According to statistics from RootData, there were 75 investment projects publicly announced by crypto VCs in October. Accordingly, this means a 10% decrease compared to the previous month. Let us remind you that there were 83 projects in September. On the other hand, when looked at on an annual basis, there is a decrease of 45%. There were 135 projects in October last year. Let’s look at the details.

The decrease in projects in the crypto sector attracted attention

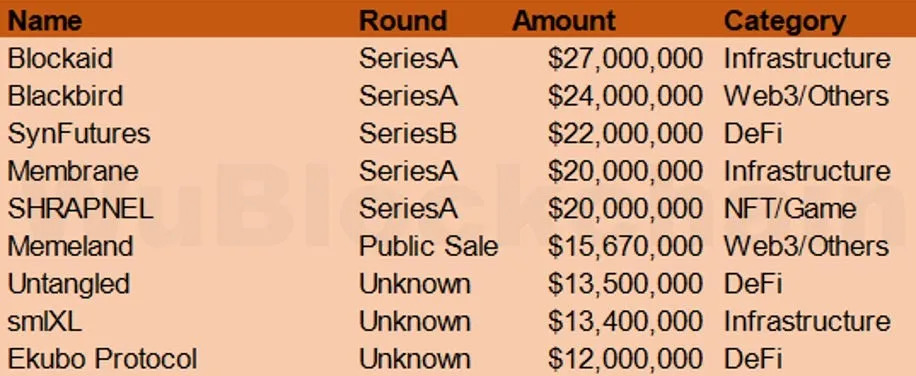

In the crypto sector, infrastructure projects accounted for approximately 24% of financing in October. On the other hand, DeFi accounted for about 21%, CeFi about 9%, and NFT/GameFi about 13%. The total financing amount in October is at the level of 430 million dollars. Accordingly, there is a 20% decrease compared to the previous month. In September 2023, this figure was $530 million. On the other hand, it is 63% compared to the same period of the previous year. In October last year, the figure was at 1.15 billion dollars. On the other hand, tours exceeding $12 million are listed below.

The $6 million fundraising round, in which Web3 security development company Blockaid, Sequoia Capital, Greylock Partners and Cyberstarts participated, attracted attention. It also raised $33 million in financing, including a $27 million Series A round led by Ribbit Capital and Variant. On the other hand, Blackbird announced the completion of its $24 million Series A financing round led by a16z. Blackbird provides loyalty and connection tools for restaurants. These developments show that the crypto sector is open to significant funds

Other initiatives

Decentralized derivatives exchange SynFutures has raised $22 million in a Series B funding round led by Pantera Capital, with participation from HashKey Capital and others. SynFutures is currently the second largest derivatives protocol on Polygon. Accordingly, co-founder and CEO Rachel Lin is also open to the idea of launching a native crypto in the future.

Cryptocurrency trading and lending platform Membrane Labs also made important moves during this period. Accordingly, Brevan raised $20 million in the Series A financing round with the participation of important companies such as Howard Digital and Point72 Ventures. The funds will be used to help establish the mature trading infrastructure needed in the cryptocurrency space.

Important breakthrough from the game company

Gaming company NEON Machine announced the completion of a $20 million funding round led by Polychain Capital, with participation from IOSG Ventures and others. The investment will be used for game development. Binance, on the other hand,39. announced the launch pool of its new coin mining project Memecoin (MEME). The cryptocurrency MEME is the ecosystem token of Memeland, a Web3 creative studio under 9GAG. The community presale of Memecoin (MEME) has ended. Accordingly, it collected approximately 8737 ETH ($15.67 million).

On the other hand, RWA lending platform Untangled Finance has completed a $13.5 million financing round. Accordingly, the cryptocurrency was launched on the Celo network. Startup smlXL announced the completion of a $13.4 million seed funding round with participation from a16z crypto, Greylock, and others. Finally, the Uniswap community accepted the proposal to “invest in Ekubo Protocol”. When we look at Kriptokoin.com, Ekubo’s founder, Moody Salem, was previously the engineering manager at Uniswap.

To be informed about the latest developments, follow us Twitter’in,Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.