Private patients are usually entitled to treatment by a chief physician.

(Photo: Westend61/Getty Images)

Frankfurt The corona crisis appears to have been overcome in 2023, but the market environment for private health insurance has not become any easier: the number of people with full insurance is falling, expenditure on benefits continues to rise, and political discussions are leading to uncertainty. “There are a number of problem areas for private health insurance providers,” said Alexander Kraus, specialist health insurance coordinator at the rating agency Assekurata, at a press conference. Nevertheless, the industry is solidly positioned and has further growth potential in some areas.

In comprehensive health insurance, however, providers are still finding it difficult to acquire new customers on a large scale. It is true that many civil servants continue to opt for private health insurance. In addition, in 2022, for the fifth year in a row, more people switched from statutory health insurance to private health insurance than the other way around.

>> Read also: Are you in good hands with private health insurance?

All in all, according to Assekurata figures, private health insurers lost around 14,000 insured persons. Kraus also attributes this to the aging clientele and a higher number of deaths. “The future political framework, such as the significant increase in the annual income limit, could make access to private health insurance even more difficult,” he added.

While civil servants and the self-employed can take out private insurance regardless of income, this is only possible for employees above the annual income limit of currently 66,600 euros per year. It could continue to increase in the future, also to keep more people in the statutory health insurance system.

Supplementary dental insurance is a “best seller”

Many people are now unsure whether they should switch to private health insurance, said Kraus. It is therefore important for insurers to make even more attractive offers, especially for voluntarily insured persons and families.

According to the private health insurance association, there are a total of 8.7 million fully insured people. 2.5 million alone are insured with the market leader Debeka. In addition, the Ergo subsidiary DKV, Signal Iduna and Allianz are among the larger providers.

Things are going more positively for insurers in supplementary insurance. Here, the industry grew by 2.1 percent to around 29.4 million policies in 2022. Assekurata expert Kraus describes the supplementary dental insurance in particular as a “best seller”. Insurers were also able to make gains in company health insurance.

Assekurata also sees opportunities in the fact that care is once again becoming more of a focus of public discussion. In recent years, there have been strong increases in premiums for compulsory and supplementary long-term care insurance. As a result, the policies were no longer so well received by customers. Because of the rising costs, however, private insurance is important, says Assekurata division manager Abdulkadir Cebi.

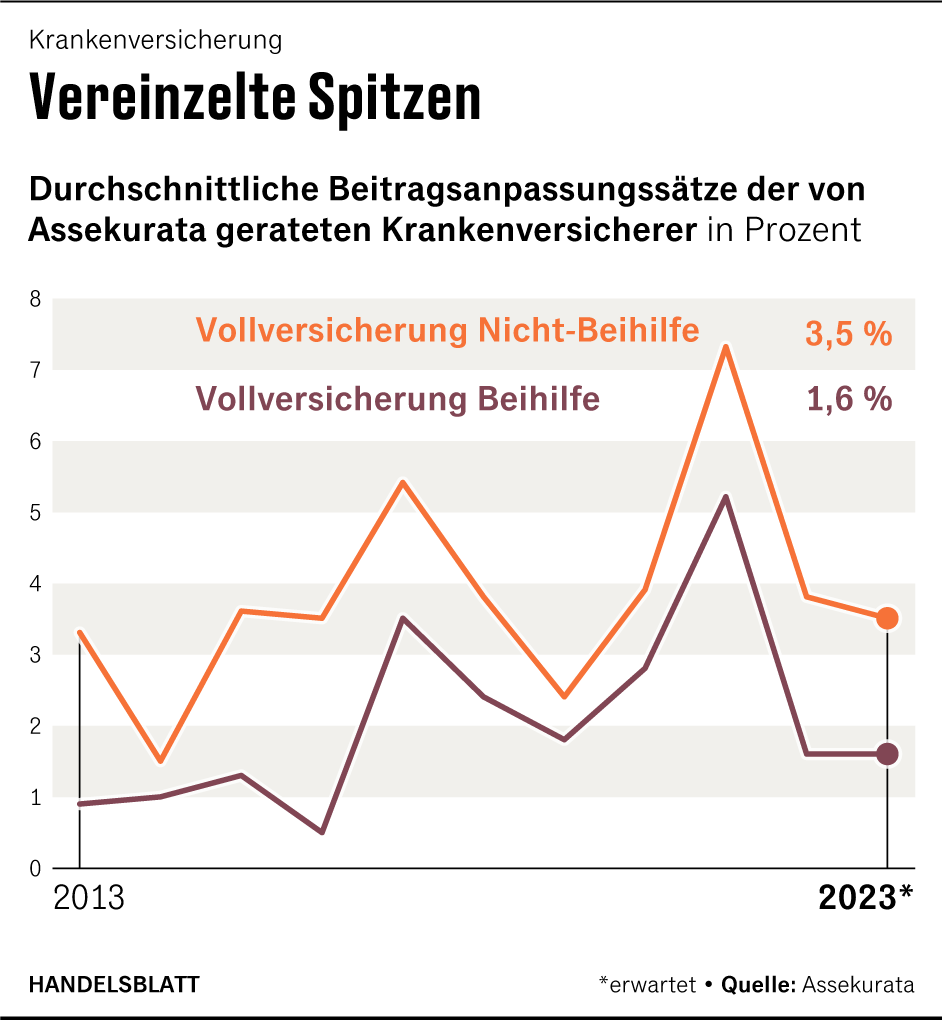

Overall, the premium income of private health insurers will continue to rise, according to Assekurata estimates, to 48.4 billion euros in 2023. The increases in contributions were still moderate, emphasizes Kraus. They are likely to increase by 1.6 percent in the current year for civil servants who receive an allowance from their employer and only have to insure the remaining costs privately, and by 3.5 percent in the non-benefit tariffs.

Rising interest rates provide relaxation

High increases in private health insurance premiums have repeatedly been the subject of public criticism in the past. However, the insured no longer have to reckon with that for the time being. According to Assekurata, the rising interest rates will ensure relaxation in the years to come. According to the experts, you can cushion the rising costs.

Because recently, the performance expenditure has increased again quite significantly to now 32.6 billion euros. During the corona pandemic, growth had slowed due to postponed doctor visits and hospital stays, but now the pre-corona level has almost been reached again. Benefit spending has increased by 17.2 percent since 2017.

The division is currently not as badly affected by the high inflation as non-life insurance, for example, according to Cebi: “A further increase in costs can be expected with a time lag.” Future structural reforms, such as the planned hospital reform or an amendment to the Doctors’ fee schedules could also increase service expenditure.

However, rising expenditure coupled with only moderate growth in premiums are reducing industry profits. The insurance result ratio fell from 15.1 to 12.9 percent in 2022. However, Assekurata continues to rate this as “good”.

More: For whom is it worth switching to private health insurance?