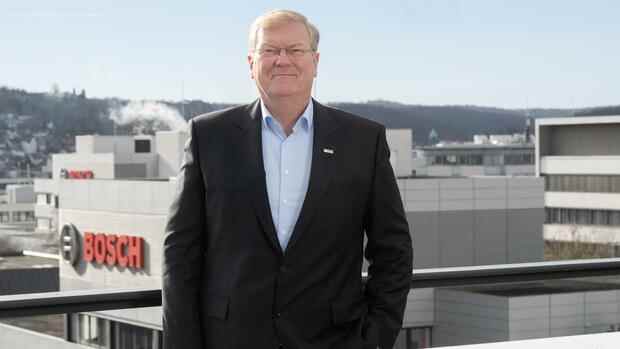

Stuttgart The new Bosch boss Stefan Hartung is not exactly considered a pessimist. At his first public appearance after almost 40 days in office, he remained true to his nature: “We are going into the new year with optimism,” said Hartung. However, conservative forecasts have a long tradition at Bosch. Even the new boss of the world’s largest auto supplier doesn’t break out.

“We expect an increase in sales for 2022,” explained Hartung on Tuesday evening at the traditional – but virtual for the second time in a row – start of the group and did not dare to go too far. The operating return should only be at the level of the previous year. The otherwise rather lively manager does not spread much momentum in this way.

The pandemic that has not yet been overcome, the supply bottlenecks that will continue for the whole year for chips, rising raw material and transport prices and high inflation cloud Hartung’s forecast. On the other hand, it is easier for him to surprise positively later with low goals in his first year. Newly appointed CEOs like to use this method.

Hartung’s agenda is clear. Connectivity, software, and artificial intelligence should characterize every Bosch product, making customers’ lives easier and more sustainable. He does not differ significantly from his predecessor Volkmar Denner. And in his 20 years at the company, Hartung has been heavily involved in the strategy.

Top jobs of the day

Find the best jobs now and

be notified by email.

As CEO, what matters to him now is that the 60 billion euros that Bosch has invested in research and development over the past decade now pay off more quickly. And not only in the mega-topics of electric mobility and autonomous driving, but also in the other areas of household appliances, power tools, building and industrial technology. In any case, Hartung does not have portfolio adjustments in mind at the moment: “All divisions have grown.”

In any case, the new Bosch boss can build on a solid foundation. In 2021, the group practically reached pre-pandemic levels. Sales rose from 71.6 to 78.8 billion euros, as the group announced on Wednesday. Earnings also increased from two to 3.2 billion euros.

However, if the return on sales remains the same as forecast, that also means that it will not be well above four percent for the fourth year in a row. However, according to its own specifications, the foundation group needs a return of more than seven percent in order to remain financially independent in the long term. Hartung announced that he would continue to strive for the goal.

The new head of finance, Markus Forschner, has not yet made a statement on the returns of the Mobility division. The aim is to show a positive return. But he could only say concrete things about the presentation of the balance sheet. In 2020, Bosch’s core division was still making a loss.

The meager returns are not only due to the pandemic and chip crisis, they point to the most important point in Hartung’s agenda: the huge efforts in the transformation to electromobility and autonomous driving are associated with high costs. The group hired 4,000 highly paid software developers last year. There are already 38,000 in total. Of these, 30,000 work in the mobility division. 1000 more positions are not yet filled in Germany alone.

Bosch invests billions in continuing education

Every tenth Bosch associate worldwide is now a software developer. The group has spent one billion euros on further training alone in the past five years, reported Personnel Manager Filiz Albrecht. Hundreds of skilled workers from combustion engine technology were retrained for use in electromobility, mechanical engineers became software developers. Bosch intends to continue investing in the workforce to a similar extent in the future.

“We see ourselves as the software house of mobility,” said Markus Heyn, head of the largest Bosch division. It is about a market of 200 billion euros in 2030. “Bosch will grow in this market at double-digit rates,” explained the manager. “Not least, we will benefit from the development of the car into an Internet node.” Tech giants such as Google, Apple and Sony are also entering the market.

Heyn has taken over the complete management of the core Mobility division from Stefan Hartung and thus a key position in the group. His internal adversary Harald Kröger left in December.

The group invests large sums in the further training of its employees.

(Photo: Reuters)

The company evening also showed how much Bosch boss Hartung relies on the manager. Heyn not only manages the largest division, but also has the most important strategic future project under its control with the cooperation with the VW software subsidiary Cariad, which was only announced in January.

The aim of the alliance is to bring partially and highly automated driving into widespread use. Specifically, it is about functions that allow the driver to take their hands off the steering wheel at times, right through to an autopilot that takes over all driving tasks on the freeway. The first market launches should be as early as 2023.

In the industry, closer cooperation between Europe’s largest car manufacturer and the world’s largest automotive supplier was actually expected earlier. However, CEO Hartung countered the assessment that Bosch was now rushing to help VW with practically finished developments because the Wolfsburg-based company had not been able to manage such systems: “Nothing is finished there. It’s a pretty tiring thing,” said the manager.

>> Read our comment here: Cooperating instead of dictating – VW needs a new way of dealing with suppliers

However, the importance of software goes far beyond the VW cooperation. “We want to set standards for the market that will also benefit other automakers,” said division head Heyn. The aim is to offer basic vehicle software, middleware, cloud services and development tools that can be used across the board.

Bosch already equips 200 million control units with its own software every year. In order to make these devices updateable, a powerful software platform is required, an operating system for the interaction of vehicle computers and cloud. “The car is getting a new brain, and we are concentrating our know-how on it,” said Heyn.

Alliance of Bosch and VW is doomed to success

Continental and ZF are also looking forward to the cooperation. Because at Volkswagen, the hardware from Continental has always come with the central computer. “Let’s see how that harmonizes,” says a high-ranking manager from the industry.

However, the alliance between VW and Bosch is doomed to success. Because if Bosch doesn’t make it with its army of software developers, then it would look bad for purely German solutions for a key competence for the future of the German automotive industry. In any case, Continental and ZF do not have such large resources.

However, Bosch and Volkswagen have something else in common. Both have grown rapidly in China in recent years and are becoming increasingly dependent on the Middle Kingdom. Bosch does not report any sales in China. But in Asia/Pacific, sales increased by twelve percent to 24.4 billion euros last year. At over a third of the group’s sales, that’s twice as much as in America.

More: The new Bosch boss is already setting the tone