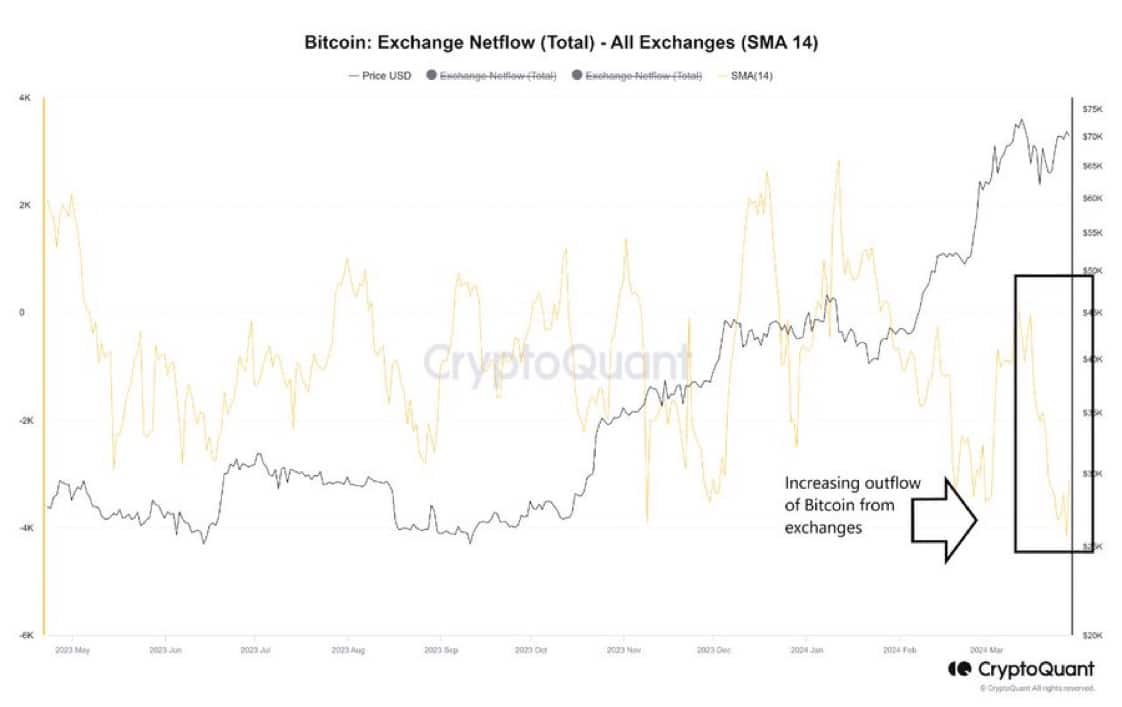

According to a recent data analysis by CryptoQuant, Bitcoin There is a record increase in withdrawal transactions. This trend marks a significant accumulation phase in the cryptocurrency market and indicates a notable shift in investor behavior. Notably, this increase follows a recent 10% decline in the market, indicating a potential cooling period.

Analysts and industry watchers speculate that the increased withdrawals could be due to a variety of factors. One prominent theory revolves around the upcoming Bitcoin halving event. Historically, before halving events, investors tend to accumulate Bitcoin in anticipation of future price increases. This model is supported by information from CryptoQuant reports that show a correlation between increased withdrawal activity and halving events.

Moreover, the increase in withdrawals underscores a growing sentiment among investors regarding Bitcoin’s long-term potential. Amid ongoing market fluctuations, the move towards accumulation crypto- It shows broader confidence in the durability and future prospects of money. The increase in withdrawals serves as a notable indicator of evolving market dynamics as investors position themselves for potential market shifts.

Reducing Leveraged Trading and Market Stability

In parallel with the increase in Bitcoin withdrawals, there has been a significant decrease in leveraged trading activities in the cryptocurrency market. Open positions on derivatives exchanges recorded a significant decline, falling from $18 billion to $14.2 billion. This decrease in leveraged trading signals the transition to a more stable market environment.

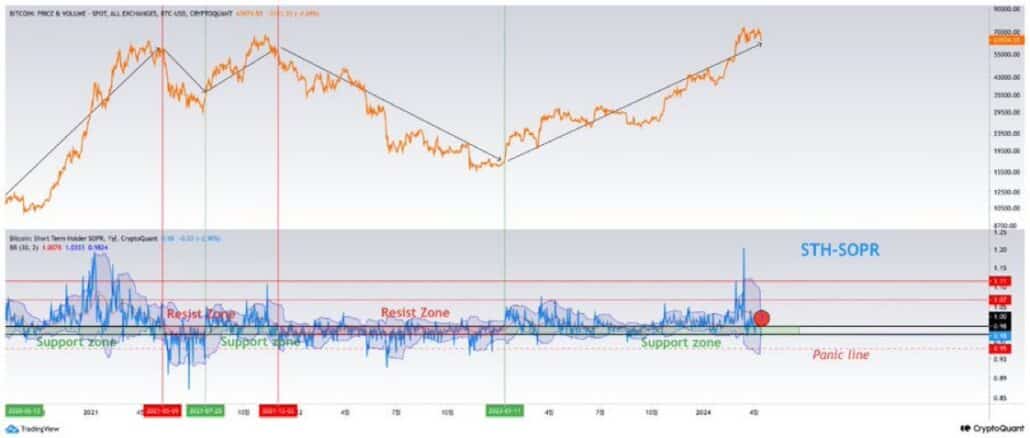

Analysts consider this decline in leveraged trading as a positive sign for the market to stabilize. After a period of increased volatility and trading activity, the decline in leveraged positions indicates a readjustment of market dynamics. Additionally, Bitcoin’s entry into the Short-Term Holder Spent Output Profit Ratio (STH SOPR) support zone further strengthens the notion that it could be a potential buying opportunity.

Historically, movements within the STH SOPR have served as leading indicators of market sentiment and price action. When short-term holders begin to sell their positions, this often precedes periods of price increases and highlights a potential shift in market dynamics.

Bitcoin Price Movement and Market Benchmarks

Despite the recent fluctuations in the market, the Bitcoin price experienced a modest increase, reaching $64,209.56, up 2.99%. However, trading volume experienced a significant decline, falling by 8.94% to $40.08 billion in the last 24 hours. This discrepancy between price movement and trading volume underscores the complexity of current market conditions.

As we reported as Koinfinans.com, despite the fluctuation in transaction volume, BTC continues to maintain a significant market value of $1.26 trillion. This resilience underscores Bitcoin’s enduring importance and significance within the broader cryptocurrency landscape. As market participants navigate evolving market dynamics, Bitcoin’s price action and market metrics serve as critical indicators of sentiment and investor behavior.