FTX and Alameda Alameda was known to run FTX’s venture capital division.

The Financial Times published a report claiming that Alameda Research had accessed its entire private equity portfolio.

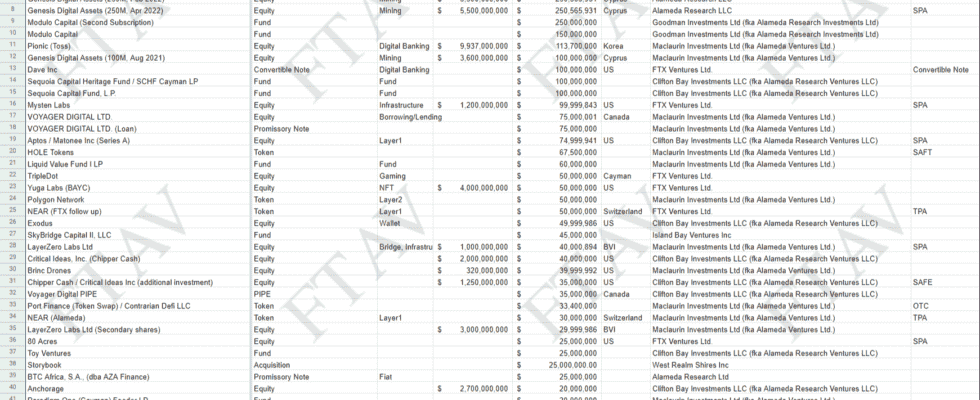

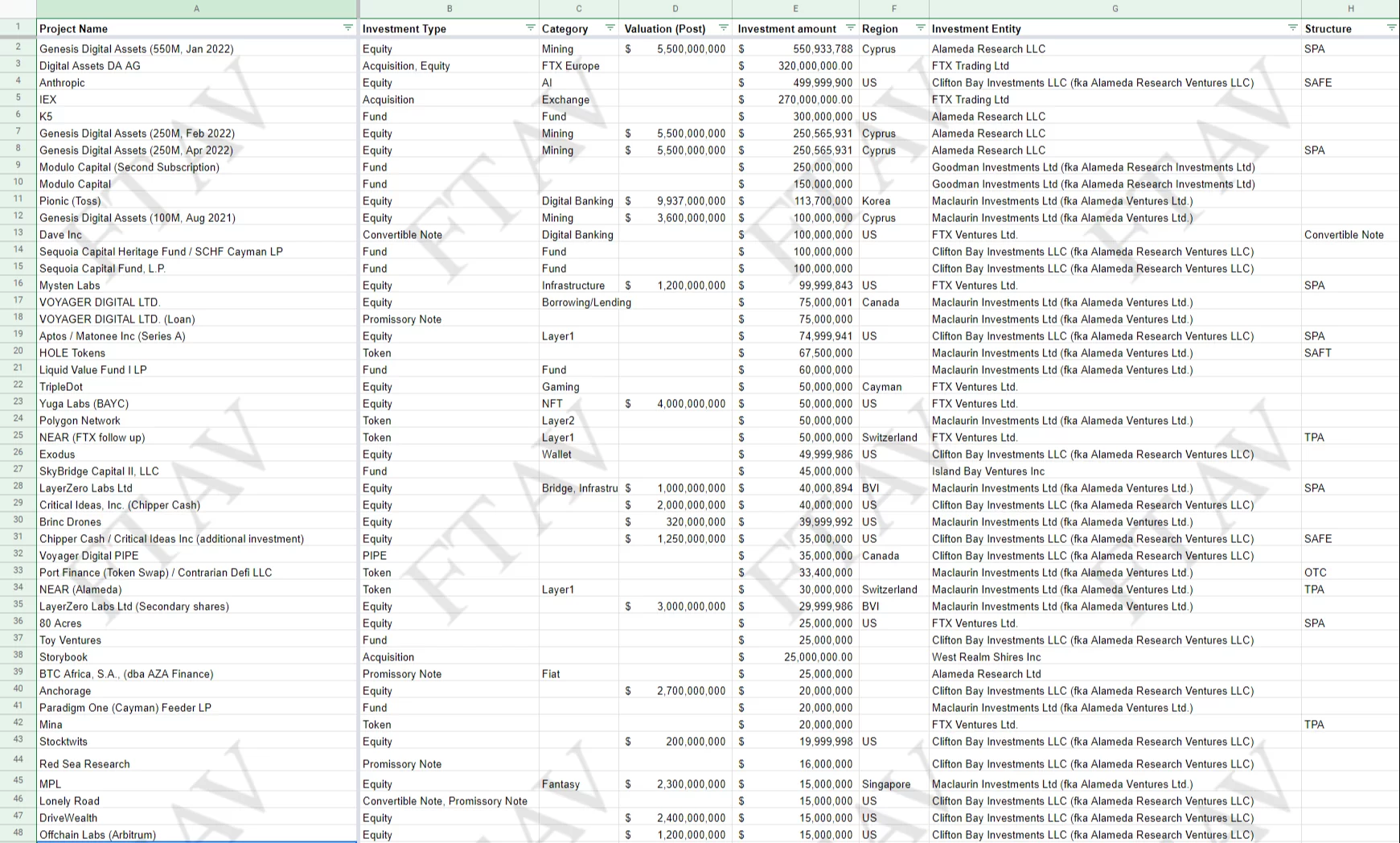

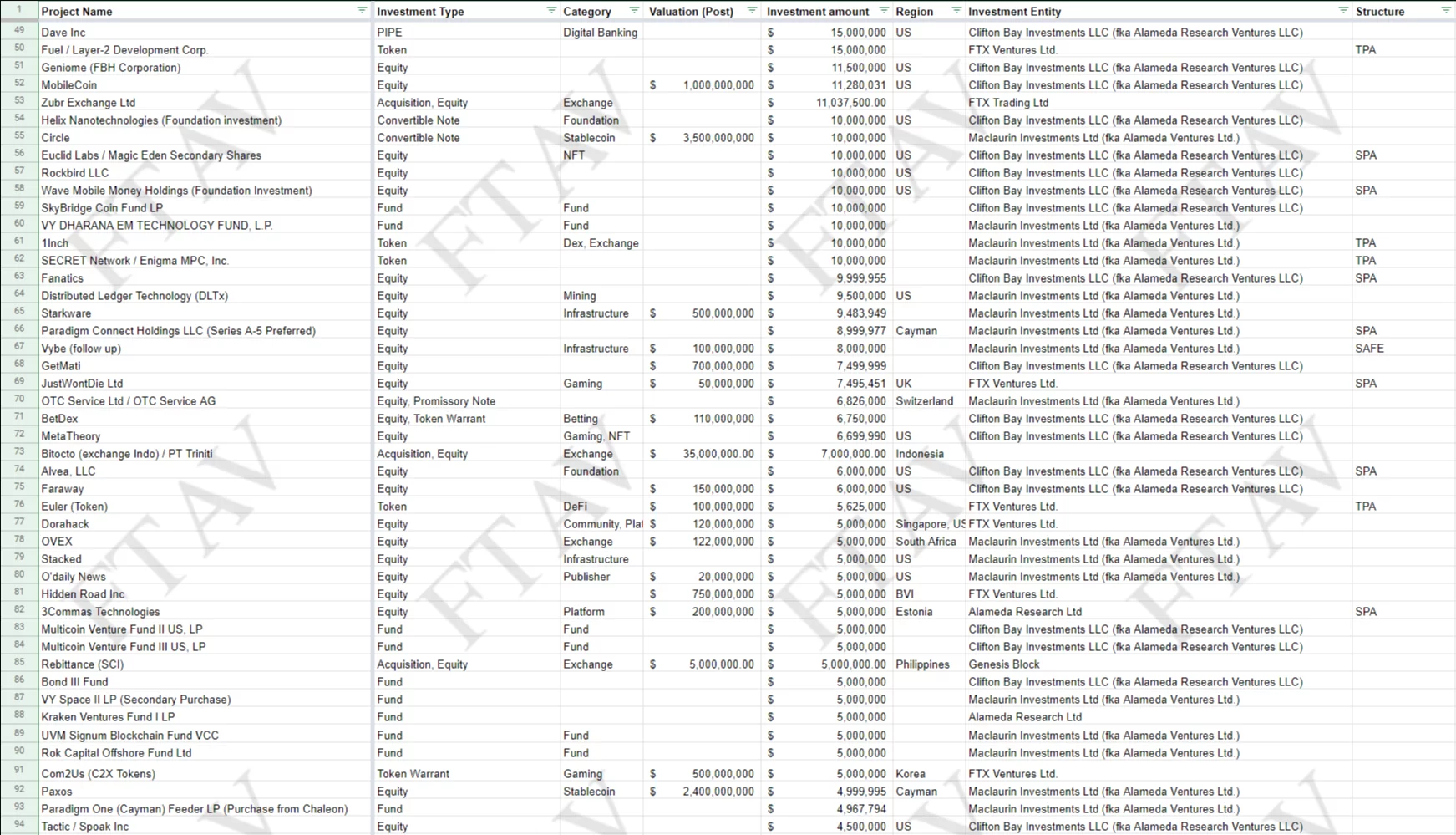

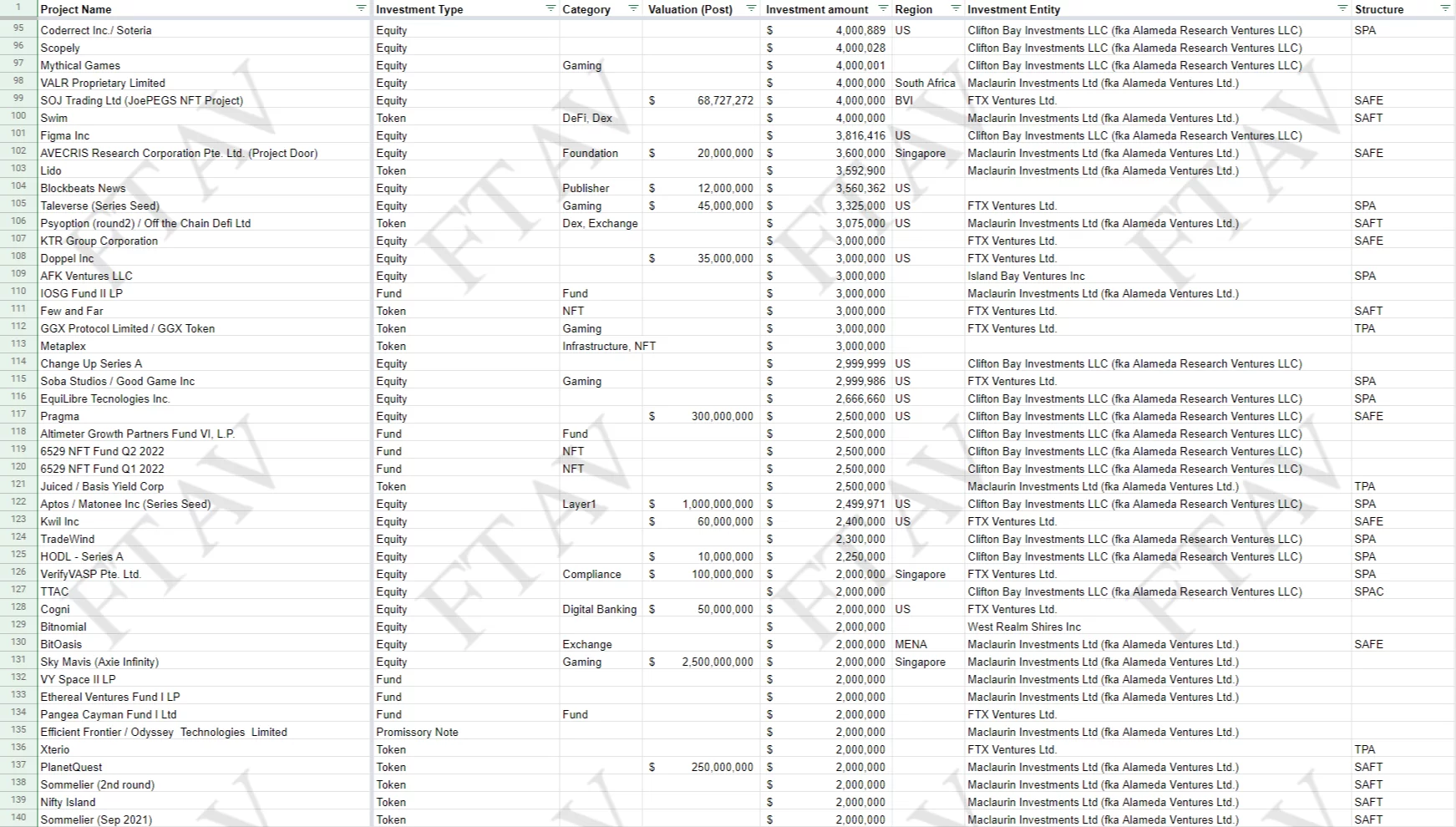

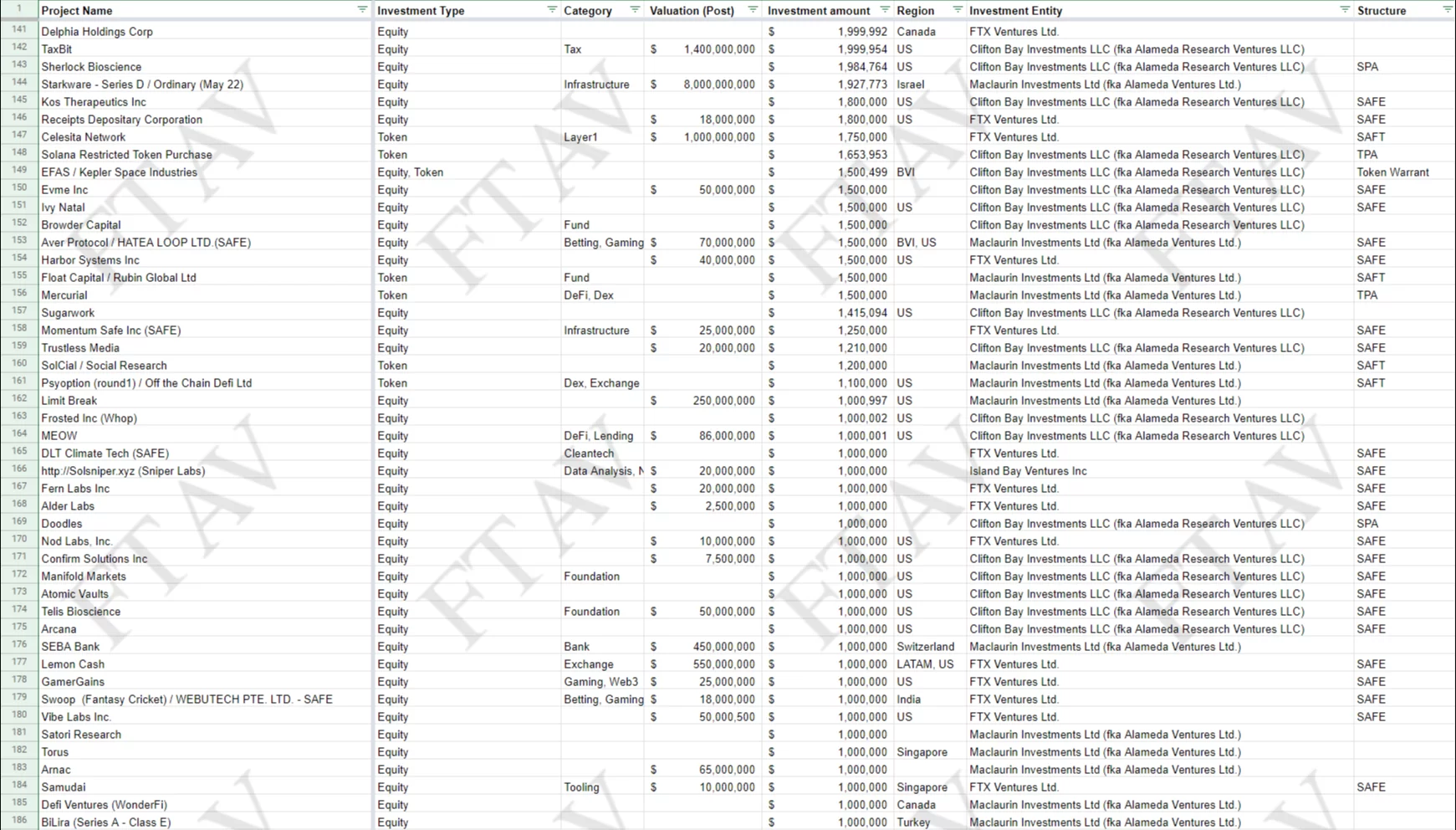

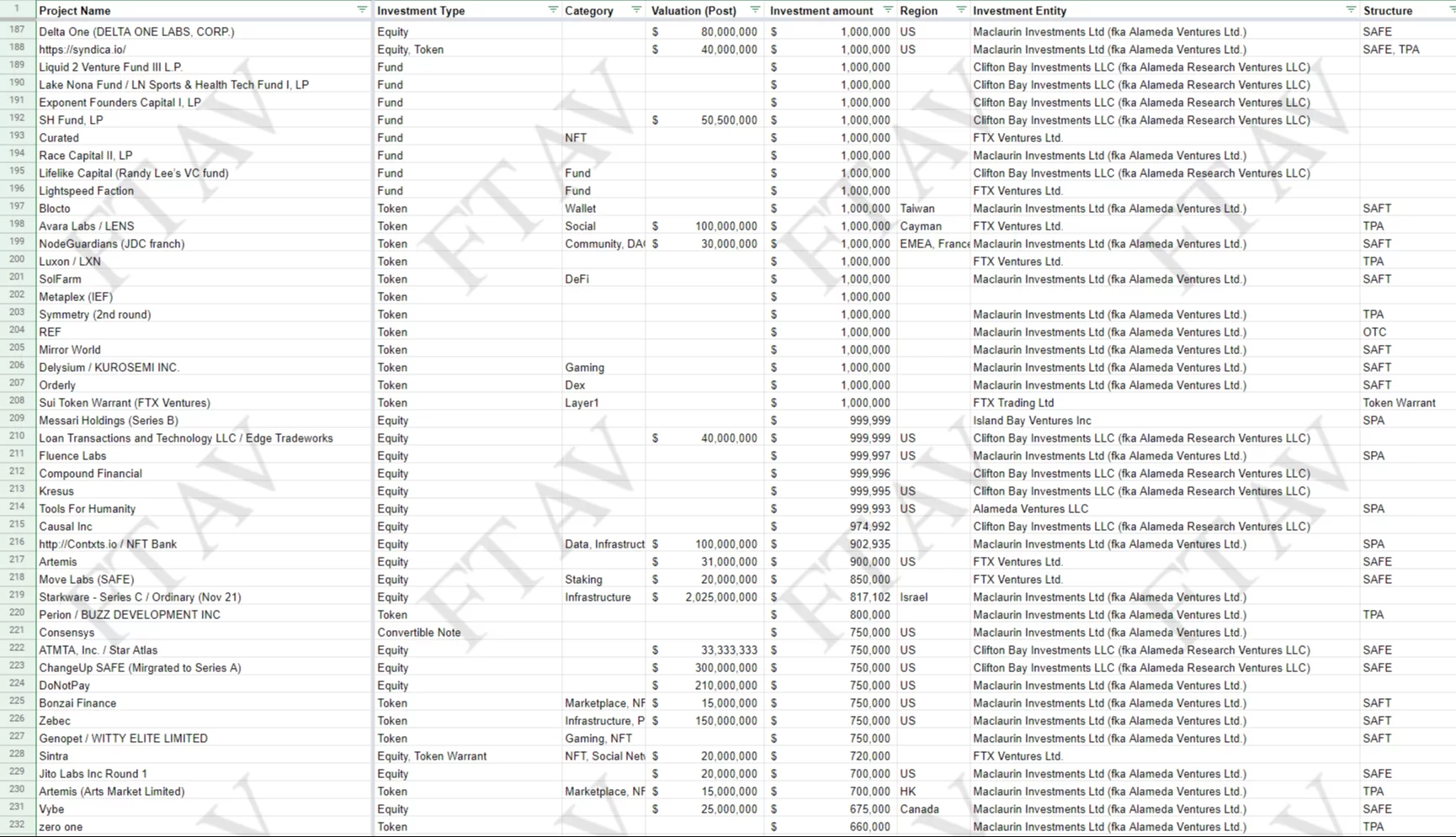

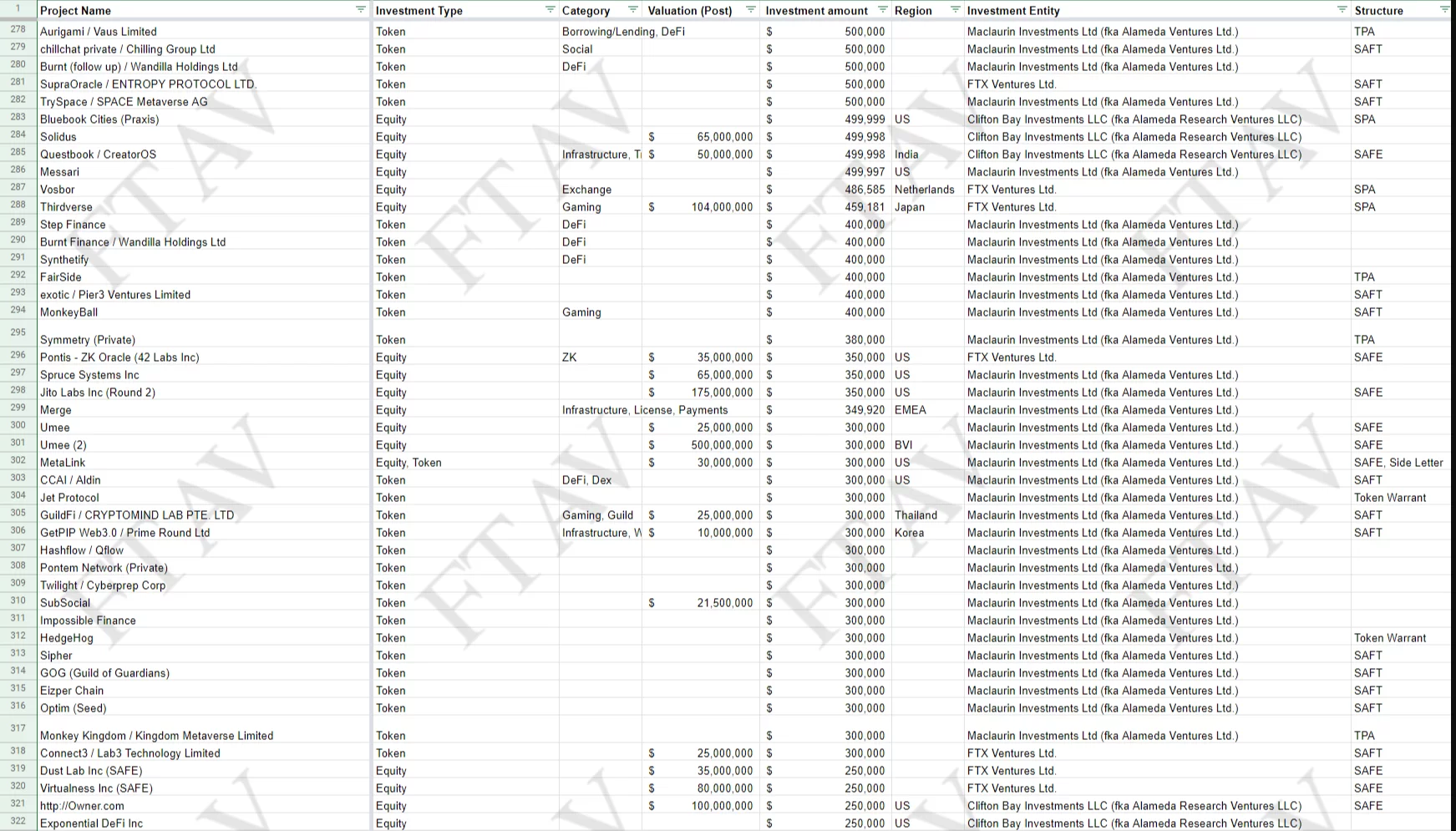

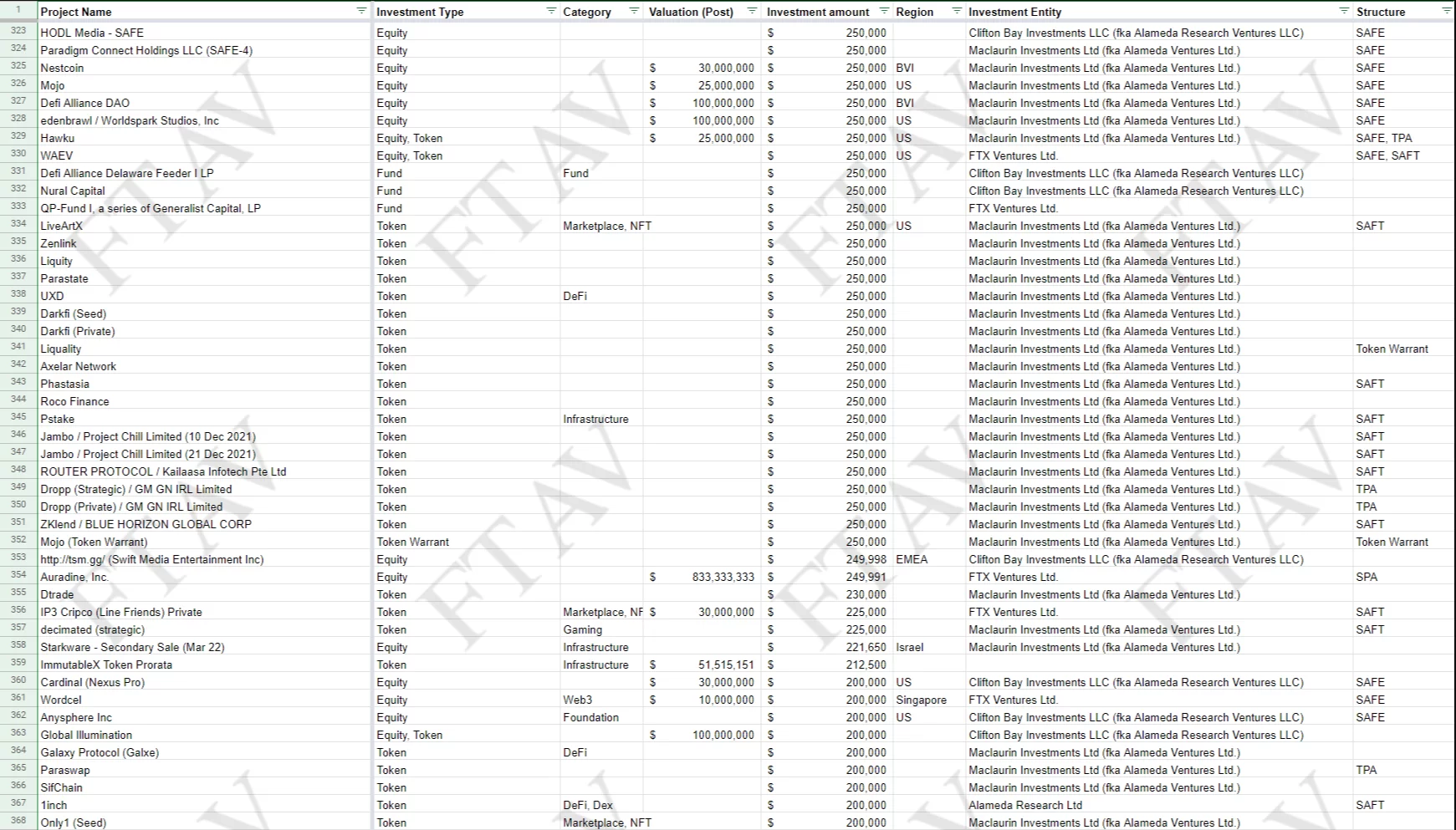

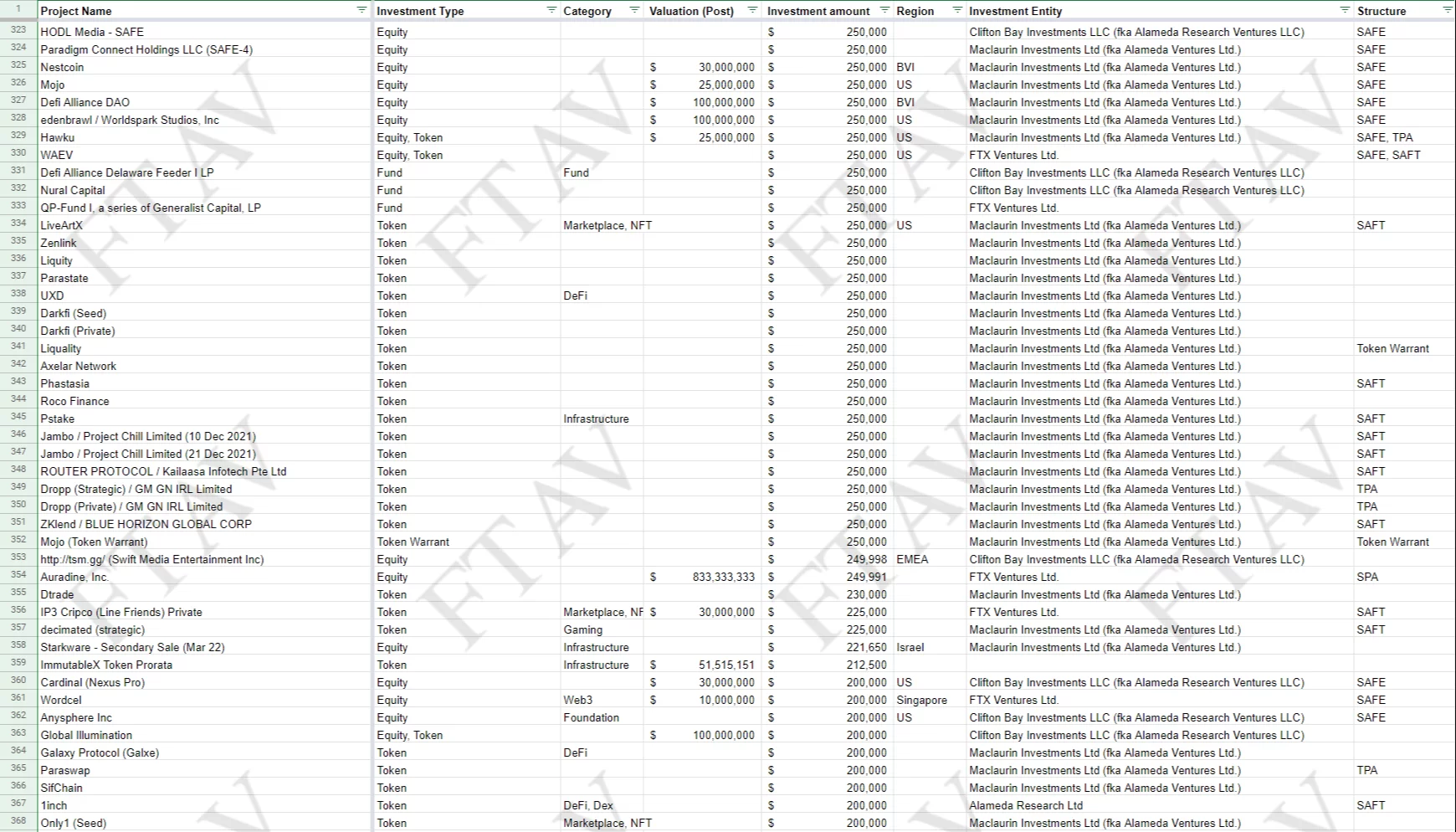

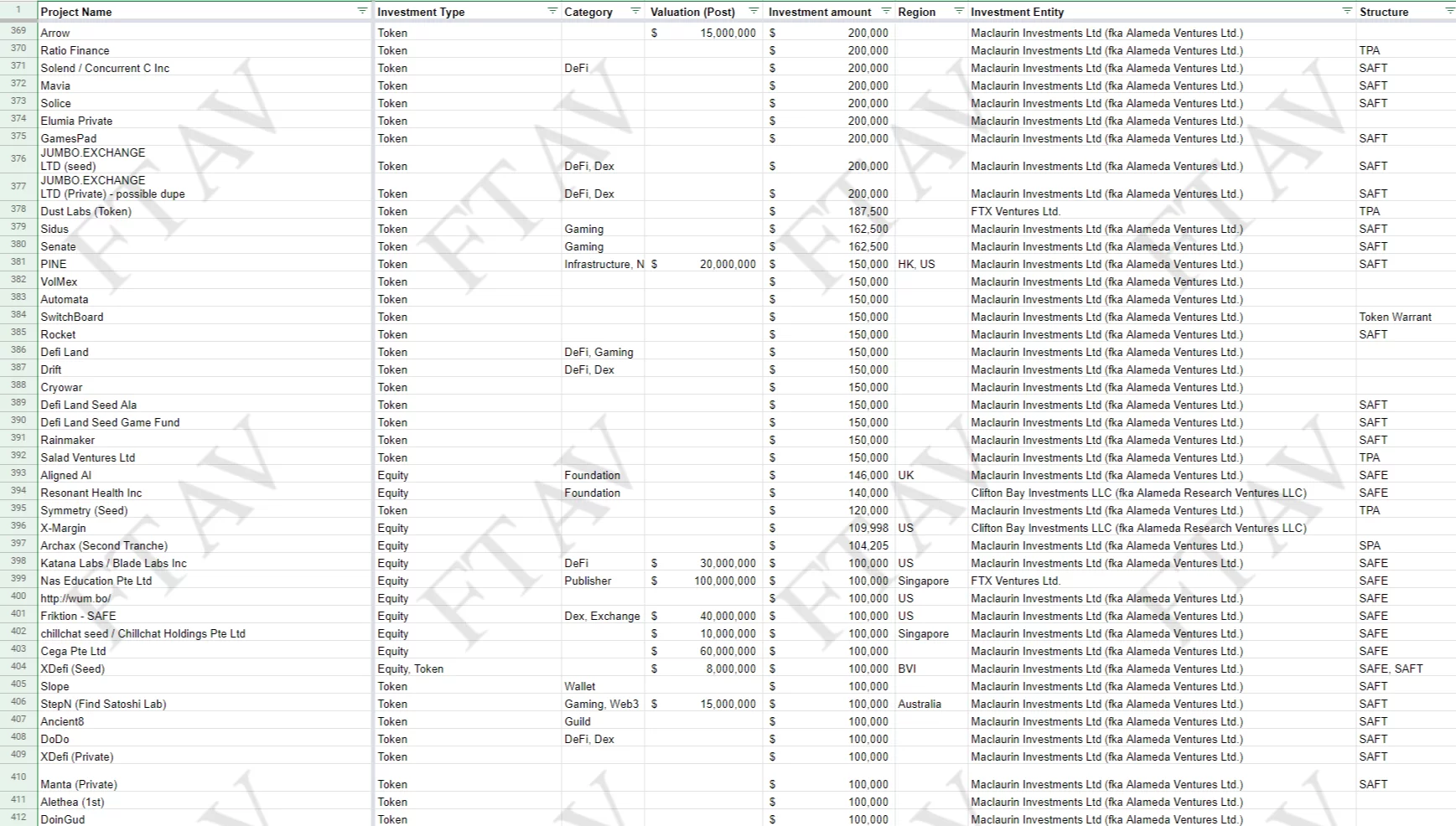

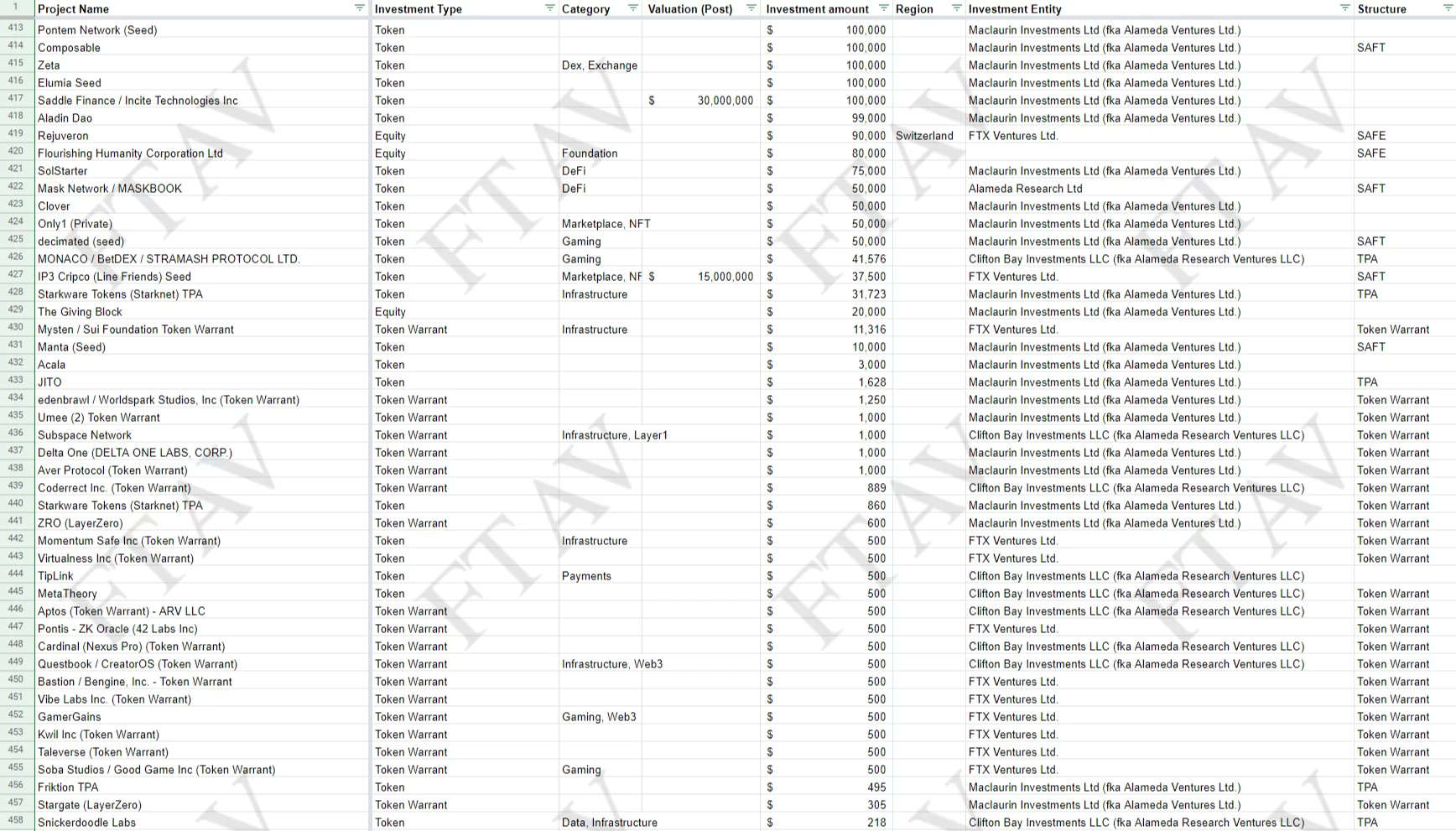

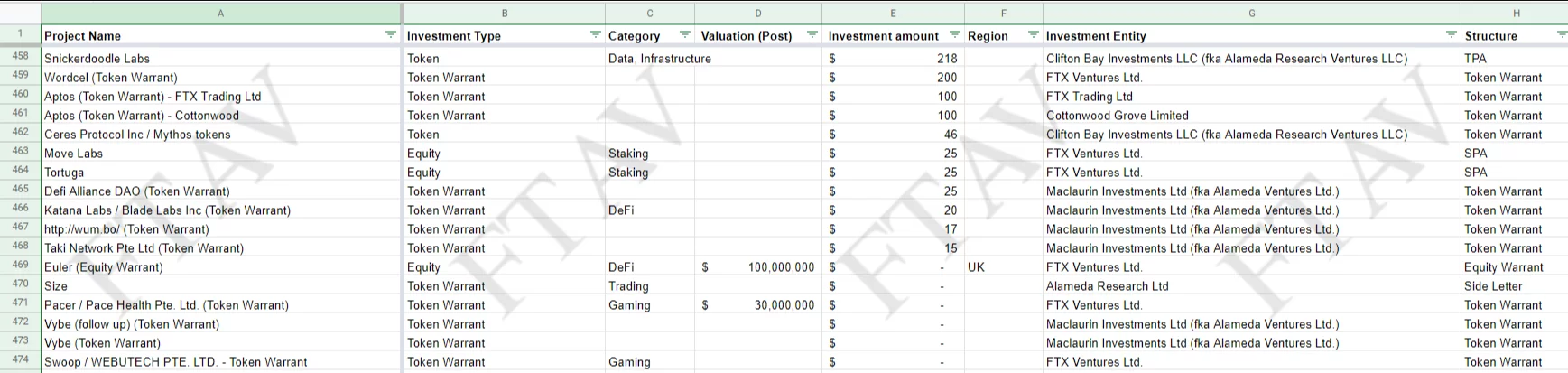

According to the report, these documents include all companies and projects in which Alameda and FTX have invested.

As you know, in the days when FTX’s liquidity crisis arose, SBF started to look for some loans. During this loan search, information about the assets in the portfolio and the companies invested in was shared in the form of an excel table as collateral to the institutions that requested loans.

FT claimed to have accessed these excel spreadsheets and shared the images below.

There are about 500 investment products that are illiquid in the charts. It is stated that the total value of the investments here is 5.4 billion dollars.

There is also a Turkish company in the table. It is seen that Alemeda invested 1 million dollars in the project named BiLira in the 186th place.

Some of the Alameda investments on the list were listed as investments by FTX in previous balance sheets. For this reason, it was stated that the line between Alameda and FTX has become blurred.

In addition to technology companies and crypto money projects, the list also includes video game platforms, betting applications, online banking systems, publishers, an unmanned aerial vehicle manufacturer and an agricultural company.

1xBit: 40+ Cryptos and Up to 7 BTC Welcome Bonus

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!