Operation Choke Point 2.0 has deprived the US crypto industry of important fiduciary payment channels. The liquidity of the Bitcoin market is near historic lows, but what about altcoins like Litecoin (LTC), Chainlink (LINK), and XRP?

Besides BTC, which altcoins are the most liquid?

cryptocoin.com To this end, Kaiko, a digital asset data provider, has published a new study, as we reported. For traders, this research is a must-read to assess how volatile each crypto asset is based on its liquidity. And it has a few surprises in the study.

At the beginning of the report, Conor Ryder, a research analyst at Kaiko, states that market depth is at a 10-month low as OCP 2.0 and market makers have had to withdraw their orders from exchanges. “This is why it is crucial for investors to be able to accurately assess the liquidity of each asset so that they understand how short-term volatility they should expect,” explains Ryder.

Overall, Kaiko reviewed data on the 29 largest cryptocurrencies by market cap, excluding stablecoins and wrapped altcoins. He used three criteria to define a liquidity ranking: volumes, market depth and spreads. For volume and market depth, it combined data from all active USD, BUSD, USDT and USDC pairs from the 11 most liquid central exchanges. For the spreads, Kaiko only used data from Binance, the most liquid exchange with the widest range of markets.

Altcoins featured in the report

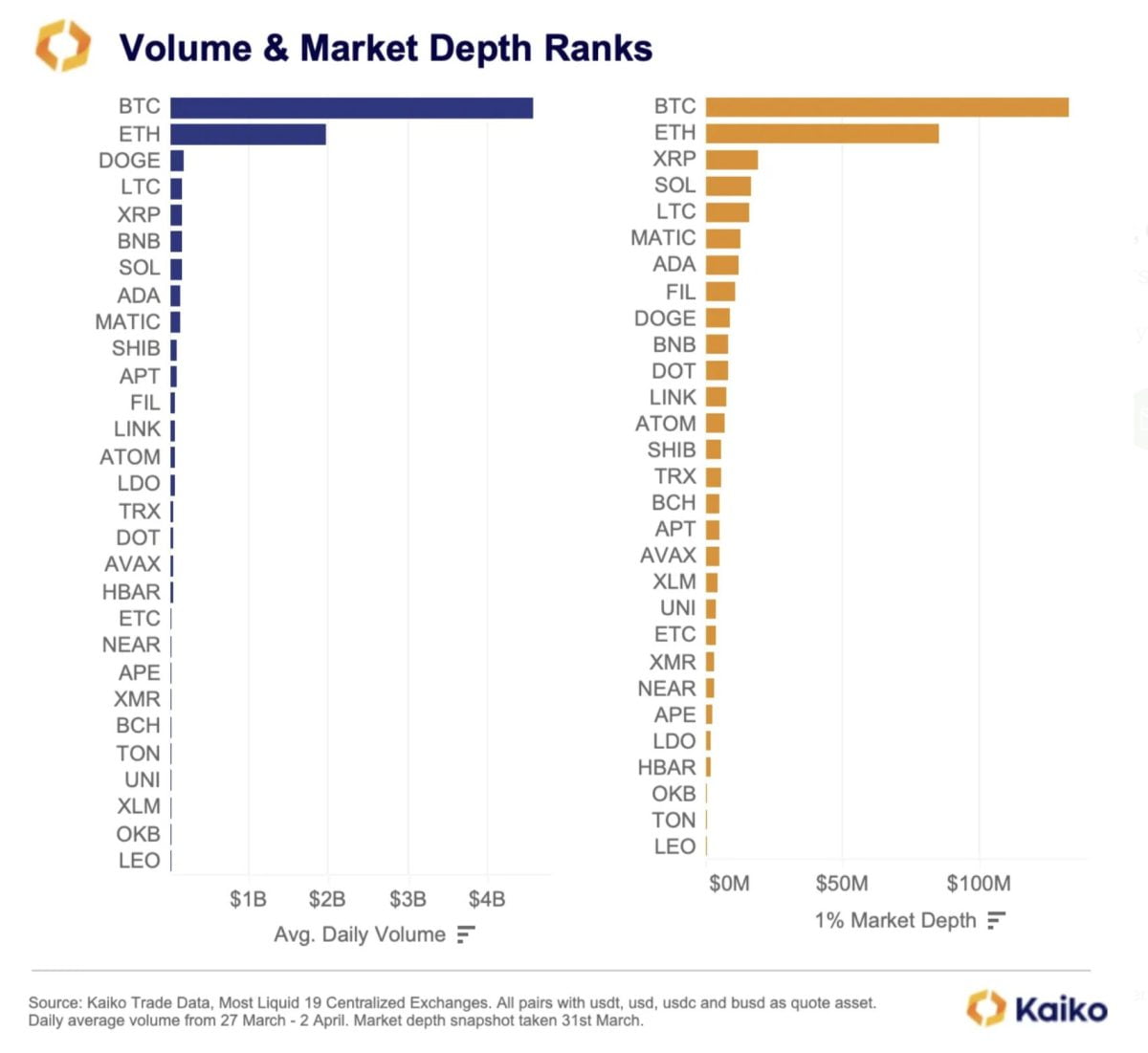

In terms of volumes, Dogecoin and Litecoin were the most notable altcoins in the first quarter of 2023. As the chart below shows, DOGE occupies an impressive third place after BTC and ETH, ahead of several tokens with larger market caps.

Litecoin, on the other hand, ranks 4th despite having the 11th largest market cap (excluding stablecoins). “Cautionary note regarding LTC volumes, I found some examples of LTC wash trading on Bitforex earlier this year, so the volume figure alone is not enough to conclude that LTC is particularly liquid,” the analyst says. Chainlink also outperforms its rankings by market capitalization and ultimately ranks 13th by trading volume.

In terms of market depth, XRP and Solana stand out favorably after BTC and ETH. Litecoin is again in a very good fifth place, while LINK is in a respectable 12th place. On the other hand, BNB is giving a negative surprise. “The depth of BNB is surprisingly low considering it is the most liquid exchange’s native token, and it remains tenth despite being the third largest non-stablecoin token,” said Ryder. The lower the market depth, the easier it is for larger market orders to affect the price. states that it is.

In traditional finance, spreads are the most widely used indicator to assess the liquidity of a market. Generally, the smaller the spread, the more liquid the market. In this category, Polygon (MATIC) and Cosmos (ATOM) stand out ahead of Ethereum (ETH). On the other hand, BNB, which ranks 21st in terms of spreads on its exchange, and Solana, which is ranked 16th despite being the 8th largest unstable token by market capitalization, is once again disappointing.

How about LTC, LINK and XRP in general?

There are certainly surprises in the overall liquidity ranking resulting from the three aforementioned liquidity ratios. The general rule of thumb is that the lower a metric’s score, the better its liquidity. Behind Bitcoin and Ethereum, MATIC and LTC occupy the best places and are therefore less susceptible to the impact of larger orders. XRP ranks 6th, Chainlink 8th, making them less prone to volatility overall. Ryder also highlights Aptos:

APT liquidity far exceeds market cap, implying that it is one of the most liquid tokens for its size and should benefit from less volatility as a result.

On the other hand, LEO and BNB worry Kaiko’s analyst. The market cap of these two exchange tokens is too extreme compared to their liquidity. “It’s a similar situation to FTT, where illiquidity played a role in FTX’s downfall,” Ryder says.

At press time, the Litecoin price was at $90.30. Thus, LTC is still writing higher lows on the 4-hour chart and continuing the uptrend.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.