Markus Thielen, CEO of 10x Research, issued another frightening warning Wednesday for traders and investors as they consider “buying the dip” in the wake of the broader crypto market crash. Thielen, Bitcoin ETF He predicts that after approval, BTC price will drop to $38,000 and then BTC will rise to $50,000. Thielen stands out as one of the first few analysts to correctly predict the recent crash.

More Capitulation in Bitcoin and Ethereum Prices?

In a new report published on March 20, senior analyst Markus Thielen wrote about Bitcoin (BTC) and Ethereum He explained why (ETH) prices are falling and why it is too early to buy the dip.

The crypto research firm adopts different approaches besides the analog model to make accurate predictions using data, predictive models and objective analysis. According to current data, the $63,000 and $60,000 levels have been identified as important support points for Bitcoin. If the $60,000 level is broken, it is predicted that the BTC price may drop to the $52,000-54,000 range.

While Markus Thielen predicted that BTC would drop to $63,000, he maintained his belief that Bitcoin would reach $150,000 within this year. Additionally, another prominent analyst, Rekt Capital, is signaling a possible correction based on historical pre-halving reversal patterns.

Although Bitcoin, Ethereum and other altcoins look much cheaper at the current level, Markus Thielen says, “It is still too early to buy in this downturn.” Thielen expects Bitcoin to fall below $60,000 before a new rise. The firm has an upside target of $83,000 and $102,000 for Bitcoin.

“Technically, we expect Bitcoin to trade below 60,000 before a more meaningful rally attempt begins. “Based on previous new high signals, we can paint a rosy picture of 83,000 and 102,000 upside targets.”

Other Factors Affecting Bitcoin’s Upward Trajectory

The FOMC will announce its monetary policy decision on interest rate cuts today, and Fed Chairman Jerome Powell will provide further guidance on timing and expected rate cuts in 2024. CME FedWatch Tool shows that the Federal Reserve will keep the interest rate unchanged at 5.25%-5.5% for the fifth consecutive meeting. However, the important data is when the Fed will start reducing interest rates.

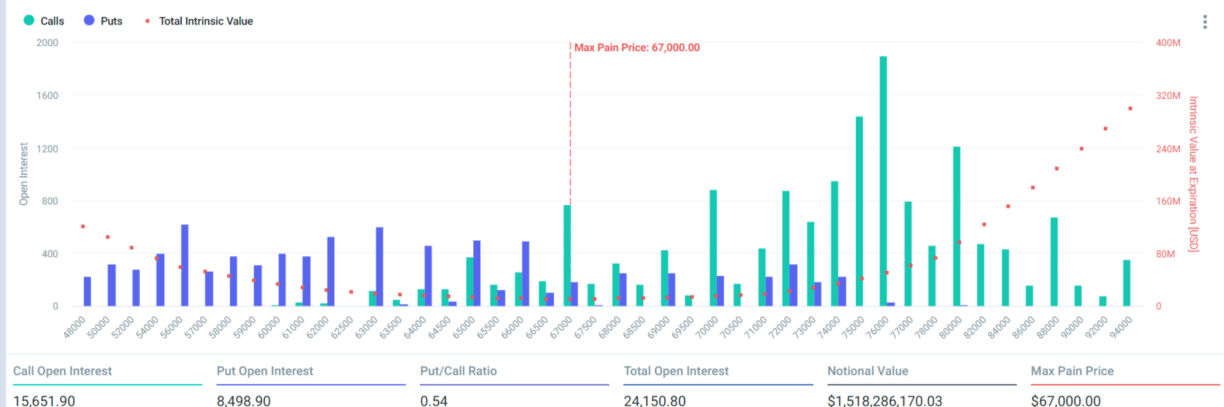

Additionally, options expiration data for this week shows traders betting on $58,000 worth of contracts. Current data shows sentiment for Bitcoin price to fall below $61,000. As traders stay in Bitcoin for a long time, the expiration day will see a large liquidation.

Meanwhile, Bitcoin futures open interest is indicating a slight bounce. However, total OI remains stable at around $33 billion. Bitcoin is seeing a muted move as spot Bitcoin ETFs recorded net outflows of $326 million on Tuesday and pre-market data suggests outflows will continue this week.

BTC price dropped 14% in a week and is currently trading at $63,177. The 24-hour lowest and highest price are $60,807 and $65,757 respectively. Additionally, trading volume remained stable over the last 24 hours.