Phantom (FTM) The price action followed the positive mood in the markets after the order to halt military exercises on the Russia-Ukraine border. Along with the positive news, improvements are also seen in the crypto money markets. In this process, while the bulls gained ground, they started to gain momentum for the rise.

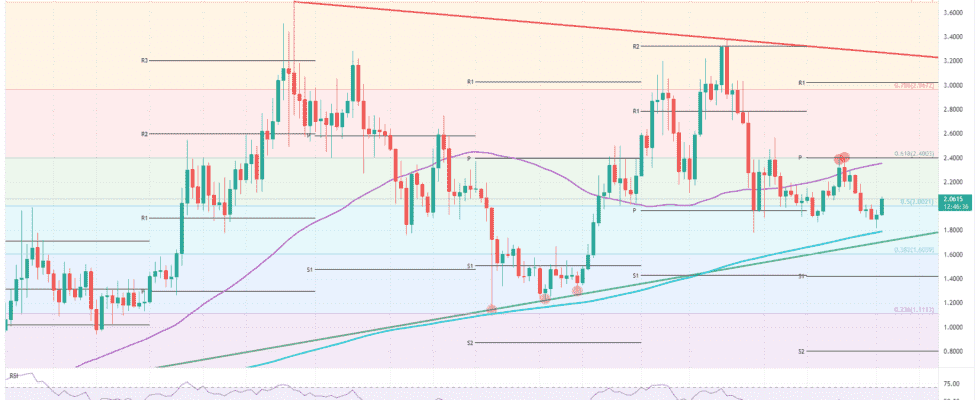

phantom pricewitnessed the breakout of several critical short-term levels, such as this week’s low and the 50% Fibonacci level at $2.00. With this move, more bulls and investors are joining the rally and trying to be a part of it in the first hour of a tailwind that could last for days or even weeks. However, it is highly attractive to traders to have a well-marked trading plan and some critical profit levels already in place to generate potential profits, as the rally can offer around 70% profits from solid earnings.

The first target for the FTM bulls is the $2.40 level, which coincides with the 55-day Simple Moving average, the monthly pivot, and the 61.8% Fibonacci level. As bulls will try to allocate about a third of their profits, taking some profits can definitely see a short drop and it will be important to wait until that level.

As long as the current momentum holds, you can expect to continue with the 78.6% Fibonacci level towards $3.00 and hold the remaining funds while just a few clicks above the monthly R1 resistance level as another portion of profits can be reserved. At least for a test or possible break of the red descending trendline, the trade will be around $3.2.

The hawkish statements and moves by the FED may show that the markets are in a structure that can prove to be fragile. Such a scenario would frighten investors and could result in fund outflows from cryptocurrencies.

On such news, you can expect the 200-day Simple Moving Average and the green ascending trendline and the Phantom price action to return to the supportive levels at $1.80, both of which will work together to keep the long-term uptrend in check with higher lows overall.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.