In February, 1,271 applications for corporate bankruptcy were received by the district courts.

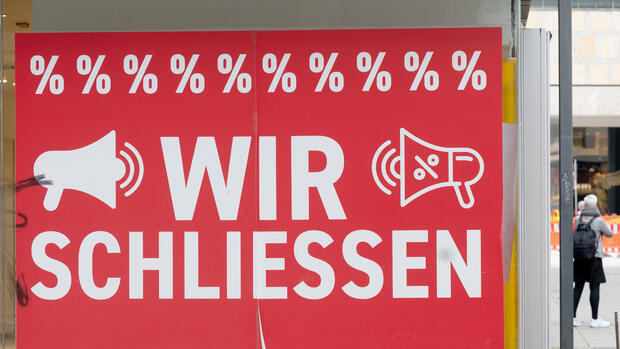

(Photo: dpa)

Berlin In view of the economic downturn and rising interest costs, there are signs of an increase in company bankruptcies in Germany. The number of standard insolvency proceedings applied for in February was 13.2 percent above the level of the previous month, as the Federal Statistical Office announced on Wednesday. In February there was already an increase of 10.8 percent.

These statistics only show business closures that take place in the course of insolvency proceedings – but not those for other reasons or before acute payment difficulties occur.

Despite the corona and energy crisis, the number of company bankruptcies in 2020, 2021 and 2022 was at a historically low level. The reason for this was extensive state aid such as the partial suspension of the obligation to file for insolvency, the expansion of short-time work benefits, financial aid and the freeze on enforcement by the tax authorities and health insurance companies.

A trend reversal is now emerging. Higher production costs, growing personnel expenses, significant rise in interest rates: Experts are predicting more company bankruptcies in Germany due to the difficult framework conditions. The credit insurer Allianz Trade expects an increase of 15 percent this year.

The number of company insolvencies actually applied for at the district courts was 1271 in January, as reported by the statistical office. That is 20.2 percent more than a year earlier. In December, the increase was 19.7 percent. At the beginning of the year, most corporate insolvencies were in the construction industry with 246 cases (+19.4 percent). This was followed by trade (including the maintenance and repair of motor vehicles) with 204 procedures (+27.5 percent).

>> Read here: What to do if you are threatened with insolvency?

The probable claims of creditors from the corporate insolvencies reported in January were estimated by the district courts at almost 2.3 billion euros. In January 2022, the claims were significantly lower at a good 1.4 billion euros. The number of consumer bankruptcies filed also increased in January, by 1.9 percent.

More: 108 percent more bankruptcies: fashion companies restructure themselves through bankruptcies