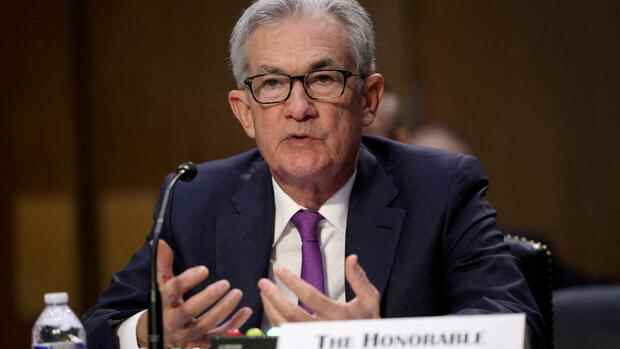

new York Jerome Powell urges a quick turnaround in monetary policy. In view of the high inflation in the US, the US Federal Reserve (Fed) will “use all instruments to support the economy and a strong labor market and to prevent inflation from settling,” said the US Federal Reserve Chairman at one Senate hearing on Tuesday.

US President Joe Biden had nominated Powell for a second term, but the Senate now has to confirm this. Powell has to convince the senators and the markets of his new strategy. For a long time, the Fed chief stuck to his assessment that rising prices were only a temporary phenomenon.

Now the Fed has to say goodbye to the ultra-loose monetary policy, “and quickly,” as Allianz’s chief economic advisor, Mohamed El-Erian, emphasizes. The Fed would now have to “rush to go on the offensive, that’s risky,” he wrote in a guest post for financial services provider Bloomberg. You run the risk of a recession if you raise interest rates too quickly.

Powell had to explain again and again why such a drastic U-turn was necessary. The Fed chief had “like many other economists believed that the problems with the supply chains had meanwhile been resolved,” he admitted. It is now clear, however, that this is not the case.

Top jobs of the day

Find the best jobs now and

be notified by email.

The new and highly contagious Omikron variant has shown that there could be delays for months. That will continue to put pressure on prices. “We assume that the high inflation will continue until the middle of the year,” said Powell.

Experts expect inflation to continue to rise

That puts the Fed chief in a difficult position. He wants to avoid a collapse in the economy, but at the same time fight high prices. “We know that high inflation is taking its toll,” he clarified. The sharp rise in the cost of food, housing, and gasoline is particularly bad news for low-income Americans.

It was precisely these people that he actually wanted to support with his loose monetary policy, which gave both the stock markets and the labor market tailwind, but drove prices up further. The rate of inflation rose to 6.8 percent in November – the highest value since 1982.

Fresh inflation data is expected on Wednesday. Experts surveyed by Reuters anticipate an increase to seven percent. Powell pointed out that this was “well above the target rate of price increase”. The Fed is aiming for an average inflation rate of two percent.

Monetary politicians signaled in December that they could hike rates three times this year. Goldman Sachs economists expect four interest rate hikes. Jamie Dimon, CEO of major bank JP Morgan Chase, believes it could be even more. “I am confident that we can achieve price stability,” Powell told the senators.

A reduction in total assets is also being discussed

The Fed is already in the process of scaling back the emergency programs it launched during the pandemic to prop up the markets. A reduction in the balance sheet total, which has grown to almost nine trillion dollars during the crisis, is also being discussed. “It’s a lot bigger than it needs to be,” Powell clarified.

Powell, however, left it open when the Fed will start the reduction and what exactly the strategy should look like. The monetary politicians had already discussed this at their most recent meeting in December. The subject would be on the agenda again at the next meeting in January. “We haven’t made a decision yet,” said Powell. It usually takes “two, three or four sessions to generate the best ideas”.

There is speculation in the markets that the Fed could initiate a turnaround in interest rates as early as March and brace itself against the sharp rise in prices. Statements by Atlanta District Chief Raphael Bostic support this assumption.

The US Federal Reserve must fight the risk of inflation quickly and powerfully, said Bostic in an interview on Tuesday. He warned that the increased price pressure may last for a long time. “We have to react directly, clearly and aggressively.” The Fed meeting in March may offer “an appropriate opportunity” for a turnaround in interest rates.

Fed Vice-President resigns early

His deputy-designate, Lael Brainard, will also be heard by the committee on Thursday. The long-time Fed director is to replace the current vice-president Richard Clarida. After an affair about securities transactions, this resigns prematurely. He will take off his hat on January 14th, it said on Monday on the Fed’s website.

Clarida’s term does not expire until January 31st. According to media reports, Clarida shifted its portfolio in February 2020 a day before an important announcement by Fed Chairman Powell. Most recently, media reports said that Clarida corrected its financial information at the end of December. The events join the affair of the trading activities of high-ranking US central bankers, which led to the resignation of two Fed executives in 2021.

Biden is trying to ensure more diversity in his nomination practice for vacant positions on the board of directors of the Fed – that is, to allow more women and members of ethnic minorities to have a chance.

According to media reports, economics professor Lisa Cook, who was recently appointed director of the Chicago Fed, is a hot contender for one of the Fed’s leadership positions. In addition, the former Fed director Sarah Raskin could return to her old place of work. Another candidate for a director post is the African-American economist Philip Jefferson.

With its clear strategic shift, the Fed had recently repeatedly caused turbulence in the markets. However, investors remained calm on Tuesday. The Nasdaq, which had come under strong pressure in the past few days for fear of rising interest rates, was up 1.2 percent in New York trading by midday. The leading index Dow Jones and the broader S&P 500 also rose slightly.

With agency material

More: Clarida’s term of office was supposed to end at the end of January. But a new report on securities sales has apparently increased the pressure on the Fed vice-president