Bitcoin (BTC) has shown significant consolidation recently, with its price oscillating between $69,000 and $64,000 for a week, marking a period of quiet volatility. This change contrasts with Bitcoin’s usual high volatility, which indicates a stagnation phase despite being traditionally viewed as a high-growth asset.

Market watchers and crypto enthusiasts, especially cryptocurrency The unit closely followed Bitcoin’s movements as it hovered near key resistance levels. The views of Captain Faibik, one of the important names of the crypto world, say that Bitcoin is on the verge of a potential breakout, provided that it exceeds the $ 70 thousand resistance level. is showing.

$BTC is Bouncing back Nicely but still Consolidating within the Triangle.

Bulls must Clear the 70k Resistance area to Confirm the upside Breakout.#Crypto #Bitcoin #BTC pic.twitter.com/NxAz8Y1ktq

NEWS CONTINUES BELOW— Captain Faibik (@CryptoFaibik) April 5, 2024

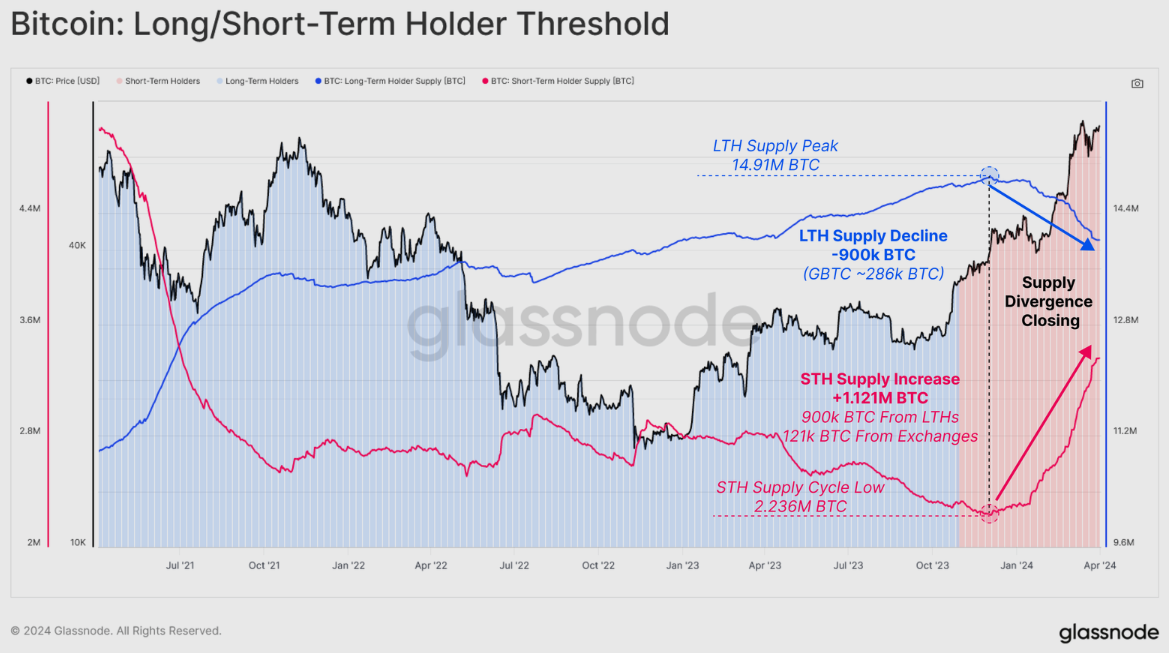

This perspective is consistent with the expectation of a broader increase in volatility that could redefine the current market landscape. A recently published Glassnode report adds depth to the analysis of Bitcoin’s market position by shedding light on the fundamentals of this trend. The report highlights a significant shift in Bitcoin supply dynamics as evidenced by on-chain data.

In particular, the report provides important insight into the market behavior of the cryptocurrency, revealing that the idle BTC supply has been reactivated after an unprecedented period of tightness. The gap between Long Term Holder (LTH) supply and Short Term Holder (STH) supply is narrowing. This is a phenomenon typically observed as prices rise and unrealized gains persuade LTHs to sell.

Since December 2023, LTH supply has decreased significantly, falling by 900,000 BTC from its peak of 14.91 million BTC. Notably, outflows from the GBTC trust account for approximately one-third of this decrease, accounting for approximately 286,000 BTC.

Meanwhile, STH supply increased by 1,121 million BTC, not only absorbing the distributed LTH supply but also adding another 121,000 BTC from secondary market purchases via exchanges.

This shift from long-term holdings to more speculative behavior indicates a changing landscape in the Bitcoin ecosystem. The report’s analysis of the ratio between LTH and STH supplies also supports this transition and points to a broader trend towards distribution, profit-taking and speculation during macro uptrends.