The group leader disappointed investors with a weak outlook.

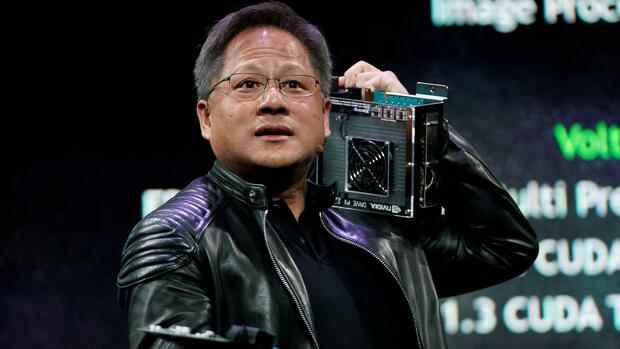

(Photo: Reuters)

Munich From stock market darling to bogeyman: Nvidia founder and CEO Jensen Huang scared investors away with his forecast for the current quarter. In premarket trading in New York on Thursday, the semiconductor manufacturer’s share price fell by more than five percent to around $160.

Huang only expects revenues of $8.1 billion in the current quarter, analysts had assumed a good $8.4 billion. On the one hand, the entrepreneur cited the lockdowns in China as reasons. The supply chains were torn due to the strict measures to contain the corona virus. On the other hand, Russia’s war of aggression against Ukraine is putting a strain on business. Overall, the Silicon Valley group would lose around half a billion dollars in sales.

In the past six months, Nvidia has already lost around half of its stock market value – around 400 billion dollars. Investors fear that the semiconductor boom of the past two years will end soon. However, the chip manufacturer is still rated significantly higher than tech companies such as Apple, Google or Microsoft and also than other semiconductor manufacturers such as Intel, Qualcomm and AMD.

This is not least due to the fact that business continues to develop extremely dynamically despite the gloomier prospects. Revenue soared 46 percent to $8.3 billion last quarter. Nvidia thus exceeded analysts’ estimates by $200 million. The profit was also better than expected by the bankers.

Top jobs of the day

Find the best jobs now and

be notified by email.

The business with chips for network computers has grown particularly strongly. In the division, revenues climbed by more than 80 percent. This is due to the fact that cloud providers such as Amazon or Microsoft are expanding their data centers worldwide.

More: Masses of microchips from domestic production: why the plan is in jeopardy