Kraken, one of the most popular crypto exchanges, Ethereum (ETH) its investors; has issued a warning that some on-chain metrics point to further downward pressure on the second-largest digital asset by market cap.

Kraken, in a statement on Twitter, said that an increase in the amount of ETH flowing to exchanges could mean that the bears are currently dominating the bulls.

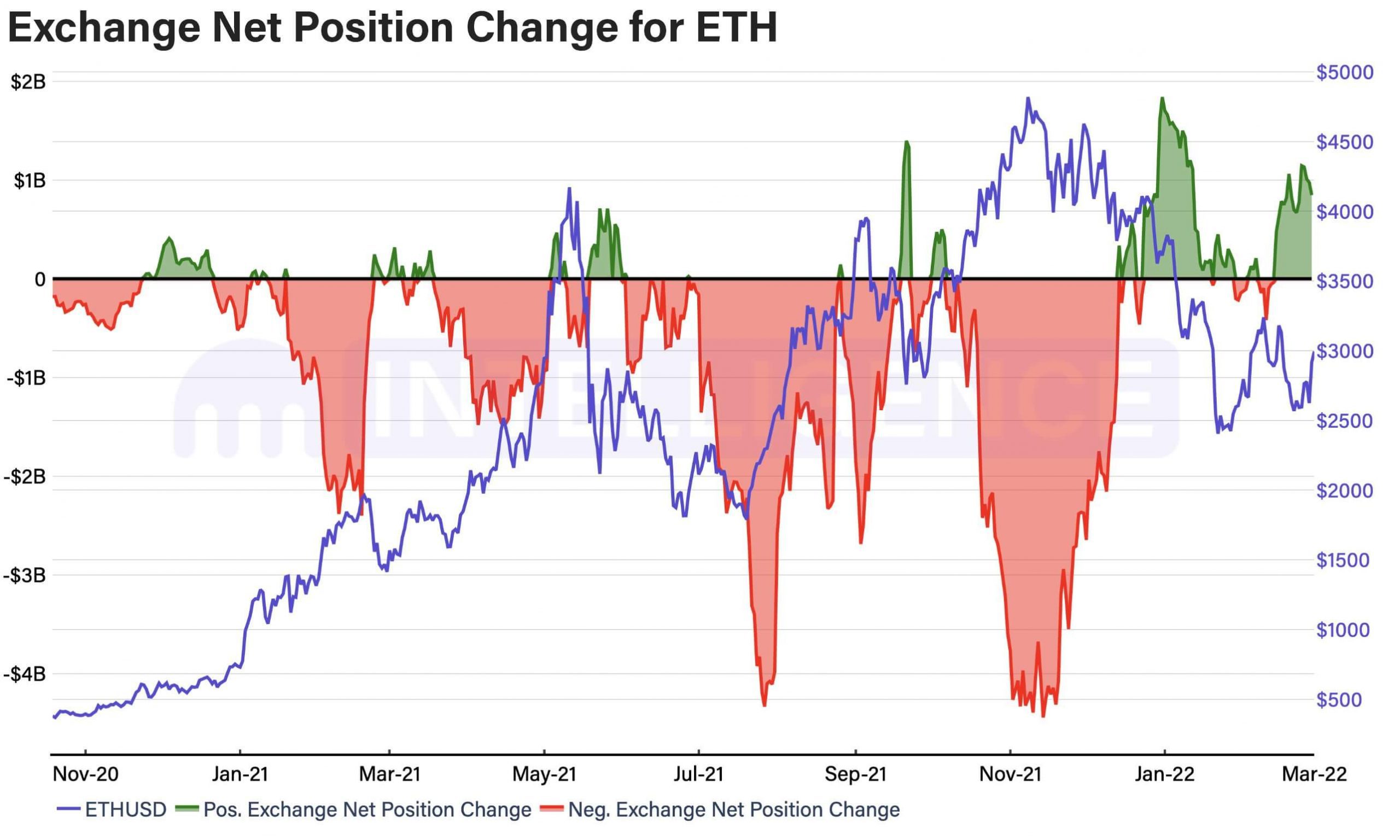

“Net flows of ETH on exchanges suggest that market participants are moving ETH to exchanges, meaning that demand on the sell side may be outpacing demand on the buy side.

If this trend continues, the price of ETH could fall as marketable supply increases.”

While Kraken is seeing signs of increased selling pressure for Ethereum, the crypto exchange also notes that an on-chain metric indicates ETH is poised for a bounce.

In a new report, Kraken says that Ethereum’s market-to-real-value Z-score (MVRV Z-score), which compares an asset’s market value to its actual value and is used to detect overbought or oversold conditions, is currently hovering in bullish territory.

“Although ETH is down almost -37.5 percent from its all-time high, the cryptoasset’s MVRV Z-score of 1 indicates that ETH is in the ‘oversold’ territory and is back on the upswing. The MVRV Z-score for ETH confirms that the cryptocurrency has entered a correction and could soon reverse trends as ETH rarely falls into the oversold territory before prices rise again.”

Kraken also says that the impact of the current uncertain macroeconomic conditions may have already been reflected in price in the crypto markets as healthier price movements begin to reappear. However, the exchange claims that a slight bearish trend is still ongoing in the crypto markets, where Ethereum currently appears to be more at risk than Bitcoin.

“It is difficult to confidently predict what the crypto markets expect next. On-chain data, on the other hand, currently paints a somewhat bearish picture. Metrics such as FX net position change suggest that market participants are potentially shifting BTC and ETH from long-term holdings to marketable supply. That is, the FX net position change for BTC shows that net flows accelerated favorably through most of January, but the trend was bearish in February.

In the last 30 days, the total foreign exchange net position change for BTC is currently +13.5 million dollars. ETH’s net position change in the stock market tells a similar story, but the bearish momentum appears to be greater than that of BTC. In the last 30 days, the FX net position change of ETH was +$874.5 million. Yet while the bearish momentum is slowing for BTC, the opposite is true for ETH.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.