SBI Holdings, one of Ripple Labs’ major partners in Japan, established a partnership with Saudi Aramco. Saudi Aramco is the second largest company in the world in terms of market value. This partnership focuses on SBI’s digital asset investment and support of crypto startups. Thus, it marks an important step in its strategic expansion into the Middle East.

Ripple partner SBI Holdings expands tech reach in Asia

SBI Holdings reached an agreement with Saudi Arabia’s giant company Saudi Aramco. Under the partnership, they will establish a new initiative to promote the growth of digital assets and related initiatives. This collaboration is in line with SBI’s broader vision of embracing digital transformation in financial services. The alliance will leverage Saudi Aramco’s significant presence in the market and SBI’s expertise in digital finance. Thus, it will create a formidable force in the digital asset landscape.

The partnership focuses on digital assets. It also includes the construction of semiconductor factories in Saudi Arabia and Japan. This move shows SBI’s determination to diversify its portfolio and enter the lucrative semiconductor industry. Moreover, it further solidifies its leading position in technological innovation. Ripple partner SBI Group’s recent activities reveal a determined effort to expand its influence in the Middle East and Asia. The collaboration with Taiwan-based Power Crystal Manufacturing in semiconductor manufacturing underscores SBI’s commitment to technological advancement and its strategic position in key global markets.

Additionally, SBI has also formed an alliance with Circle, which issues the USDC stablecoin. This collaboration underscores Japan’s commitment to modernizing its financial environment. Additionally, the partnership aims to increase the use of USDC in Asia following Japan’s regulatory adoption of stablecoins. The Japanese government’s revision of the Payment Services Act clearly demonstrates its intention to integrate stablecoins into its economy. This is a move that Ripple partner SBI is keen to capitalize on.

SBI leads digital transformation of traditional finance

This series of partnerships by SBI Holdings marks a significant shift in the global financial ecosystem, where traditional financial giants are increasingly engaging with the digital asset sector. The collaboration with Saudi Aramco, in particular, is evidence of the growing recognition of the potential of digital assets in mainstream finance.

SBI supports Japanese crypto startups looking to enter the Saudi market. Thus, it not only promotes international business growth but also contributes to the global expansion of the digital asset industry. Experts expect this move to bring new innovation and dynamism to the sector.

Saudi Arabia and crypto

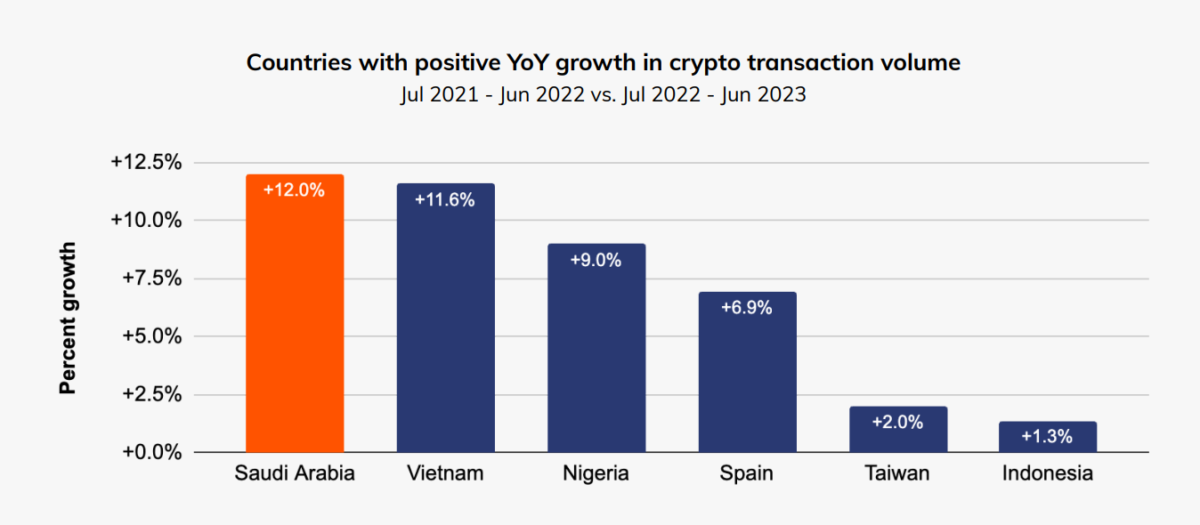

Meanwhile, Saudi Arabia aims to become a major crypto hub in the Middle East. Accordingly, according to an annual report published earlier in the year, it topped the relevant lists as the country with the highest crypto transaction volume in a 12-month period between July 2022 and June 2023. Notably, the kingdom led globally with a 12% year-over-year (YoY) crypto transaction volume increase, reaching nearly $31 billion from July 2022 to June 2023, compared to the same period from 2021 to 2022. Vietnam comes in second place with 11.6%. Nigeria ranks third with 9% and Spain ranks fourth with 6.9%.

On top of this, Chainalysis’ annual report since 2019 identified the Middle East and North Africa (MENA) region as having the world’s sixth-largest crypto economy, worth $390 billion from July 2022 to June 2023. However, it still lagged behind leading regions such as North America and Western Europe.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!