Even in the most challenging times in 2022, we haven’t stopped talking about four-year cycles and expected bull markets. This year, the euphoria following BTC breaking its all-time record and historic low of $15,500 was particularly notable. However, in crypto markets, prices stabilize quickly and investors always desire more. Will the halving, which will take place on April 20, give us what we hope for?

Halving Predictions for 2024

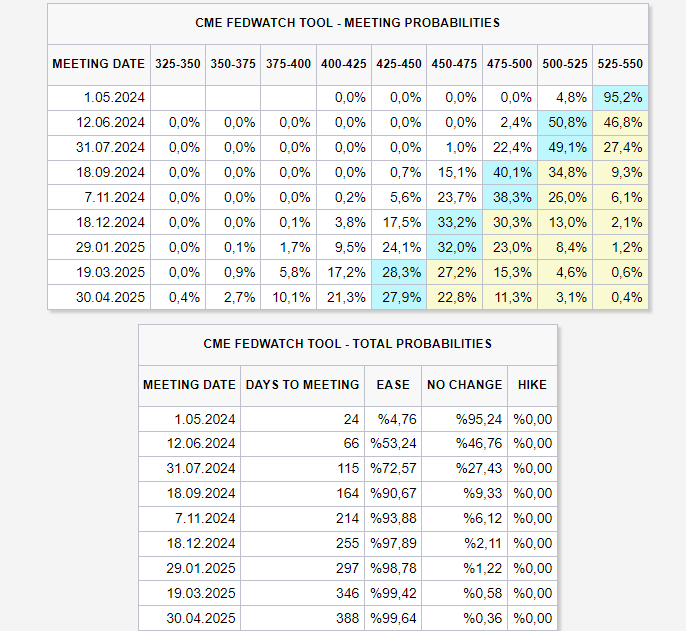

Over the past 12 months, I have written many articles explaining why 2024 looks promising. The Halving on April 20, possible adoption of ETF approvals, possible declines in interest rates (most likely at the June meeting) and many other factors will help us reach new highs in 2024. However, investors are likely to have already priced in some of these positive developments. According to the Coinbase cryptocurrency exchange, many investors have already accepted this phenomenon. Moreover, a new story is needed for the price of BTC to increase.

“The BTC halving on April 20 or 21 could be a catalyst to push prices up; “But crypto markets and other risky assets typically face poor performance around this time of year.”

The Future of Cryptocurrencies

Coinbase’s main focus is on the post-halving period, which has historically underperformed in the June-September period. According to data from Brave New Coin, Bitcoin has gained an average of 2.7% between June and September since 2011. On the other hand, the “story” Coinbase is talking about could be the Fed cutting interest rates and sparking a new wave of demand from institutional and retail investors in the spot Bitcoin ETF.

If the Fed reduces interest rates as expected, the increased demand in the ETF channel could trigger the appetite in risk markets, multiplying the total inflow of $12 billion and leading to new peaks. Additionally, the supply contraction that comes with the halving may make BTC even more prominent, especially in risk markets (considering its high return potential).

So, what happens if the Fed says, “This year we will lower interest rates by 25 basis points instead of 75 basis points because inflation has definitely stopped falling?” As $12 billion in net inflows into the spot Bitcoin ETF channel are transferred from Coinbase custodial wallets to spot markets for the sale of large amounts of BTC, what price will we expect? The structure of the crypto world, full of surprises, is truly exciting in an environment where both of these scenarios are possible.