new York 2023 is the year of the AI hype. At the end of November 2022, the Microsoft partner OpenAI ChatGPT went online. Anyone could use the text robot, which works on the basis of artificial intelligence (AI). This triggered a boom in AI applications around the world – and in investments in the corresponding companies.

But despite promising start-ups such as StabilityAI from London and DeepL from Cologne, Europe is falling further behind when it comes to investments in AI companies, as an exclusive evaluation by the analysis company Pitchbook for the Handelsblatt shows.

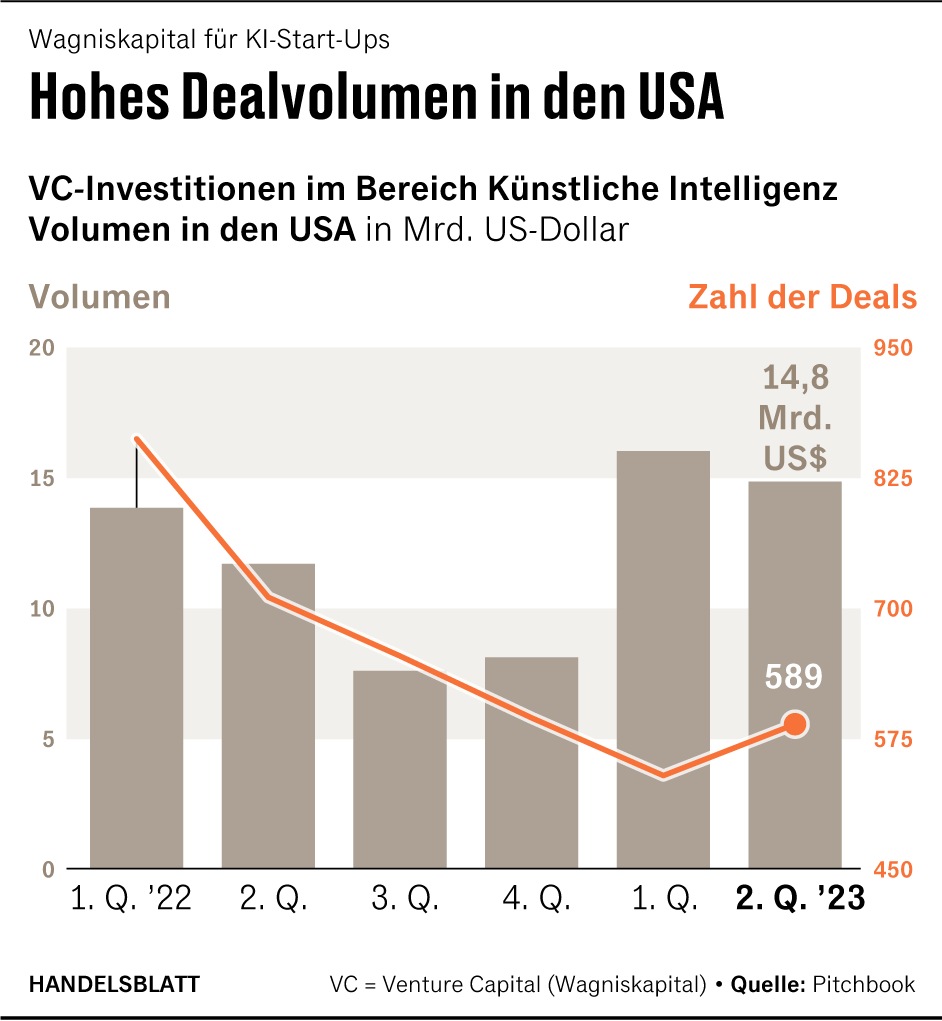

According to this, there were 1129 venture capital deals in the field of AI and machine learning (ML) in the USA in the first half of 2023. 30.8 billion dollars flowed into corresponding start-ups. This is a strong plus compared to the second half of 2022: At $ 15.6 billion in 1249 deals, only half of the investments came together.

The situation in Europe is different. In the first half of 2023, 3.7 billion dollars were taken from 646 deals. Not only did significantly less money flow into AI than in the USA – the pace of European investment even slowed down in 2023: In the second half of 2022, 761 deals still totaled 4.6 billion dollars.

The development alarmed observers. It is not so much the absolute figures that are surprising: the fact that European start-ups have less money at their disposal is nothing new – the US capital markets are simply more developed, and investors are traditionally more willing to take risks. Rather, it is problematic that in the AI hype year 2023, European venture capital financing declined instead of increasing significantly as in the USA.

Influence of Google, Meta & Apple: Europe’s AI investment weakness intensifies

“Europe is falling further behind when it comes to the future topic of AI,” says Brendan Burke from the analysis company Pitchbook. “There are also important AI researchers, academic institutions and capable founders in Europe. However, they are not able to raise comparable sums as in the USA.”

According to Burke, the fact that Europe’s investment weakness worsened in 2023 is due to the “increasing effect of the tech giants”, i.e. the influence of US companies such as Google, Meta and Apple. For one thing, many AI startups are founded by former employees of the tech giants. On the other hand, they deliberately invested in promising start-ups in order to use their developments for internal research – and thus drove the growth of the AI sector in the USA.

A similar ecosystem is missing in Europe, according to Burke. “The European research laboratories were not as successful.” Even European hopefuls like StabilityAI from London, which is behind the Stable Diffusion program, could not have closed “mega deals” like their US competitors.

StabilityAI raised $101 million in the fall, achieving “unicorn” status. An attempt to attract further investments at a higher valuation this spring failed.

And even if European software manufacturers invest, the money does not necessarily go to Europe. Venture capitalist Sapphire Ventures, which receives much of its funding from SAP, plans to invest more than $1 billion in AI-focused startups, it announced on Tuesday. However, the investor makes a considerable part of the deals in Silicon Valley.

AI specialists: European start-ups are becoming takeover targets

What happens to those promising European start-ups that survive the start-up phase? A second evaluation, which the analysis company Dealogic created for the Handelsblatt, sees them as a takeover candidate.

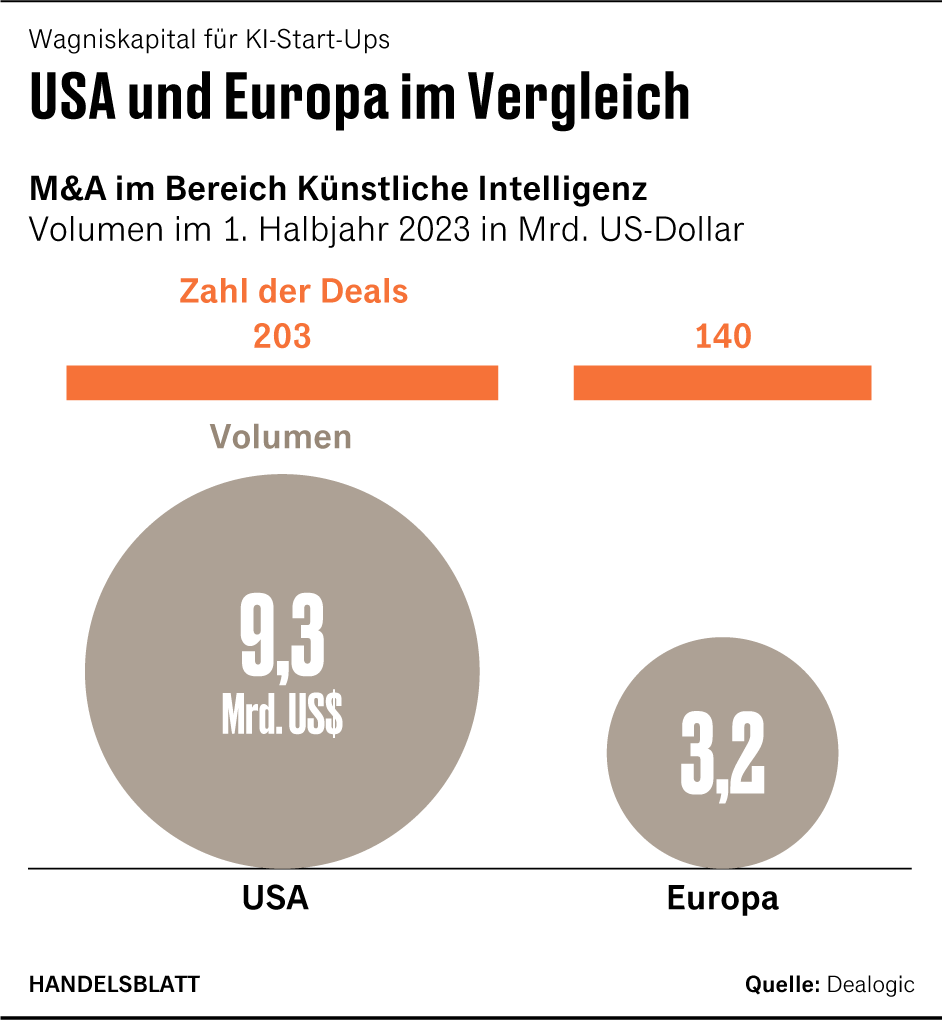

Dealogic looked at the AI mergers and acquisitions (M&A) market in the US and Europe. In principle, the US market dynamics are stronger here as well, as analyst Kalina Tzerovska explains: In the first half of 2023, $9.3 billion was spent on M&A transactions in the USA and $3.2 billion in Europe.

On the other hand, European AI start-ups are becoming foreign takeover targets much faster. In the first half of 2023, 1.6 billion dollars flowed to Europe for corresponding M&A transactions. In return, European companies spent $1.0 billion to acquire AI specialists in other world regions.

The situation is different in the USA: Only 775 million dollars flowed there for mergers and acquisitions. And the US players appear to see few attractive takeover targets in the rest of the world: They have just put $238 million into foreign M&A transactions.

Europe: Opportunities in AI compliance

If you superimpose both analyzes on top of each other, the following picture emerges, roughly formulated: The AI hype has gripped the USA. Venture capitalists invest in founders, takeovers mainly take place within the country. In Europe, on the other hand, there is a lack of both start-ups and the wherewithal. And if European AI companies are successful, they are threatened with being sold abroad.

Analyst Burke calls it a “worrying trend,” and he doesn’t see an easy fix. Of what he sees as the most promising AI start-ups – OpenAI, Anthropic, CharacterAI, AI21 Labs and StabilityAI – only the latter comes from Europe. “The AI sector is a very consolidated field. A few companies drive the lion’s share of innovation,” Burke said. The dominant US players also “did not support a broad global ecosystem of start-ups”.

Nevertheless, there are opportunities for Europe to react. Instead of trying to develop new basic models, so-called “foundation models”, founders should rather focus on adapting the leading AI models for enterprise customers – and on the area of compliance, i.e. on how AI complies with rules and laws. Models are Weaviate from Amsterdam and Qdrant from Berlin.

And European politics? This must counteract the poaching of European talent abroad, for example through better conditions for founders. “Keeping talented people in Europe” is the central task.

Assistance: Stephan Scheuer

More: Seven graphs show where in the world AI development is concentrated