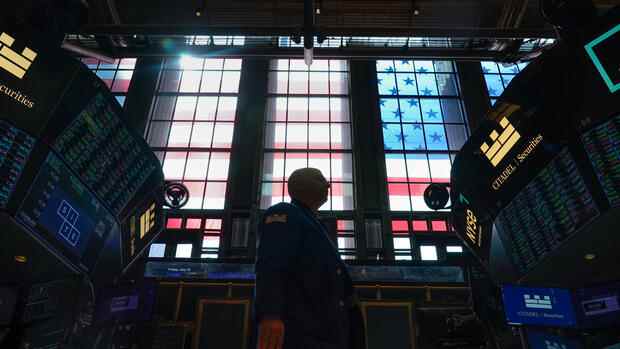

Has the US market reached the end of the correction yet?

(Photo: AP)

Dusseldorf Professional investors who are betting on falling prices for exchange-traded funds (ETF) on the US market are currently less aggressive than they were in May. As of July 8, these short sellers opened just $3 billion worth of new short bets on a 30-day view. This is the result of an analysis by the financial data provider S3 Partners. In May, new bets worth $20 billion were opened.

This trend also applies to individual stocks, but the informative value is stronger for ETFs. Because: “Institutional investors use short bets on ETFs as a hedge for the portfolio,” write the S3 analysts Ihor Dusaniwsky and Matthew Unterman. This applies above all to ETFs on the market-wide leading index S&P 500, the small-cap index Russel 2000 and the technology index Nasdaq.

>> Read about this: Signs of an end to falling prices? Short sellers open fewer new bets

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue