Bitcoin price held above $40,000 on January 25, 2024, increasing bullish expectations. However, risks such as US Gross Domestic Product (GDP) data and $5.8 billion option expiry may negatively impact the market.

US GDP data is influential for Bitcoin price

Important factors that may affect Bitcoin price are US GDP data and option expiry.

- US GDP data: US GDP data will be announced on January 26, 2024. Expectations are that the economy grew by 5.2% on an annual basis in the fourth quarter. Strong GDP data could raise expectations of aggressive interest rate hikes from the Fed. This, in turn, could suppress the Bitcoin price by reducing demand for risky assets.

- Option expiry: The $5.8 billion option expiration will occur on January 26, 2024. Options are contracts that give investors the right to buy or sell an asset at a certain price. Large amounts of option expirations can cause volatility in the market. This can cause the Bitcoin price to both rise and fall.

What are the expectations?

The final situation for Bitcoin price will depend on the factors mentioned. Factors such as improving the general economic situation, not increasing interest rates and loosening regulations may contribute to the rise in Bitcoin price. However, factors such as the worsening of the general economic situation, increasing interest rates and tightening of regulations may cause the price of Bitcoin to decline.

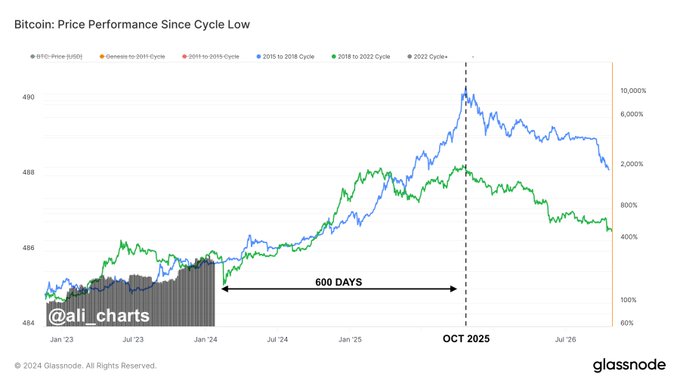

In other words, the Bitcoin price held above $ 40,000 on January 25, 2024, increasing bullish expectations. However, risks such as US Gross Domestic Product (GDP) data and $5.8 billion option expiry may negatively impact the market. Meanwhile, cryptocurrency analyst Ali Martinez commented on the future movements of Bitcoin price. Martinez stated that the Bitcoin price is in an upward trend according to technical analysis and the rise may continue if it holds above $40,000.

Warning from Ali Martinez

Martinez said, “Bitcoin price continues its upward trend by holding above its 200-day moving average. “This situation makes us think that the price may rise even further,” he said. Martinez also noted that US GDP data and option expiry could impact the market. “If US GDP data is strong, it could increase expectations of aggressive interest rate hikes from the Fed,” Martinez said. “This could suppress the price of Bitcoin by reducing the demand for risky assets,” he said. Martinez noted that option expiration could also cause volatility in the market. “The $5.8 billion option expiration could cause market volatility,” Martinez said. “This can cause the Bitcoin price to both rise and fall,” he said.

Overall, bullish expectations for the Bitcoin price have increased. However, risks such as US GDP data and option expiry may negatively impact the market. According to Ali Martinez’s comments, Bitcoin price is in an upward trend according to technical analysis. However, risks such as US GDP data and option expiry may limit the price’s rise.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.