Treasury and Finance Minister Nureddin Nebati said in the past weeks that a tax assessment will be made instead of the SCT reduction. This week, it is stated that it will take place on December 1st. However, contrary to expectations, the regulation entered into force with the President’s Decision published in the Official Gazette at midnight tonight.

SCT tax regulation came earlier than expected!

Treasury and Finance Minister Nureddin Nebati said earlier this month that the expectation of tax cuts on new cars is unrealistic. However, they were happy to buy new cars by saying that they would make a special tax assessment in the past few days.

He even stated that it will come into effect as of December 1st. After this announcement, we saw that new car orders were canceled and the market came to a standstill. However, unexpectedly, with the Official Gazette published on 24 November 2022, the new SCT tax regulation came into effect.

Former base rates

- Engine displacement not exceeding 1600 cc

- SCT base 120 thousand TLnot exceeding – 45 percent

- SCT base 120 thousand TLover the 150 thousand TLnot exceeding – 50 percent

- SCT base 150 thousand TLover the 175 thousand TLnot exceeding – 60 percent

- SCT base 175 thousand TLover the 200 thousand TLnot exceeding – 70 percent

- Others – 80 percent

- Engine displacement above 1600 cc and below 2000 cc

- SCT base 130 thousand TLnot exceeding – 45 percent

- SCT base 130 thousand TLsurpassing, 210 thousand TLnot exceeding – 50 percent

- Others – 80 percent

- Vehicles with an engine displacement of more than 2000 cc:

- No excise tax base limit: 220 percent

- Only electric motor cars SCT base rates:

- Engine power not exceeding 160 kW

- SCT base 700 thousand TLnot exceeding – 10 per cent

- Others- 40 percent

- Engine power exceeding 160 kW

- SCT base 750 thousand TLnot exceeding – 50 percent

- Others – 60 percent

- Engine power not exceeding 160 kW

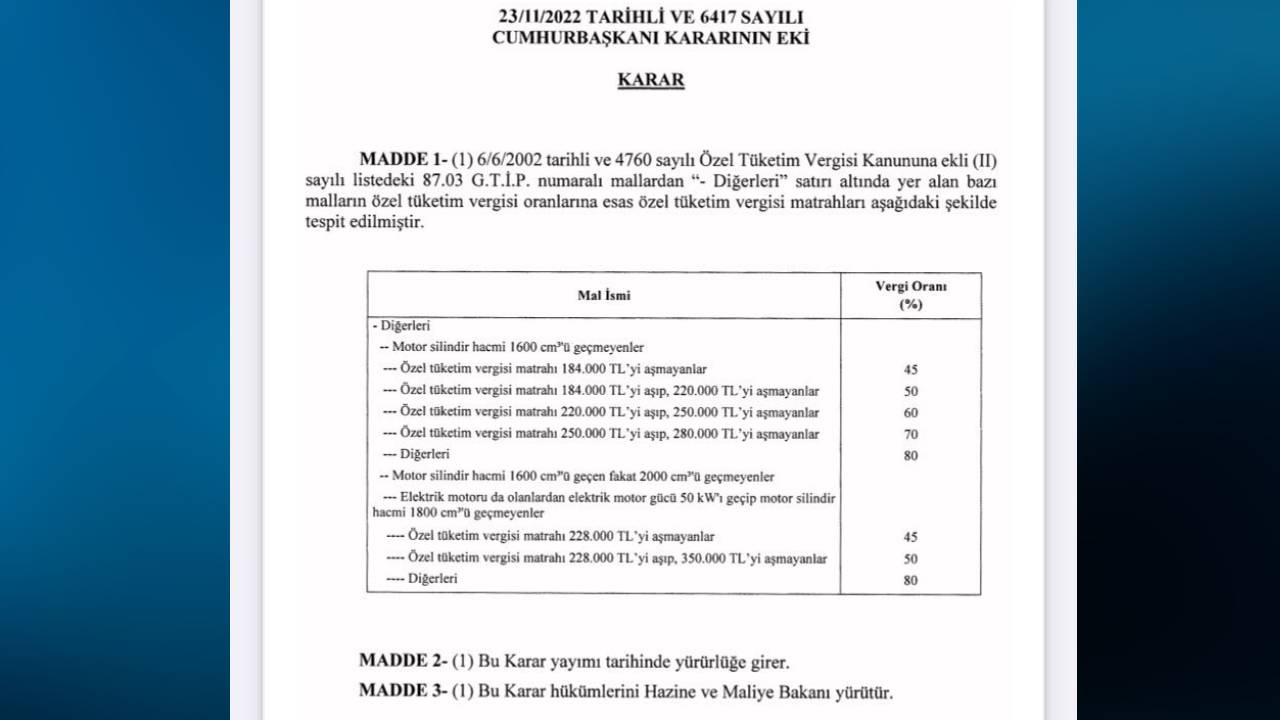

New base rates

- Engine displacement not exceeding 1600 cc

- SCT base 184 thousand TLnot exceeding – 45 percent

- SCT base 184 thousand over TL 220 thousand TLnot exceeding – 50 percent

- SCT base 220 thousand TLover the 250 thousand TLnot exceeding – 60 percent

- SCT base 250 thousand TLover the 280 thousand TLnot exceeding – 70 percent

- Others – 80 percent

- Engine displacement above 1600 cc and below 2000 cc

- SCT base 228 thousand TLnot exceeding – 45 percent

- SCT base 228 thousand TLsurpassing, 350 thousand TLnot exceeding – 50 percent

- Others – 80 percent

- Vehicles with an engine displacement of more than 2000 cc:

- No excise tax base limit: 220 percent

- Only electric motor cars SCT base rates:

- Engine power not exceeding 160 kW

- SCT base 700 thousand TLnot exceeding – 10 per cent

- Others- 40 percent

- Engine power exceeding 160 kW

- SCT base 750 thousand TLnot exceeding – 50 percent

- Others – 60 percent

- Engine power not exceeding 160 kW

If we calculate roughly how much cheaper new cars will be over the sales price after this change; The price of cars up to 347 thousand TL will decrease by close to 10 percent and fall below 315 thousand TL.

Automobiles up to 467 thousand TL fell under 390 thousand TL with a price decrease of close to 17 percent, cars up to 531 thousand TL fell under 472 thousand TL with a decrease of 11 percent, and automobiles up to 594 thousand TL decreased by approximately 17 percent. It will be sold under 561 thousand TL with a price decrease of close to 6.

When we look at hybrid cars, those up to 484 thousand TL will be sold for 390 thousand TL with a decrease of nearly 20 percent, and those up to 743 thousand TL will be sold for less than 620 thousand TL with a decrease of 17 percent.

What do you think about this subject? Don’t forget to share your views with us in the comments!