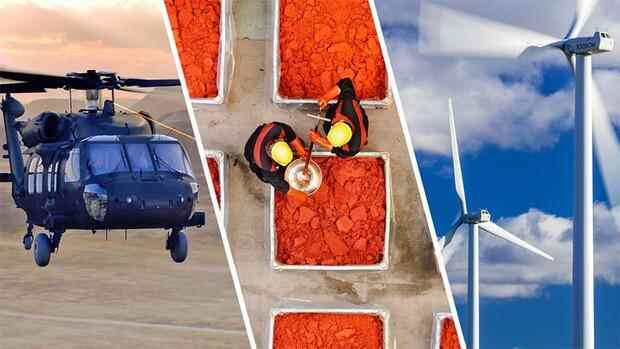

The Ukraine war has given many areas of the stock market a new direction.

(Photo: AP)

Dusseldorf The Ukraine war surprised the stock markets – including hedge funds that are betting on falling prices. “Some were caught on the wrong foot,” says Ivan Ćosović from Breakout Point. The financial data provider analyzes the behavior of hedge funds, also known as short sellers.

Data from Breakout Point and from the Federal Gazette, where short sellers have to publish their positions, show that short sellers have therefore massively rebalanced their bets in recent weeks: 130 adjustments to short bets have been reported in the Federal Gazette since the Russian invasion of Ukraine.

These changes are meaningful, says Volker Brühl, Managing Director of the Center for Financial Studies at Frankfurt’s Goethe University: “They are an interesting indicator because they show the market’s expectations as to which stocks could tend to benefit from the chaos and which could suffer more. “

Here are the key insights that investors can draw from short bets.

Top jobs of the day

Find the best jobs now and

be notified by email.

Energy: Short squeeze on Nordex shares

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

further

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

further