After a decade of silence, a significant Bitcoin whale has returned to activity, attracting the attention of the cryptocurrency community. This whale, who has 1,701 BTC worth an impressive $115.42 million in total, reactivated his wallet, sparking speculation. He recently transferred 246 BTC (worth $16.73 million) to two separate wallets, increasing the mystery surrounding these actions and raising questions about his intentions and potential impact on the market.

Whale made two important transactions in his recent activities: He sent 50 BTC to 1PR…jRo and 195.98 BTC to bc1…rk7. These transactions provide clues to the movement of funds after the whale’s prolonged inactivity. Notably, historical data shows that the whale acquired 4,272 BTC in 2013 and purchased them at an average price of $29.39. This context provides insight into the whale’s significant holdings and its potential impact on the cryptocurrency ecosystem.

Gabor Gurbacs, one of VanEck’s advisors, expressed his views on this situation, emphasizing the importance of the reemergence of old Bitcoin wallets that have been dormant for a long time. Gurbacs’ statements, cryptocurrency highlights the evolving nature of its environment and Bitcoin’s ongoing appeal as a store of value.

Bitcoin Whale Accumulation Before Halving

Despite recent market volatility and the upcoming BTC halving, Bitcoin whales are actively accumulating a significant amount of BTC. This accumulation trend shows that bullish sentiment prevails among large investors, especially as the fourth BTC halving approaches. At a time when miner rewards are set to decrease, whales appear to be positioning for potential future gains in the cryptocurrency market.

Analysis of whale activity reveals that major stakeholders who own large amounts of BTC (ranging from 100 to 100 thousand BTC) have accumulated a total of 319,310 BTC in the last three months. In comparison, wallets holding smaller amounts of BTC (0-100 BTC) disposed of 105,260 BTC in the same period. This difference in accumulation patterns highlights a strategic shift among larger holders who are confident in Bitcoin’s long-term value proposition.

Whales’ accumulation of BTC before the halving may have important consequences for market dynamics. This reflects confidence in Bitcoin’s future trajectory despite short-term price fluctuations. It is thought that whales are expecting a positive outcome from the halving, which could lead to increased scarcity and upward pressure on prices in the long run. This movement of whales is considered an important indicator that can affect the value of Bitcoin and the supply-demand balance in the long term.

Bitcoin Price Analysis Amid Whale Activity

Koinfinans.com As we reported, the price of BTC is hovering around $67,929.05 with ongoing fluctuations. The cryptocurrency maintains its strong position, supported by a 24-hour trading volume of $24,792,215,550.

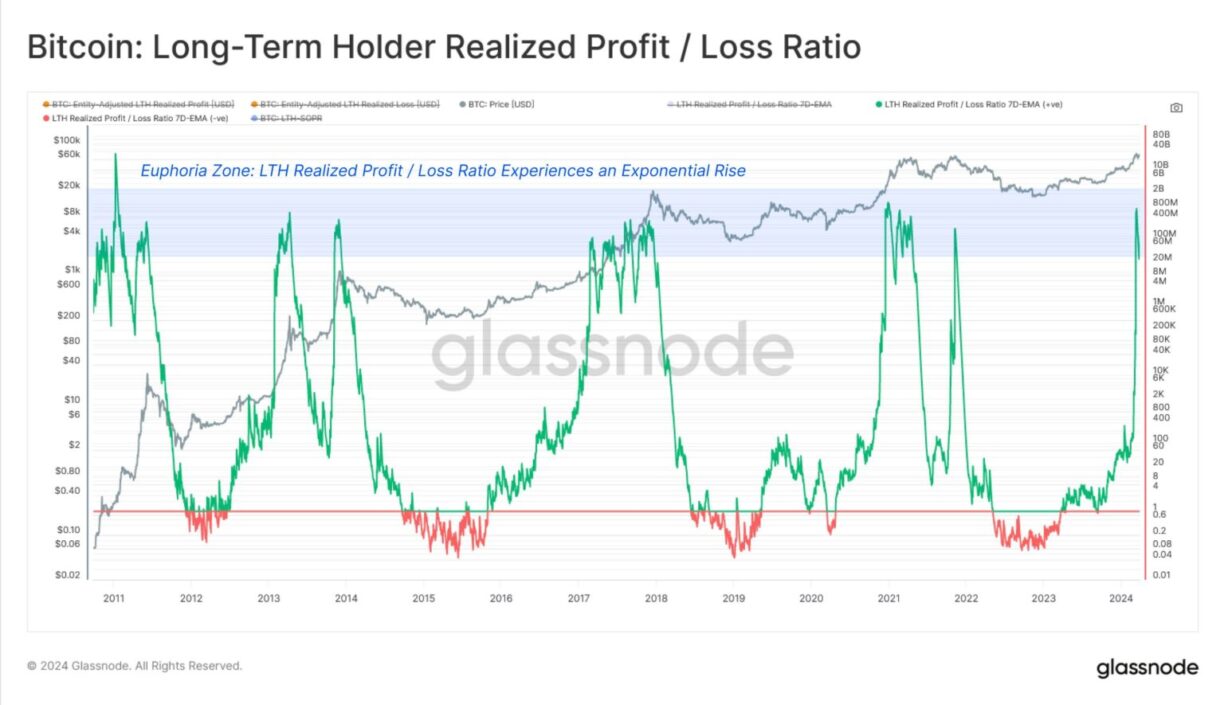

Glassnode data shows a significant increase in the realized profit/loss ratio among long-term holders. This indicates a tendency for profit-taking behavior in response to recent market conditions.

Analysis of long-term holders’ profit-taking behavior provides valuable information about market sentiment and investor psychology. Whales benefiting from recent price increases are creating a significant impact on market dynamics, with potential impacts on future price movements.

In addition, recent announcements regarding the sale of Silk Road BTC seized by US government authorities have brought additional uncertainty to the market. This has led to cautious trading behavior among investors and created extra uncertainty in the market.