Santiment said that while Bitcoin (BTC) is trading around $30,000, some altcoin He stated that ‘s experienced mini explosions.

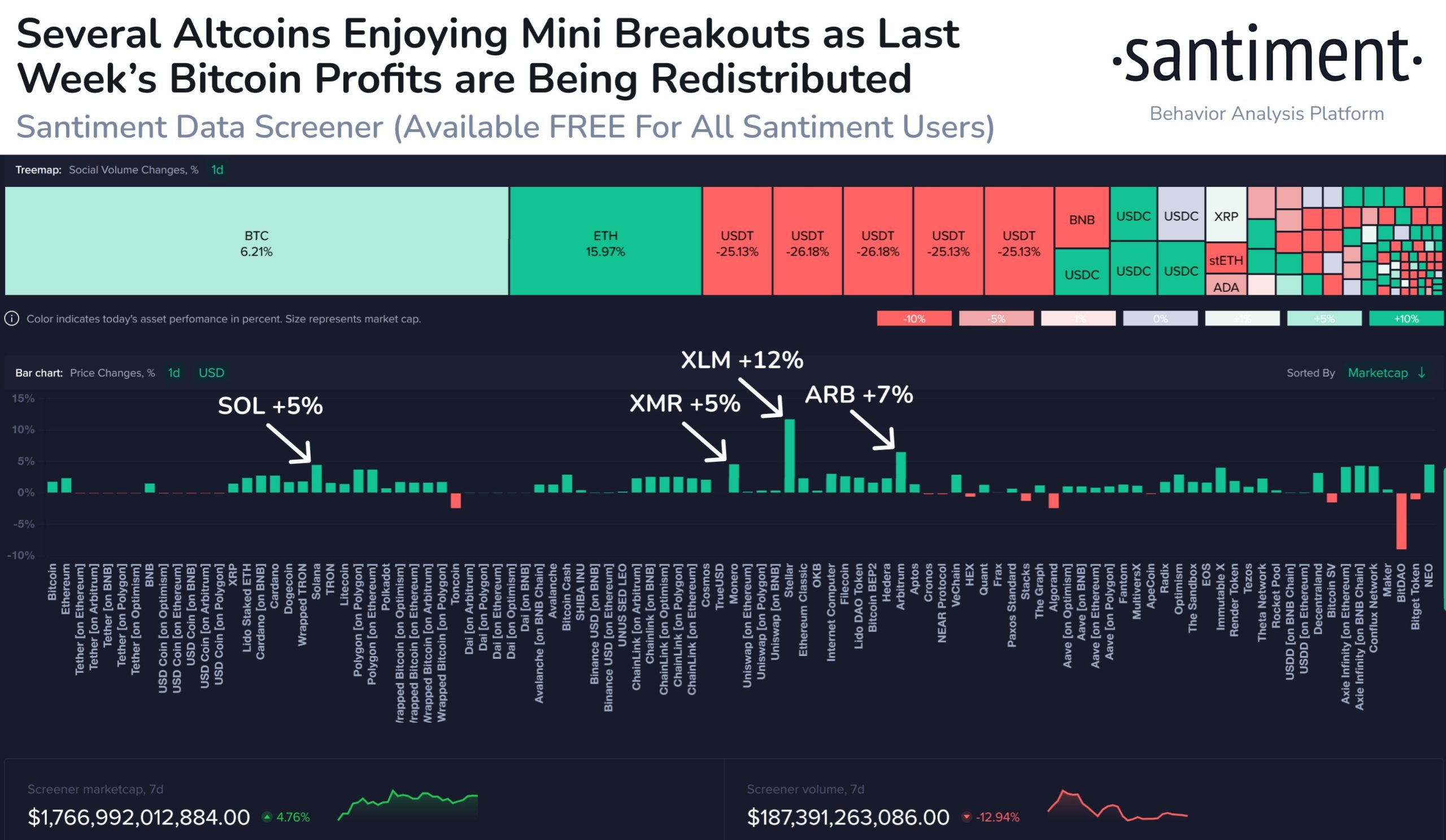

According to Santiment, Solana (SOL), Arbitrum (ARB), Monero (XMR) and XRP rival Stellar (XLM) are taking advantage of the redistribution of profits from Bitcoin’s recent rally and the excitement around the latest spot Bitcoin exchange-traded fund (ETF) filings. succeeded.

As Bitcoin continues its week-long rise between $29,000 and $31,000, altcoins are showing signs of benefiting from profit distributions from BTC’s rise. ETF applications also triggered a recovery in the market.

Santiment noted that XLM recorded the biggest rally at 12%, followed by ARB at 7% and both SOL and XMR at 5%.

Koinfinans.com As we reported, Stellar is trading at $0.10 at the time of writing, up 18.3% in the last seven days. Ethereum (ETH) scaling solution Arbitrum is trading at $1.14 at the time of writing, up 2% in the last seven days.

Solana was up 4.8% in the last seven days to trade at $17.76, while Monero was up 8% in the last seven days at $163.28 at the time of writing.

Santiment also noted that deep-pocketed investors carried massive amounts of altcoins on Wednesday, making it one of the three best days for whale trading so far in 2023.

With altcoins becoming significantly more volatile in the past week, data shows several assets are seeing massive transfers of $10M+ worth today, easily making it the three highest whale movement days of the year. Keep an eye on MATIC, CHZ, CRV and even USDT.

centimeter, many cryptocurrency The trader started this week with a bearish bias, which is a historical indicator that the market is going to be bullish.

After the crypto markets peaked last Friday, traders came to the beginning of the week with the expectation that prices will continue to pull back and offer buying opportunities at the $27,000-$29,000 level. A higher bearish bias makes it more likely to rise further.

You can follow the current price action here.