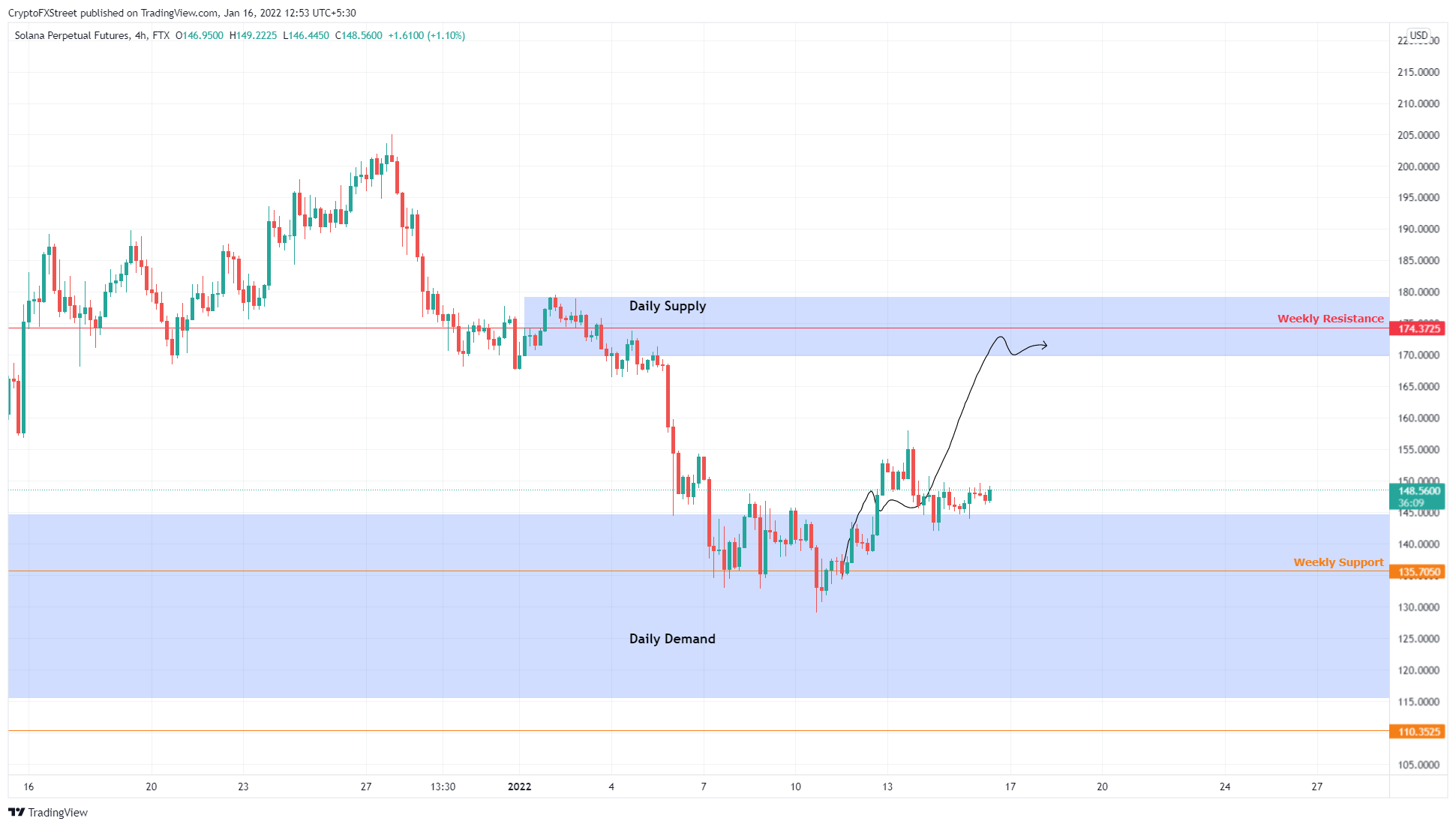

Solana priceIt managed to rally above the $115.5 to $144.7 demand zone, creating a bullish outlook. SOL continues to consolidate above this area to hit $174.3, up 15% post recovery.

However, a four-hour candlestick near the $115.5 barrier will invalidate the bullish argument and create a lower low.

If we look at the overall table Left (LEFT)is preparing for a rise, having managed to break through an important support barrier. The volatility squeeze shows that the uptrend for SOL will be fast.

Solana Price Ready to Rise

Solana price has bounced off the weekly support level at $135.7 three times since Jan 7th. The last retest of this barrier on January 11 led to a 17% rise. The move failed to continue and led to a retest of the daily demand zone from $115.5 to $144.7.

Consolidation appears to be in place as the SOL retests the aforementioned resistance, indicating a lack of volatility. Therefore, the emerging uptrend will be a fast, major uptrend that is present in the daily supply zone, retesting the weekly resistance level from $169.7 to $179.1 at $174.3.

In total, this increase would create a 16% rise from the current position at $149.1.

While searching for Solana price due to continued consolidation, the bulls’ lack of action will indicate a weakness. In this case, sellers can take control and push the SOL down to the weekly support at $135.7.

Due to the huge demand zone, there is a chance for buyers to come back and restart the uptrend. However, a four-hour candlestick near the $115.5 barrier would invalidate the bullish argument and create a lower bottom. In this case, Solana price could revisit the $110.3 support floor, where the bulls can rally and prepare for the next rebound.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.