The cryptocurrency market is heating up again, led by Bitcoin (BTC) after the flagship crypto asset reclaimed the $35,000 mark. As short-term gains advance, widespread uncertainty remains regarding the sustainability of the rally; While some market participants expect a continuation, others predict a correction. With the rise of Bitcoin, attention has also turned to altcoins and their ability to mimic the largest cryptocurrency by market cap. A few altcoins in particular are on the rise, offering investors an opportunity they can benefit from in the future. In this regard, cryptocurrency trader and analyst Michaël van de Poppe, in a YouTube video on November 5, identified the following altcoin projects to consider buying as markets warm up.

First altcoin on the list: Chainlink (LINK)

Poppe pointed out that Chainlink (LINK) should be purchased based on the token’s historical price movement. He emphasized that LINK has historically been correlated with Bitcoin, meaning the asset classes tend to move together. The analyst noted that LINK is showing a pattern of higher lows and higher highs. Poppe acknowledged that LINK’s value had already begun to rise and identified two important price levels to watch for that offer an ideal buying point. According to him, investors should expect a possible correction near $9.50 and $10.

In his analysis, Poppe noted that if the current strength in the price movement continues, LINK could potentially outperform and reach the $25 to $30 price range. Currently, Chainlink was trading at $12.21, gaining over 7% in the last 24 hours. On the weekly chart, Chainlink is up over 11%.

Aave (AAVE) is also one of the notable players

Aave (AAVE), a leading player in the DeFi space, is currently at a pivotal point as its valuation is rising along with the overall market. Poppe observed that AAVE faced formidable resistance, an impressive barrier for 542 days. However, Poppe pointed out that AAVE, which has accumulated in recent days, is probably on the verge of a possible breakthrough. If this resistance is successfully overcome, it could signal the end of a long accumulation period and potentially push the price to levels between $260 and $280, paving the way for further gains in the broader DeFi market.

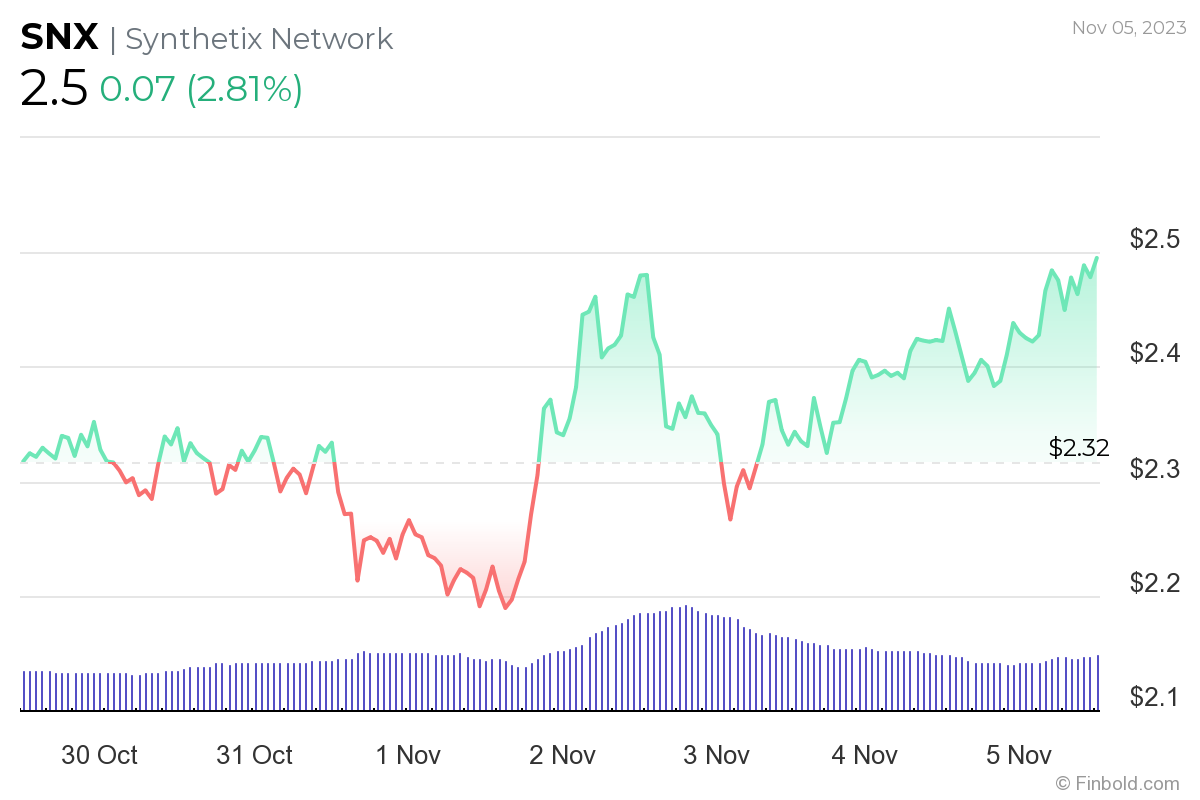

Synthetix (SNX) interest increased

The crypto analyst noted that similar moves in Synthetix (SNX) reflect sentiment around AAVE. The DeFi protocol, which provides a platform for creating and trading synthetic assets, is currently struggling with a tough resistance level. According to Poppe, market sentiment shows that intense accumulation and discussions on social media platforms indicate increased interest in Synthetix. Despite the prevailing bearish trend, Poppe believes this could signal a turning point for the asset.

According to its analysis, Synthetix has lagged in recent market movements. However, he claims that this situation could change dramatically if resistance is successfully broken. In the event of a breakthrough, Synthetix’s value could rise to a range between $7.50 and $8. This potential breakout comes after a previous attempt was deemed a “fake breakout” towards resistance, highlighting the importance of precision in timing market entry.

Last altcoin on the list: COMP

Compound (COMP) is also showing signs of revival, closely mirroring AAVE’s trajectory. Poppe pointed out that Compound, like its counterpart, is facing a significant point of resistance. In this context, the analyst emphasized the importance of monitoring social media channels where significant accumulation was seen, although some participants maintained their downward outlook. This difference in sentiment indicates a period when profit-taking opportunities may arise. From a broader perspective, Poppe suggested that emerging altcoins are poised to deliver impressive performance if the current market momentum continues.

To be instantly informed about the latest developments, contact us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.