Bitcoin (BTC) may have appreciated sevenfold since the last halving, but historical data says this gain could add up to 300% and more. Based on a simple comparison, we can calculate how much room is left for both BTC and Ethereum price action to grow. cryptocoin.com We compiled the analysis, here are the details…

Bitcoin and Ethereum halving cycle analysis

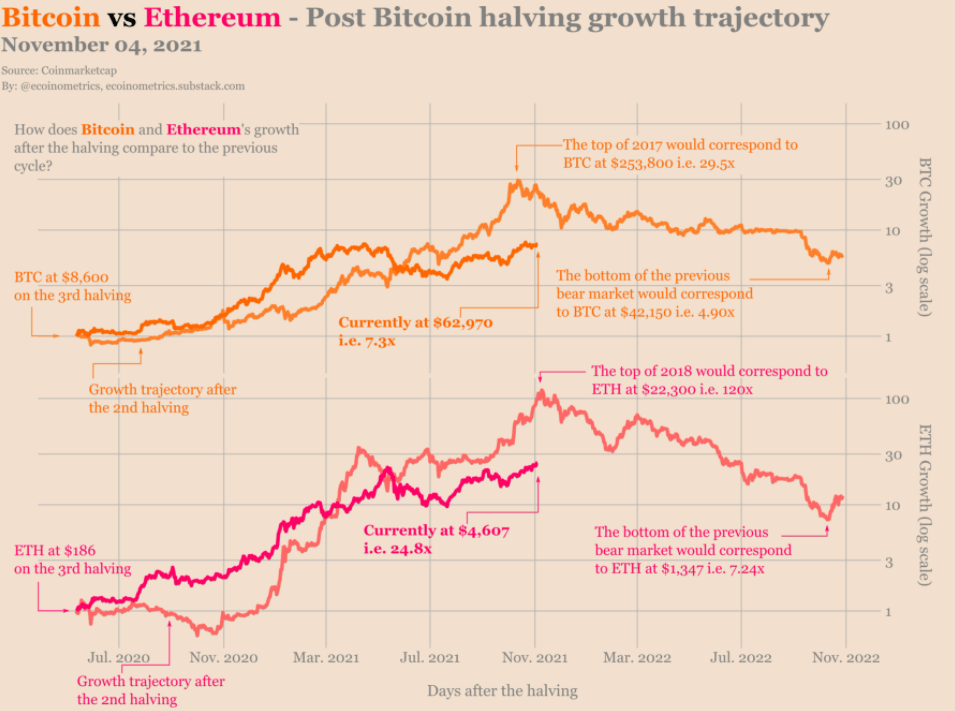

As tracked this month by on-chain analytics firm Ecoinometrics, BTC/USD has the potential to dwarf forecasts by simply following historical precedents. Bitcoin is currently trading at 7.3 times its price since the halving in May 2020. However, if the last halving cycle is temporary, the price action may not stop until it rises another 30x. The data relates to roughly four-year halving cycles, where Bitcoin has exhibited the same behavior since its inception. The current cycle is closely linked to the previous two, despite the impatience of some traders. For example, we can examine the year 2017…

Based on 2017, the next BTC price peak could be $253,800, and even then, Bitcoin is still moving within predefined parameters, according to analyst William Suberg. Ecoinometrics data also includes data on the performance of Ethereum (ETH) and Bitcoin by phase of the halving cycle. The largest altcoin has seen much larger comparative gains over Bitcoin, 120 times the halving price, marking the top of the last cycle in 2018.

Therefore, a repeat performance means that the ETH/USD pair is trading at $22,300. The possibility is not beyond their scope, however, according to the analyst. In terms of what the next bear market can bring, Bitcoin will need to bottom around $42,000 to replicate its post-2017 correction. ETH’s price will drop to $1,347.

1 BTC = 1 BTC

If such high numbers are hard to understand, they pale in comparison to what popular data analyst Willy Woo currently believes. In a tweet this week, Woo reiterated that the Bitcoin halving cycle will be unique in a certain way:

It will be priced in BTC instead of dollars, as it would be pointless to use anything to measure BTC value. What is my prediction for the peak of this cycle? We can’t find dollar value if it wins as I think this is the last cycle that leads us to saturation because things are valued in BTC.

Woo continues:

So choosing the cycle peak is easy. 1 BTC = 1 BTC

Finally, a separate post by Woo noted how close Bitcoin’s dollar is by market cap compared to the M2 supply. The situation in the next five years, the rest of the current cycle and the beginning of the next one will be “very interesting,” he commented.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.