Elon Musk’s purchase of Twitter and what happened after it has been on our agenda for weeks. A number of people following this complex agenda have expressed concerns that Musk will sink Twitter. However, it seems that Twitter users or analysts are not the only parties concerned about this issue. Tesla investors are concerned about this breakthrough of the company’s CEO. So what’s going on inside Tesla?

Elon Musk sells $3.5 billion Tesla shares!

Elon Musk sold more than 20 million shares of the company between Monday and Wednesday. According to one report, the total amount of this sale is worth $3.5 billion. It is worth remembering that this sales report is different from last month.

Having sold approximately $4 billion in the past month, Musk sold $8.5 billion worth of shares in April and $7 billion in August.

Why were the shares sold?

After Tesla investors expressed their reservations about the relationship between Twitter and Elon Musk, $ 3.5 billion was sold. At the heart of the concerns is that the Twitter deal is “unnecessary” and expensive. According to investors, the fact that Tesla’s CEO is also on a social media platform harms internal values.

According to a team of analysts, this recent stock sale is thought to be a response to the high interest Musk has to pay under the $44 billion Twitter deal. Investors say the sale was unplanned and they don’t know if Musk will continue with the sale. At the same time, shareholders who complain about the uncertain behavior of the businessman remind that Elon Musk promised not to sell shares years ago.

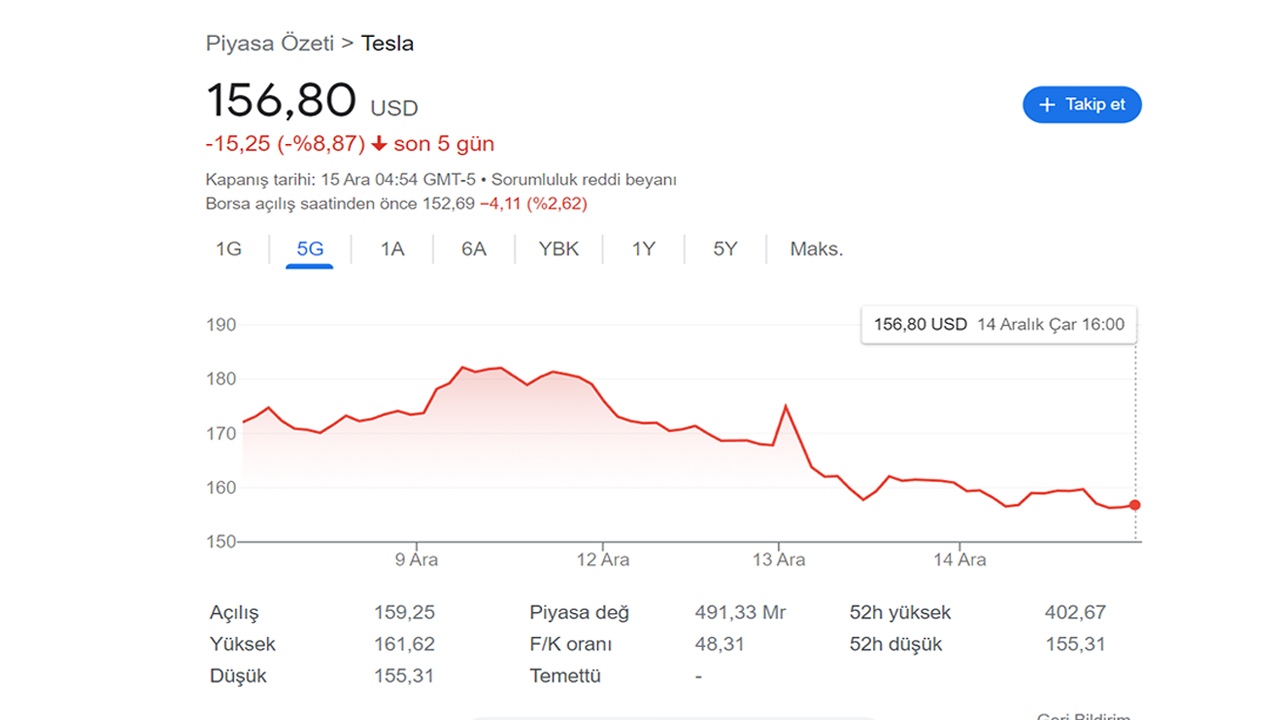

Tesla shares, which traded at $ 156.80 on Wednesday, are having their worst time in overall performance. About the shares, which fell 60.8 percent compared to January, Elon Musk mentioned that the company will buy back shares between $ 5 billion and $ 10 billion.

So what do you think about this subject? Do you think investors are justified in worrying? Don’t forget to share your ideas with us in the comments section!