Bitcoin, which rose to $ 68560 during the day, fell below $ 67,000 with the opening of the US stock markets.

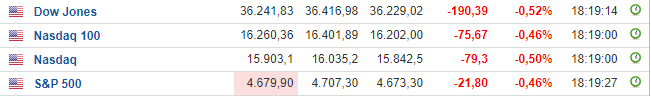

Although there was some reaction after the losses reached 1% in the NASDAQ, which includes technology stocks, we see that the seller pressure in the indices continues.

The hard sell in US indices also affected gold and silver. With the opening, losses in silver rose above 1.5%, while gold fell to $1823 an ounce.

We observe that the pullback on the Bitcoin side has recovered in a short time and the price has managed to rise above $67,000 again.

At this point, investors will keep an eye on US indices. On this side, we can see that there are also pullbacks in Bitcoin and altcoins if the sales harden.

In the short term, we will watch whether the 4-hour close will be above $66900. We observe a negative divergence in RSI, if it works, pullbacks to $64,000 should be considered reasonable.

At this point, we would like to remind you that many negative mismatches did not work during the 2020-2021 rally of Bitcoin and that the mismatch continues for a long time.

Although the selling pressure in the USA appeared to be the reason for this short-term fluctuation, we mentioned in our analysis on October 17 that Bitcoin could eat some sales at $ 68500. You can read the analysis below to reach that analysis we made according to Bitcoin’s logarithmic waves and to learn about our current price range.

*Not Investment Advice.