Crypto analyst TechDev, Bitcoin argue that the price’s recent rallies still have strong momentum and may continue to rise does.

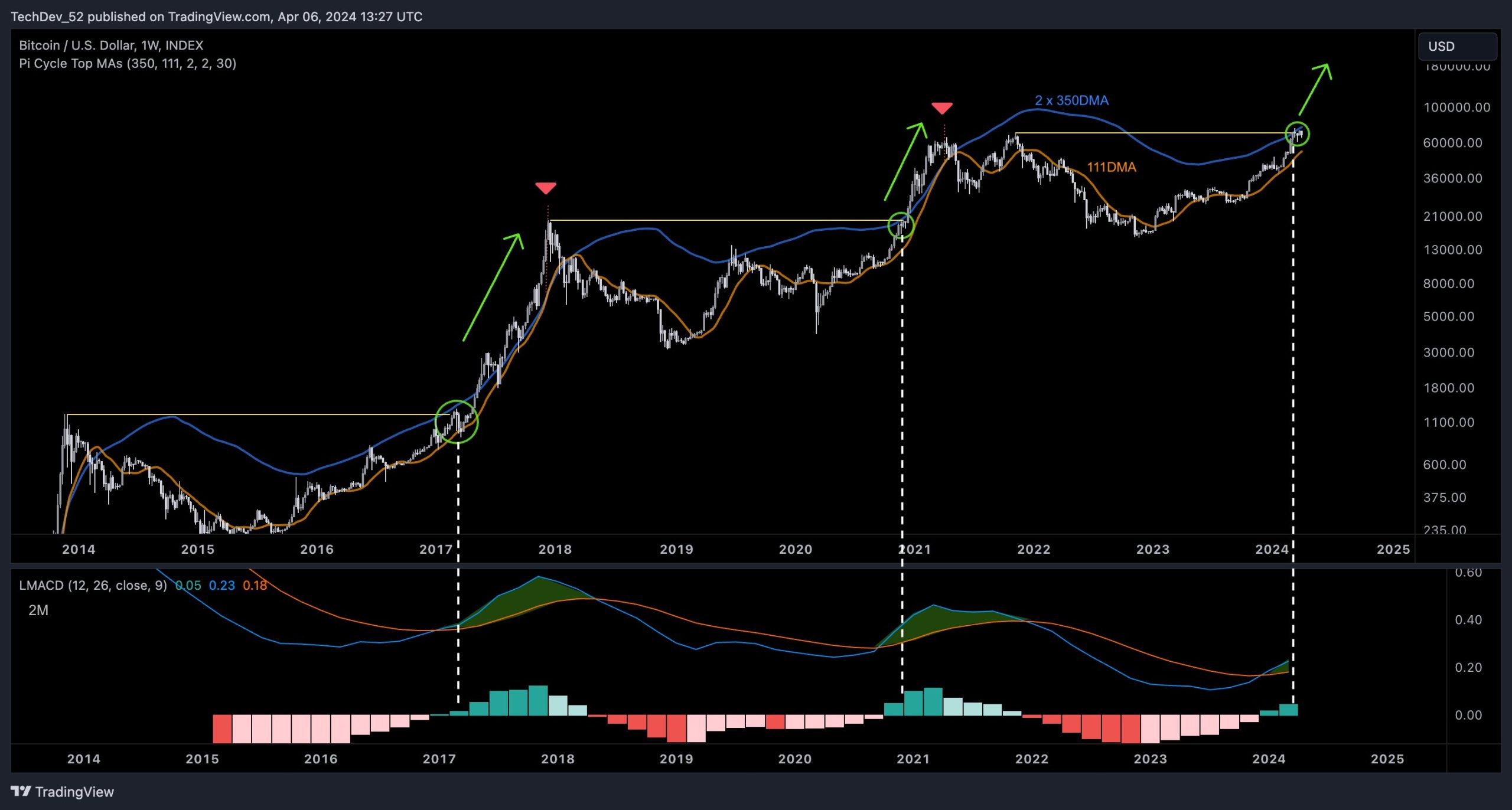

In assessing the current state of Bitcoin, TechDev highlights some particularly noteworthy indicators. For example, BTC is currently more than double its 350-day moving average (DMA) and is consolidating near all-time highs.

Additionally, TechDev notes that BTC’s moving average convergence divergence (MACD) indicator on the two-month chart has also turned green. This is one of three key features of Bitcoin’s current price action that, in the analyst’s opinion, point to a parabolic rally.

According to TechDev’s analysis, BTC price movements appear to follow a specific pattern that indicates parabolic rallies in the past. As we reported as Koinfinans.com, we generally observe that such rallies end when consolidation occurs at the intersection of 111 DMA and 2×350 DMA.

The analyst states that after such a crossover, Bitcoin reaches historical highs and heralds a parabolic rise. Therefore, according to TechDev’s analysis, the current situation could be a significant bullish signal for BTC.

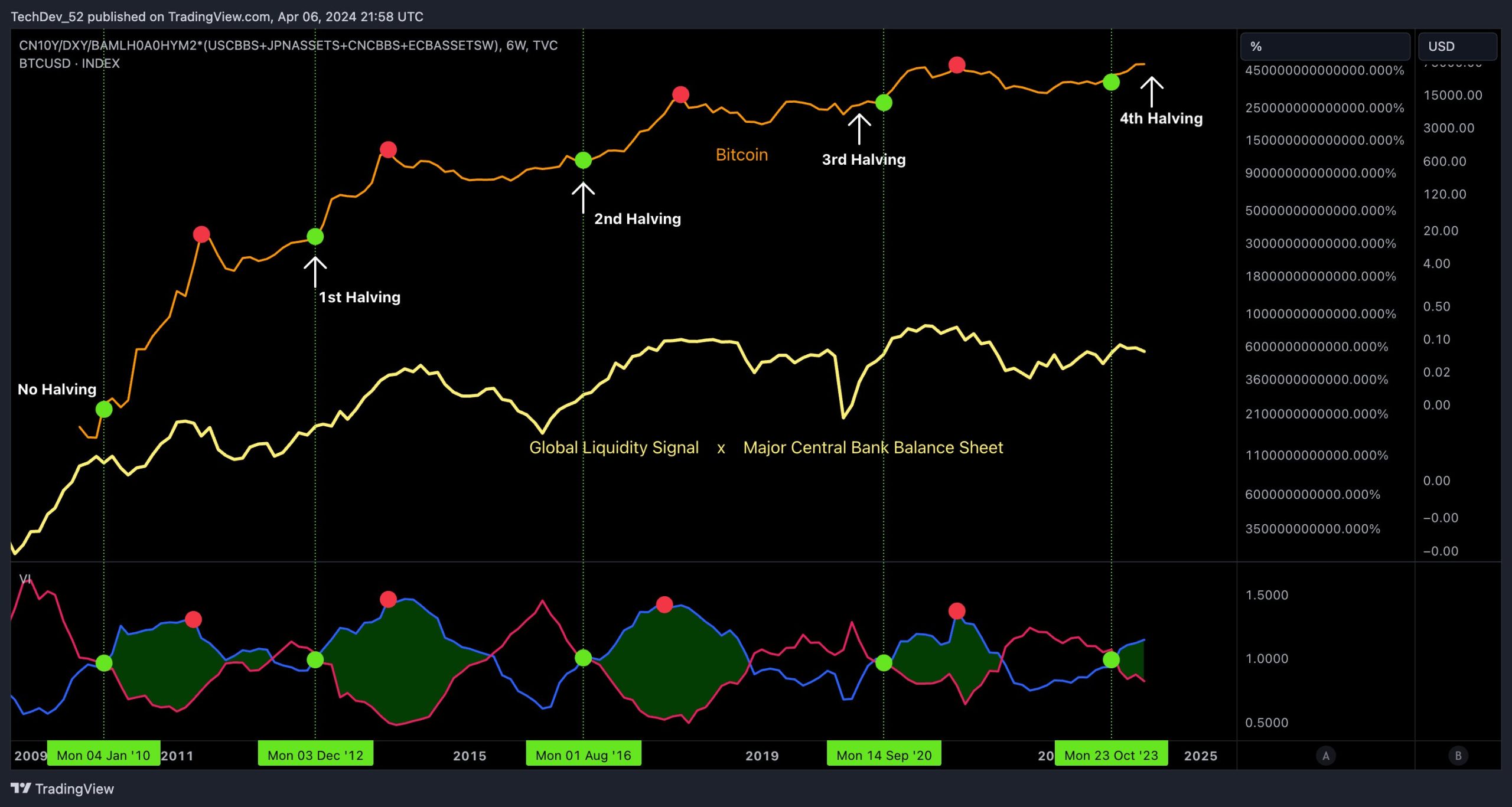

TechDev doesn’t think conventional thinking about Bitcoin’s market cycles may be limited to halvings, which occur approximately every four years and halve miners’ BTC rewards.

Instead, the analyst argues that Bitcoin is more associated with global liquidity cycles. He shares a long-term chart showing a correlation between BTC, global liquidity and the balance sheets of major central banks.

“This is the first time that Bitcoin’s all-time high came before the halving… Because this was the first liquidity cycle that started before the halving.

It reveals what drives these runs and which ones line up (except this time).”