The SEC has filed extensive charges against Binance and related parties for alleged breaches of securities law. The lawsuit represents one of the most comprehensive set of charges the SEC has ever made against a cryptocurrency company. The most important claims and facts are listed below.

Binance Coin (BNB) and BUSD are securities

The SEC has declared Binance’s cryptocurrencies as securities, including BNB Coin (BNB) and Binance USD stablecoin (BUSD). The regulator states that Binance’s BNB Vault, Binance’s Simple Earnings program and Binance.US’ staking services are also securities. He says the company makes its offers and sales illegally and off the record. More generally, the SEC notes that Binance and its US counterparts do not register as an exchange, broker-clearer or clearing house when they should.

Some tokens on Binance are also securities.

The SEC has listed Binance’s Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity ( He says various tokens are securities, including AXS) and Coti (COTI). Additionally, the SEC notes that these tokens have been “sold as an investment contract since their initial sale.” Therefore, it states that it is a security. Binance does not issue these tokens. However, the SEC has complained about Binance’s failure to restrict the trading of assets on its platform.

SEC wants Zhao and others blocked

The SEC says Binance, Binance.US parent BAM firm Trading and related parties should be permanently banned or barred from violating relevant sections of the Securities Act and Exchange Act, says Changpeng Zhao, Binance CEO. It also notes that these parties should be decided to pay compensation and civil penalties. The regulator adds that Zhao should be barred from certain leadership roles. It states that Binance and its related companies should be barred from dealing with crypto-asset securities.

Binance evades US regulations

cryptocoin.comAs you follow, the SEC alleges that Binance has marketed its services openly to US customers after its launch in 2017 and covertly after it nominally restricted US access in 2019. One of the advisors told Binance to create a “Tai Chi” organization in the US tasked with issuing reports and communicating with the SEC “only to pause potential enforcement efforts.” The advisor also encouraged Binance to block US users on its main exchange, while privately telling some of these users how to circumvent the restrictions. Binance and its executives did not fully accept the Tai Chi plan. However, many expressed that they would like to continue working with the consultant.

Binance ythe promoters were aware of the situation

Binance’s CCO (SEC name reveal) made statements showing that he was aware of the inaccuracies. “We operate as an unlicensed stock exchange in the US,” the CCO said in 2018. He also said that in 2020 Binance never wanted to be regulated, leading to the creation of local assets.

Zhao and others were also involved in the Tai Chi plan discussions. Zhao acknowledged that there are “safer” alternatives. But he went ahead with most of the plan no matter what. Zhao personally directed Binance to create a plan that advises users to bypass geo-blocking VPNs. He also told Binance to encourage VIP users to bypass KYC checks. The SEC states that it is aware that Zhao and Binance have a large number of US users. Internal presentations attest to this, with the firm estimating 1.47 million American users in 2019.

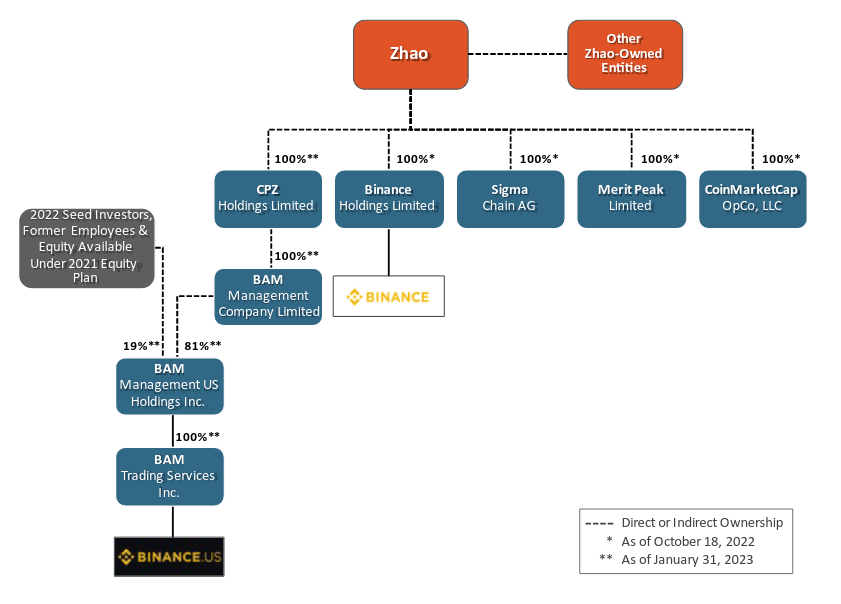

CZ owned companies, controlled US funds

The SEC says Binance CEO Changpeng Zhao has 100% ownership of several Binance-related companies, along with other Zhao-owned entities.

Zhao does not own 100% of US companies covered by BAM. However, he and Binance have substantial control over bank accounts and user crypto deposits. The SEC also says that Zhao’s Merit Peak and Sigma Chain were used to “transfer tens of billions of US dollars” between Binance and their US counterparts. According to the SEC, Zhao and Binance were also involved in the design, launch, recruitment, trading activities and operations of BiananceUS.

w on Binanceash-trading common has become

Finally, the SEC says that Binance’s U.S. companies have overestimated their safeguards against wash-trading. It also claims that it misleads users by overstating their trading volume. The SEC notes that there has been a significant amount of wash-trading due to Sigma Chain’s market maker role. At one point, Sigma Chain accounts wash-traded 48 out of 51 of the newly listed assets. At another point, these accounts wash-traded 51 of the 58 listed assets.

Binance’s U.S. firms had no trade oversight mechanisms until at least February 2022. However, he has made previous statements that this feature exists. The SEC underlines that executives are aware of wash-trading. But he claims they have taken no steps to stop this activity. The SEC states that trade data is important information for users and stock investors. Also, Binance says that US companies profit from these misleading statements. The regulator therefore claims that the firms’ actions constitute fraud and deception.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.