticipation of sharply rising energy bills and rising costs for everyday groceries, citizens are still not spending the money. “Inflation is slowing down the greatest hope for an upswing: consumption,” says IfW economist Janssen. The HDE consumption barometer, compiled by the Handelsblatt Research Institute, has fallen to an all-time low.

3. The downward trend of the major economic powers is spreading

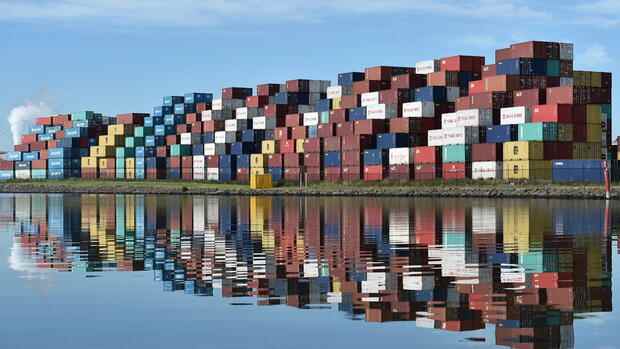

Hardly any national economy reacts as sensitively to the global economic situation as the German one. Germany still generates well over 40 percent of its wealth through exports. According to Eurostat data, exports accounted for 47 percent of economic output last year.

But the global economy is in an increasingly critical state. The USA has just announced a technical recession with a second minus quarter.

Lockdown-stricken China is now a mere shadow of its former form in terms of growth. And almost a fifth of German exports go to the two largest economies in the world.

“Germany would immediately feel a sustained weakness in our two most important trading partners,” warns Ifo boss Clemens Fuest. In fact, the situation in the US and China is critical. The zero-Covid strategy decreed by the Chinese government not only worsens the global supply chain problems, but also weakens the economic power of the People’s Republic in the long term.

The IMF has lowered its growth forecast for China this year to 3.3 percent. The economists from Washington write that these are the worst prospects for Germany’s most important trading partner in more than four decades. And in the USA, the IMF sees “systemic risks” – mainly because of the high inflation rates. Most recently it was more than nine percent.

Overall, the IMF sees the prospects for the global economy as “dark and uncertain”: The experts at the Monetary Fund only expect global growth of 3.2 percent for the current year. That is another 0.4 percentage points less than assumed in the forecast in April. This weakness primarily affects the economy that has made exports its business model: Germany.

4. The turnaround in interest rates could lead to a return of the euro crisis

The European Central Bank (ECB) was late in tackling interest rate hikes compared to the US Federal Reserve, but the tightening of monetary policy will also gain momentum in Europe – the inflationary pressure is too high. In July, the inflation rate in the euro zone was 8.9 percent.

Lars Feld, President of the Walter Eucken Institute, warns with a look at the German figures: “There are some indications that even double-digit inflation rates are possible.” At its July meeting, the ECB decided to raise interest rates for the first time in ten years – by 0 .5 percentage points. Further rate hikes will follow.

However, long-term capital market interest rates in Europe have already risen sharply – especially for highly indebted countries such as Italy, which, with a ratio of 150 percent, accounts for almost a quarter of the euro zone debt. Since the beginning of the year, yields on ten-year Italian government bonds have risen from one percent to more than three percent. At times they were even over four percent. The ECB’s announcement that it would design a special instrument for the targeted purchase of government bonds calmed the markets somewhat.

However, the fear of a return to the euro crisis has not yet been banished – countries such as Greece, Spain and France are also heavily indebted. Such a scenario would also hit Europe’s largest economy hard – almost 60 percent of German exports go to the European domestic market.

In any case, the rising capital market interest rates are also burdening the German federal budget. Last year, the federal government paid four billion euros for its debt service thanks to low interest rates.

>> Read here: Italy and France record economic growth

Thanks to the interest savings, the household consolidated itself over the years without any effort to save. But those times are over: According to the draft budget, Federal Finance Minister Christian Lindner (FDP) will have to spend 29.6 billion euros on interest as early as next year.

5. The pandemic is coming back

Almost all current economic forecasts are based on one crucial assumption: the coronavirus will no longer come back in full force, and there will no longer be any extensive restrictions. But in view of the high number of infections, more comprehensive protection requirements for everyday life are currently coming into focus again.

Pressure is growing from the federal states towards Berlin to soon determine greater options for intervention in a critical pandemic situation. Federal Health Minister Karl Lauterbach (SPD) supported the thrust. “The federal states must be unleashed in the protective measures,” he recently wrote on Twitter.

IfW head of economic activity Stefan Kooths says: “Whether there will be significant upheavals in autumn depends not only on the virus variants but also on the political reaction.” The fear that this will be exaggerated and that Germany will set back the economy again is not off the table.

More: “We are in tatters” – German economy fears recession