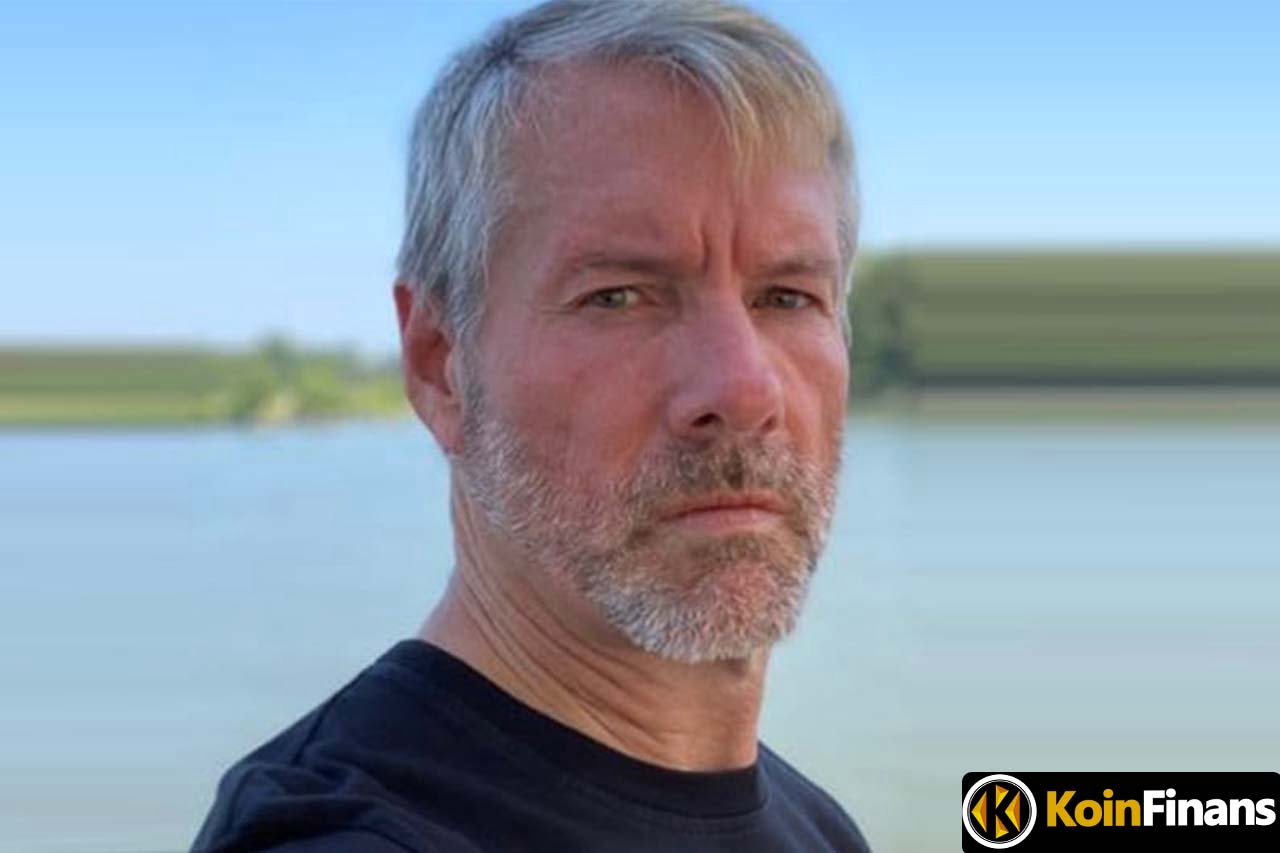

Writing firm owned by Michael Saylor MicroStrategywas already a well-known firm for Bitcoin (BTC) advocacy. The firm announced today that it has purchased 4167 BTC. The firm maintains the title of holding the most BTC among publicly traded companies.

In a tweet he shared, Saylor stated that the firm spent a total of $190.5 million on BTCs. This too Bitcoin (BTC) That means a cost of $45,714 per head. Looking at the current price, it is possible to say that the company has already made a profit. The value of one BTC was currently around $46,610.

The acquisition brings MicroStrategy’s total BTC holdings to 129,218 BTC, worth about $6 billion at today’s price. According to data from CoinGecko, the figure is almost three times the holdings of Tesla, the second largest BTC holder on Wall Street. The electric car manufacturer has 48,000 BTC.

MicroStrategy Buys Its BTCs With Debt

The acquisitions came after an announcement that MicroStrategy had borrowed approximately $205 million. The loan deal was with crypto bank Silvergate Capital and used MicroStrategy’s existing BTC holdings as collateral.

Given that the software firm has said it will use some of the loan as working capital, it seems likely that the remaining $15 million from the loan was used there.

MicroStrategy has been continuing its Bitcoin purchases since 2020. Owner of the firm Michael Saylor He is also a staunch cryptocurrency advocate. According to Saylor, BTC is pretty good at inflation protection.

Bitcoin Rally is on the agenda again

Bitcoin rallied throughout March and hit its highest level for 2022 so far. Recent technical indicators also suggest that BTC could be set for more gains.

Much of the rally was driven by firms investing in Bitcoin. Bulk purchases made by Terra also contributed to Bitcoin.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.