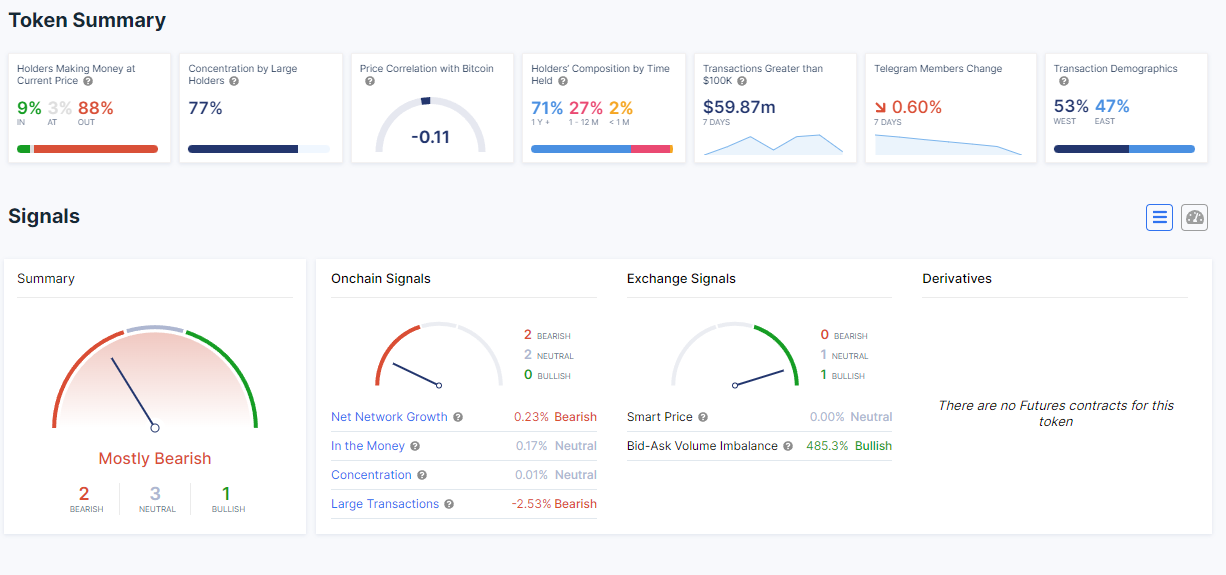

Shiba Inu It recently displayed a staggering 485% dominance on the buy side, as demonstrated by the Bid-Ask Volume Imbalance. This metric measures the difference between the volume of buy orders (bids) and sell orders (asks) in the order book. Additionally, an imbalance of 485% strongly indicates that buying pressure significantly outweighs selling pressure.

So what does this mean for SHIB? Could this be a sign of an imminent comeback? First, it is very important to understand that Trading Volume Imbalance is a volatile metric that can change quickly. A 485% imbalance in favor of the bulls is undoubtedly a strong signal. However, it is important to approach these data with caution.

Koinfinans.com As we reported, such a high imbalance could be the result of a variety of factors, including market sentiment or even manipulation. Therefore, it is not recommended to make investment decisions based solely on this metric.

However, the imbalance indicates a strong interest in purchasing the Shiba Inu at the current price level at a particular point in time. This could be a sign that investors see value in SHIB at its current price. Additionally, it could potentially set the stage for a price reversal. However, it is important to consider other on-chain metrics to get a more comprehensive view of the asset’s health.

Network activity, transaction activity in major wallets, and fund movements are generally more reliable indicators of an asset’s growth or decline potential. These metrics provide a more holistic view of investor behavior and market dynamics, which is crucial for making informed investments.

A remarkable statistic is the 485% Bid-Ask Volume Imbalance in favor of SHIB bulls. But it is not in itself an indicator of an imminent price reversal. Investors should consider a number of on-chain metrics and market indicators before making any investment decisions.