Bitcoin Cash, which has been running strong in recent days, has increased by 200% in 10 days. The altcoin still has a long way to go, according to crypto analyst Suzuki Shillsalot.

Is it possible for the bulls to sustain this pull?

BCH’s rally stalled for a short while. The bulls’ focus is on the 61.8% Fib level as a key retracement level. Will they be able to break through the upper hurdles and pass $300?

cryptocoin.comAs you follow, crypto markets closed the second quarter of 2023 in green. Bitcoin (BTC) has reached a new high of $31.4k. It also limited the brilliance of altcoins, consolidating its dominance to 50% for the first time in more than two years. However, PEPE and Bitcoin Cash (BCH) performed excellently.

Notably, BCH outperformed BTC, gaining over 200% in 10 days. In this process, the altcoin went from $ 105 to over $ 300. BTC gained about 19% over the same period. The outstanding performance of PEPE and BCH at the time of this writing has placed them in the top three in the “Hot Trending” list on CoinMarketCap.

The RSI (Relative Strength Index) has been in overbought territory since June 21 (more than 10 days). This indicates that there was a strong buying pressure in the same period. Similarly, the CMF (Chaikin Money Flow) climbed above zero, emphasizing large capital inflows for BCH. That is, the bulls had the leverage to move forward. The next critical hurdle stands at $391, the March 2022 high. Before that, however, BCH bulls need to continue their progress by breaking the 78.6% Fib level ($327) and the $348 roadblocks.

Conversely, any faltering at the 78.6% Fib level ($327) could create a possible pullback to the $273/276 level. The bulls need to defend these levels and try to surpass the recent high at the 78.6% Fib level to protect their recent gains.

How is the futures market for altcoin?

On the 4-hour chart, CVD (Cumulative Volume Delta) rose in late June. It also showed an increase in demand over the same period. However, the metric has eased, meaning the rally has cooled, giving short sellers entry. Unfortunately, nearly $8.7 million worth of short positions have been broken in the last 24 hours, according to press time.

On the other hand, nearly $7.2 million long positions were liquidated in the same period. This underlines the long-term bullish trend. It is also possible for short sellers to fall into a bear trap.

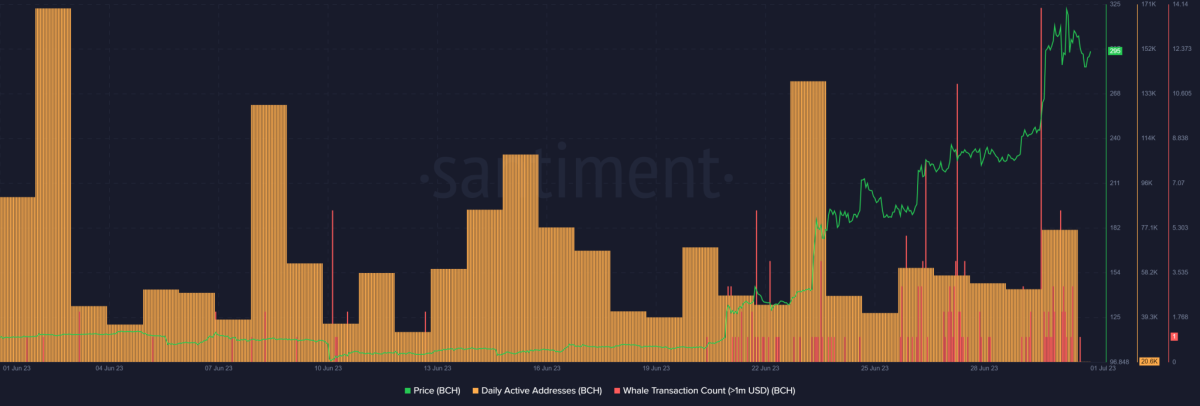

Santiment shows that the recent BCH price action coincided with strong whale interest from June 20. Whales were conspicuously absent from June 12, while from June 20 they took BCH to a new high in 2023.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.