The fact that Bitcoin (BTC) is giving new bullish signals in short time frames raises hopes among the bulls that it is at the end of the correction phase. According to crypto analysts, the buyers could really be on the winning side this time.

Bitcoin analysts predict the decline will end in weeks

BTC price made a strong breakout on May 18 as the bulls raised their expectations. Data from TradingView shows that the price has climbed to $27,400 on Bitstamp. The price thus turned green around 3.5% over the last 24 hours. Skew, the popular crypto analyst who examined the order books of exchanges, was hopeful about the continuation of the rise.

In part of his technical analysis, he summarized the current moves by saying, “The price pulled down the inhibitory swing with enough liquidity to push higher.” Skew adds that while macro conditions are causing friction for BTC price performance in general, Tether should be a “positive catalyst,” promising regular BTC purchases.

Whales support BTC bullish

On-chain data source Material Indicators tracks movement in the Binance order book. Accordingly, the latest price increase coincided with the volume increase from the whale class.

As always, not everyone is convinced of the longevity of the recent BTC rally. Among them was TraderSZ, who started the day by closing his long BTC position.

“Imagine the leap is over,” he said in his analysis, predicting a bearish turn.

Bottom ‘could be in’ for Bitcoin price correction

Meanwhile, another popular trader, Credible, has expressed a belief that a more significant upside reversal could come within the next month.

Credible shares two charts with notable trend lines. He says the top should stay as support and BTC/USD should rise later. Describing the character of the move as “absolutely explosive”, he continues, “I hope it will mean less than 30 days for the next upward move to begin.”

On-chain metrics show bear to bull transition

Reports from crypto analytics firm Glassnode have revealed metrics that show bulls taking over Bitcoin.

Glassnode’s ‘Bitcoin Bear Survival’ signal combines eight different metrics that analyze four key factors. These;

- Whether the market is trading above the basic price patterns;

- Whether there is any increase in on-chain activities;

- Whether the market is profiting and level long-term bearer supply dominance.

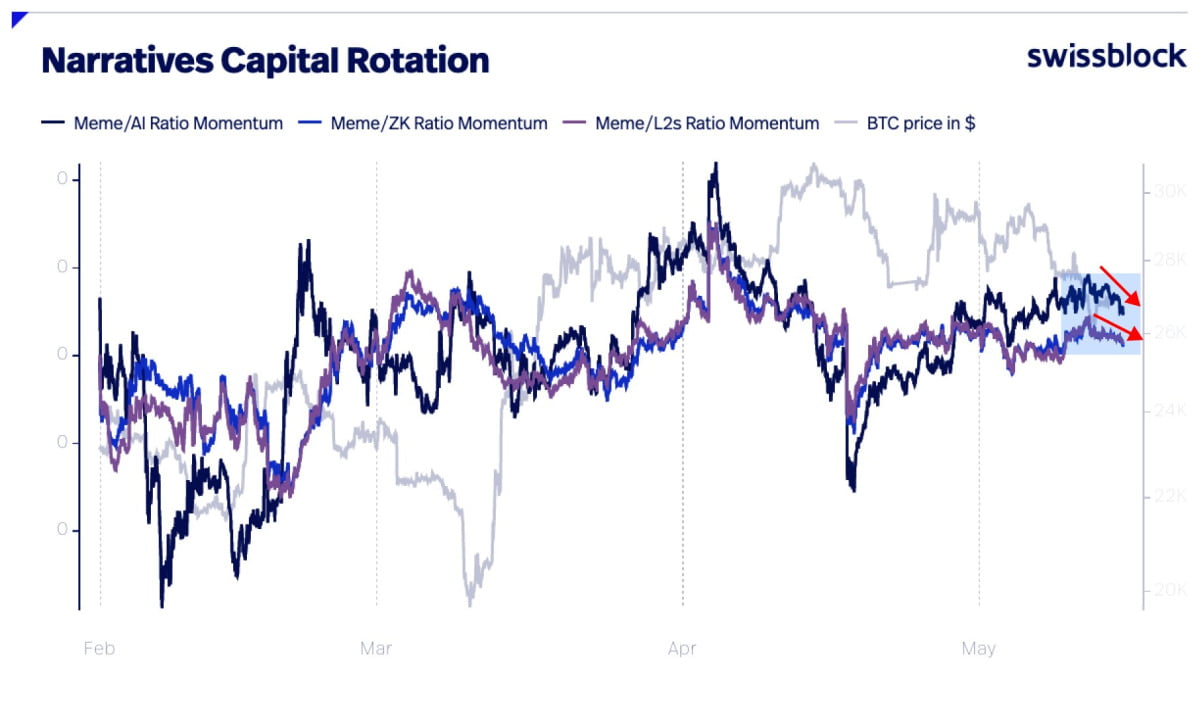

All eight metrics of the signal are currently bullish for Bitcoin. Negentropic, one of the co-founders of Glassnode, also states that the momentum is currently shifting from meme coins to Tier 2 protocols and artificial intelligence (AI) projects.

The crypto analyst also notes that Bitcoin is currently “sloping upwards but lacks momentum.” The leader says demand for crypto should start.

Santiment analysts did not ignore negative indicators

Santiment, another on-chain analytics platform that issued a serious warning about BTC today, reports that Bitcoin witnessed a significant drop in network usage and engagement in May.

For the first time since July 2021, less than 800,000 Bitcoin addresses are transacted on the network every day. This drop in network activity was in line with Bitcoin and a broad-based correction affecting the market.

cryptocoin.com As we have reported, the BRC-20 standard, which has become popular recently, gave the Bitcoin network a hard time.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.